Cattle prices this year have been dropping further and faster than most imagined, probably faster than the underlying fundamentals warrant.

Of course, the trick is making sense of market behavior so you can make marketing decisions.

The excessive downturn may be the result of fear, said Derrell Peel recently. Peel is extension livestock marketing specialist for Oklahoma State University.

"Perhaps the fact that the industry has not experienced a cyclical expansion since the early 1990s is part of the problem," he said. "Some younger producers and traders have never participated in herd expansion and no one in the industry has in more than 20 years."

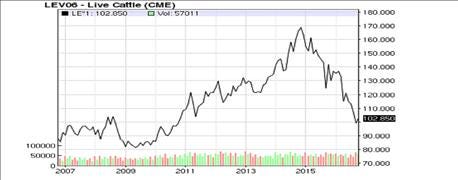

This weekly live cattle chart shows the market has already taken back 80% of the move up which started in 2009 and ended in late 2014.

Peel added there seems a common view that any data with a positive year-over-year change, whether herd inventory, cattle slaughter numbers, beef production or feedlot placements, is "cause for rampant bearishness."

It's worth noting that all the markets, including the stock market, are reacting nervously right now. Stocks run up and then down and then slip into a channel. Volatility goes up and then down and them back up again. The US dollar is seesawing back and forth with the other major currencies. Precious metals zoom up and then drift back. Everyone is waiting on the Federal Reserve to boost interest rates, making all that free money not so free anymore.

Certainly we can expect beef prices to decline through the next several years, since we are in a herd expansion period. Yet the mood seems especially ugly and the markets particularly brutal to those on the inside.

Peel said beef producers need to keep things in perspective as they watch the markets gyrate.

"The supply challenges going forward mean that caution on the part of producers and lenders is advised and warranted," he said. "However, the growth in cattle inventories and beef production thus far do not constitute a wreck, and paralyzing fear that cripples decision-making may prevent producers from taking advantage of opportunities that inevitably exist in changing market conditions."

"We’ve been through this before…just not in a long time," he added.

In addition, the Livestock Marketing Information Center recently brought attention to the partially self-inflicted plight that cow-calf operations face as it offered downgrades in its profitability index. Its expected returns index for 2016 now stands at $15 per cow. This goes along with what has been a steadily increasing cost structure for cow-calf operations for several years now, which seems to have topped and declined but not really abated. Likely this adds to the fear.

Looking back

Peel said historical perspective might offer some psychological stability in the face of such market moves.

He said the national beef cow herd is likely still expanding and could post gains of 1.5-2.5% by year end. This would put the national herd at 31 million cows, which was the its size when drought liquidation began in 2011.

"Although the expansion since 2014 is properly characterized as cyclical expansion, it can also be thought of drought recovery so far," Peel said. "There is little doubt that the herd was poised to expand in 2011 in the absence of drought so it hardly seems likely that expansion to get back to that level can be thought of as drastically overshooting the mark."

Peel also noted the increased carcass weights of recent years make it appear we'll need fewer cows to reach par with the last cow peak. He then reiterated that expansion to date could not possibly be too much.

LMIC calculates that 2016’s female cattle slaughter will represent 43.5-44% of total cattle slaughter for the year. It said based on historical relationships back to 1950, the country has never experienced that low a female cattle slaughter ratio resulting in a decreased total cattle inventory in the corresponding Jan. 1 report.

LMIC said, "It is not until we get into about a 48% ratio (female slaughter to total slaughter) or greater that a decrease in cattle inventory is likely."

The Denver-based livestock forecasting group also said it expects the number of females in the slaughter to continue increasing, the number of heifers kept for breeding to keep decreasing, and "a notable slowdown in cow herd growth" by the Jan. 1 report in 2018.

Peel said he expects US beef production overall to increase 4.5-5%, year over year for 2016. Total beef production this year is projected to be about 24.8 billion pounds, which is still 4.7% below the average beef production level from 2009-2013.

Stability possible?

Peel said he thinks there are reason for cattle and beef markets to stabilize. Current cattle carcass weights are 15 pounds below this time last year and are expected to remain below year-earlier levels for the balance of the year. Year-over-year cattle slaughter rates for the rest of 2016 will still be higher than last year, but will moderate.

Lesser slaughter combined with lower carcass weights should hold fourth-quarter beef production to less than 3 percent year-over-year increase, compared with the 7.4 percent increase in the third quarter.

Beef imports are down and beef exports are improving, thus moderating beef supply increases in domestic markets, Peel added. This helps moderate the increase in domestic feeder supplies going into 2017.

He believes all these things should help cattle and beef markets move forward with much less drama compared to the past few months.

However, this does not necessarily mean we have hit market bottom.

We are experiencing near-record supplies of competing meats and the overall economy is weak. We could still see a price retracement to $85-92, said Bill Helming recently in one of his newsletters. Helming is the Olathe, Kansas, private economist who once was lead economist for the National Cattlemen's Association. That would be a full retracement of the overall move up since 2009, but is only a little lower than the $98 price reached recently by the October 2016 live cattle contract.

About the Author(s)

You May Also Like