February 22, 2017

The dairy industry’s influence on total beef production is significant. Sometimes it’s complementary to beef markets. Other times it is counter to beef market adjustments. CattleFax beef audits for 2009 to 2013 show cull dairy cows and fed dairy cattle averaged about 20% of total U.S. beef production. About two-thirds of the dairy beef came from fed dairy cattle.

In 2014 fed cattle prices surged on tight cattle supplies and strong beef demand. Ensuing record profits pulled cattle into feedlots. Feeding out dairy calves became attractive for many feedlots, boosting demand for dairy calves.

Feedlots pulled dairy calves away from the veal industry, accelerating the decades-long decline in U.S. veal production. Essentially all U.S. veal production comes from dairy calves. Eroding veal industry demand for dairy calves coincided with surging beef feedlot demand for those animals. Additionally, the national dairy cow herd was increasing, due in part we suspect, to the improved income opportunities to dairy producers in the form of feeder and fed cattle. These factors diverted dairy calves from the veal sector into feedlots.

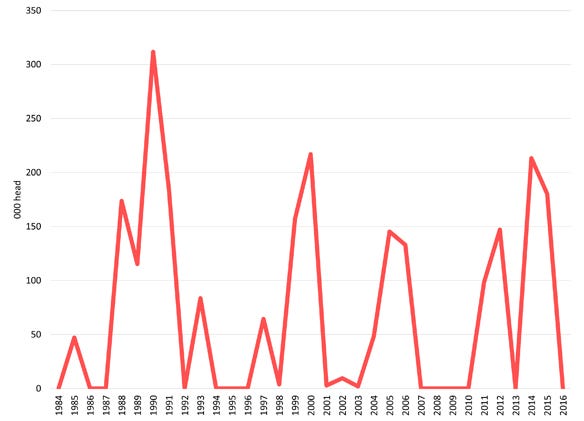

Dairy calves are typically placed on feed at very light weights and stay in feedlots up to a year. This means that relatively large numbers of dairy calves impacted fed cattle markets in 2015. Using Livestock Marketing Information Center (LMIC) calculations, about 213,000 additional dairy calves were placed into U.S. feedlots in 2014 compared to 2013 (see the accompanying chart). An additional 180,000 head of dairy calves entered feedlots in calendar year 2015 thereby, impacting fed cattle markets in 2016.

Feeder cattle placed at very light weights stay on feed longer and get counted on more of USDA’s monthly Cattle on Feed Reports. That complicates forecasting beef production from feedlot inventory counts.

Changing economics reverse trend

Increased beef cattle inventories and lower prices in 2016 reversed the trend of a shrinking veal industry and the U.S. dairy herd providing more calves to the beef industry. Nationally, beef cow numbers were up 3.5% in 2016. The 2016 U.S. calf crop was 35.08 million head, up 2.9% from 2015.

The larger calf crop resulted in a 2.2% rise in estimated feeder cattle supplies on Jan. 1, 2017. For 2016, federally inspected calf slaughter was 479,800 head, which was 34,300 head above 2015. No additional (or approximately the same number) of dairy calves were placed into U.S. feedlots in 2016 as in 2015.

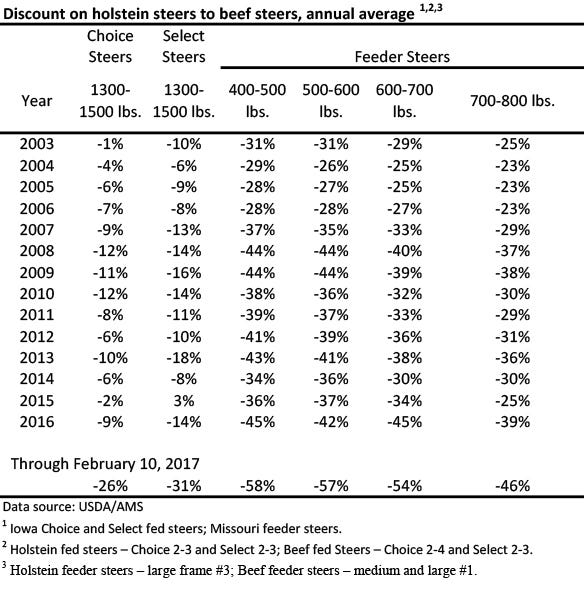

Dairy cattle normally sell at a significant discount to beef cattle. But market forces do impact the magnitude of the discount. From 2003 through 2007, average discounts were 5% for Choice steers and 9% for Select Steers. The discount hovered between 23% and 37% for all weight classes of feeder cattle shown in the accompanying table. In 2008 and 2009, exceptional drought in the southern U.S. forced cattle liquidation. More beef cattle temporarily coming on the market ramped up discounts for Holsteins compared to historical levels. Drought again in 2011 and 2012 caused liquidation and temporarily hiked the supply of cattle, and discounts ramped up again, especially in feeder cattle.

In 2014 and 2015, discounts decreased noticeably on the heels of an extremely tight national beef supply and increased demand for any cattle to fill shackle and bunk space. With a relatively stable dairy herd in 2016, along with a growing national beef cattle herd, these price discounts started to increase once again.

Dairy beef feels a squeeze

So far in 2017, steep Holstein to beef steer price discounts exist. This is for not only fed cattle, but also feeder cattle. This imbalance could persist for many months before other adjustments bring feeder and fed cattle Holstein to beef price discounts back into alignment with historical levels. Changes in the national dairy cattle herd will eventually have impacts on Holstein steer availability. As of Jan. 1, the dairy cow inventory was 9.35 million head, up only 0.4% from one year earlier. The inventory of dairy replacements, at 4.75 million head, was down 1.2% from a year ago.

The impact of the dairy industry on beef production is always significant and has been larger than usual in the recent past due to low beef cattle numbers. Rising beef cattle inventories as the beef herd continues to rebuild will reduce this impact, along with relative price relationships, to more typical levels in the coming years.

Schulz is the Iowa State University Extension livestock economist. Contact him at [email protected].

About the Author(s)

You May Also Like