August 7, 2017

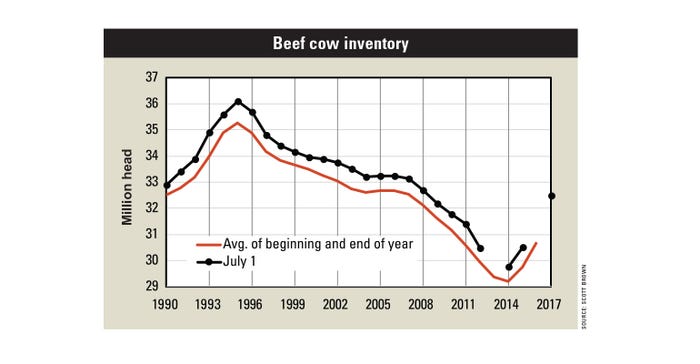

Cattle industry participants welcomed the resumption of the USDA July Cattle Report following last year’s suspension due to budget constraints. While there was no report last year to compare to, most inventory categories showed significant growth relative to July 2015.

The report showed beef cows up 6.6 %, and total cattle and calves up 4.5%. The notable exception was heifers 500 pounds and over held for beef cow replacement. This category was 2.1% lower than July 2015.

Striving to glean information from the midyear report to make projections of next January’s cattle numbers is always a tough chore, especially this year with no prior midyear comparisons.

More cows on horizon

There is a reasonably close relationship between the July beef cow USDA estimate and the average beef cow inventory of the two surrounding Januarys. The July number averaged 639,000 head larger than the midpoint of the surrounding two Januarys from 1990 to 2015, with the smallest difference being 413,000 head (1990) and the largest 916,000 head (1993). Budget constraints also canceled the July 2013 midyear estimate.

Applying these ranges to the July 2017 and January 2017 numbers (assuming no data revisions) yields a January 2018 beef cow inventory estimate between 32 million and 33 million head. The smallest end of this range still implies 750,000 more beef cows in 2018 than the year began with.

If the January 2018 beef cow inventory is notably higher than 2017, odds are that we will start 2019 with even more cows. The last few inventory downturns have followed years of marginal inventory growth. The decline which began in 2007 followed a gain of just 28,000 beef cows in 2006; the 1997 downturn followed herd growth of 128,000 in 1996; and the shrinking inventories of 1988 and 1983 followed growth years of just 192,000 and 457,000 head, respectively.

Drought slows herd growth

It is difficult to stop the momentum of a multiyear beef cow expansion. While producers may be tapping the brakes on expansion, with the heifers held for beef cow replacement falling in the July report relative to 2015 (the Jan. 1 measure of this variable showed just 1.2% annual growth), it will take larger measures to halt rising inventories anytime soon.

Unfortunately, the drought in the Northern Plains is an event that could lead to a speedier reduction in the national herd if it continues and intensifies. But while conditions are extremely challenging for cow-calf producers near the heart of the worst conditions, only 13% of U.S. beef cow inventory resides in Montana, North Dakota and South Dakota; most of the rest of the nation is experiencing average to above-average pasture and range conditions.

More cows and beef will continue to be a reality for quite some time. Beef demand must stay strong to pass through this portion of the cattle cycle without severe financial consequences for cow-calf producers.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like