March 22, 2017

By John Otte and Paul Quam

When times are good, farmers have choices. One is to use profits, likely in combination with borrowed money, to expand. Another is to pay down debt and build liquidity to be in a position to take advantage of opportunities that will arise during the next down cycle, when fewer farmers will be in position to compete.

How you manage debt and time your borrowing are keys to being in position to capitalize on the next ag boom.

The grain export boom and accelerating inflation of the 1970s lured farmers to borrow heavily to buy land that was sure to rise in value. However, when the Federal Reserve clamped down on the growth rate of the money supply to fight inflation, interest rates shot up. Highly leveraged farmers faced surging debt service requirements on variable-interest-rate loans. Collapsing land values resulted in debt loads that topped land values. Restructuring became nearly impossible.

Memories of the financial stress of what became known as the farm financial crisis of the mid-1980s are fading. But the risks of overleveraging remain, and are very real.

Lower grain prices are squeezing farm cash flows. Highly leveraged farmers are most vulnerable to financial stress. Farmers with high operating costs or family living withdrawals are also vulnerable.

Leverage is a friend

During the boom phase of the ag cycle, rates of return often exceed the cost of borrowing. Leveraging can accelerate your equity growth rate. Some examples will illustrate:

Example 1: Suppose you have $10 million of equity. You commit $5 million of your equity to pay this year’s operating expenses. Your farm earns $2 million. You grow your equity to $12 million. You capture a 20% return on your equity, ignoring withdrawals for things like living expenses and taxes.

Example 2: Alternatively, suppose you borrow $5 million of operating money at 10% interest to double your acreage. Your expanded farm earns $4 million. You pay $500,000 in interest. That leaves $3.5 million return on your equity, which ups your net worth to $13.5 million — which is a 35% return on your equity.

Leverage is a foe

When the bust phase of the cycle comes and earnings falter, leverage can wipe out equity even faster.

Example 3: Instead of your initial $10 million of equity earning $2 million, it loses $2 million. The negative 20% return on investment erases 20% of your equity, trimming it to $8 million.

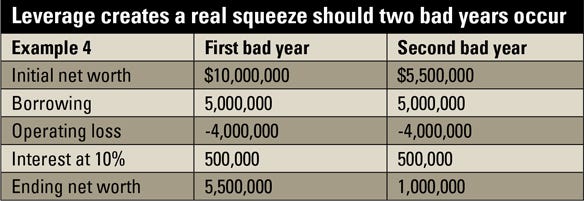

Example 4: Alternatively, suppose you borrow $5 million at 10% interest to double your acreage. You lose $4 million on your expanded acreage. You pay $500,000 in interest. Your $4 million loss plus $500,000 in interest wipes out $4.5 million of your equity, cutting it to $5.5 million.

Further, suppose your lending institution extends you $5 million of credit to put out the next year’s crop. For a second year, you lose $4 million. You still have to pay $500,000 in interest. Your $4.5 million shortfall cuts your net worth to $1 million.

When things go sour, leverage can slash your net worth faster than it can grow your net worth in the good times.

Take action for 2017

Recalculate your 2017 cash-flow projection. Scrutinize your balance sheet and calculate your leverage position. Calculate your current-debt-to-current-asset ratio and total-debt-to-total-asset ratio. Know what those ratios mean.

If you see trouble looming, visit your lender sooner rather than later. The more time you have to adjust, the more options you will have, and the more likely you will make the most advantageous adjustments.

Otte is the former economics editor for Farm Progress Publications. Quam is a farm financial consultant based in Jefferson, Iowa.

You May Also Like