December 5, 2017

By Chris Hurt

At the start of a new year, prospects look promising for another year of favorable margins for pork producers. Production is going to be higher by about 3%, which is quite a bit of expansion. However, strong usage is expected to support hog prices near levels of 2017, or slightly higher.

The source of robust pork demand will be a strong U.S. economy, where wages are rising and unemployment is low. More people working and more income mean some of that increase will find its way toward pork purchases.

In addition, the world economy will be at its strongest level since the 2008-09 recession. The world likes U.S. pork, and USDA expects our pork exports to grow by 6% in 2018. That means foreigners will buy 22% of all pork produced in the U.S.

New packing capacity will get up to full speed in 2018, and that is expected to provide a positive tone for hog prices.

While pork export prospects are strong, there are worrisome issues over trade negotiations with our three largest pork customers. The U.S. dropped out of the Trans-Pacific Partnership agreement, and as a result, Japan, our No. 2 customer, wants to move ahead with a trade pact with the remaining nations in that group without the U.S.

Japan has also signed a more favorable pork agreement with the European Union. Of course, the future of the North American Free Trade Agreement is uncertain, as well. With Mexico our No. 1 destination for pork and Canada at No. 3, pork export levels to both of our neighbors could be affected.

Moderate feed prices help

Feed prices are expected to remain moderate due to record U.S. corn yields and record production of soybeans. Those feed prices will be low in the first three quarters of the year, but current 2018 new-crop corn futures are suggesting higher prices for the 2018 corn crop, likely due to reduced acreage as more acres continue to shift to soybeans.

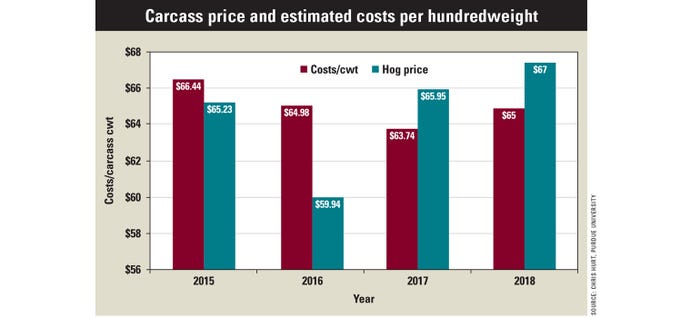

Carcass-based pork prices averaged around $66 in 2017 and are expected to be about $1 higher in 2018. My estimated cost of production is expected to be around $65 per carcass hundredweight for the entire year. That means average-cost producers would be expected to cover all costs and still have about a $5-per-head profit. Keep in mind these costs are my estimates and will be different for individual producers.

It’s nice to start the year with positive income prospects. We all know that a year is a long enough time to have multiple twists and turns in the outlook. Nevertheless, at least the pork industry will start with an upbeat tone.

Hurt is a Purdue University Extension ag economist. He writes from West Lafayette, Ind.

You May Also Like