January 20, 2017

There are many big-ticket items our new president has vowed he will implement, repeal or drastically change. The question is: Will agriculture be in the mix? Inevitably, changes in trade could bludgeon an already wounded ag economy. A tug of war with punitive tariffs has already started with the world’s second-largest economic powerhouse — China.

In a global economy, trade has the ability to distort entire industries, creating both winners and losers. Food, fuel and fiber are all mammoth bargaining chips in this high-stakes poker game.

On Jan. 12, China’s Ministry of Commerce began subjecting U.S. distillers dried grains with solubles to anti-dumping and countervailing duties following a yearlong investigation. The goal is to restrict access to that market for U.S. feed grains and related products, specifically corn, DDGS and ethanol. The duties will remain in effect for five years if not challenged.

This new ruling follows the Jan. 2 announcement that China is dramatically increasing tariffs on imported U.S. ethanol from 5% to 30%.

China’s ethanol industry pushed hard for the ruling, saying the U.S. industry was unfairly benefiting from subsidies.

In a final ruling on DDGS, the Commerce Ministry put anti-dumping duties between 42.2% and 53.7%, up from 33.8% in its preliminary decision in September. Antisubsidy tariffs will range from 11.2% to 12%, up from 10% to 10.7%.

No country benefits

This does not benefit China or the U.S., and represents a threat to the global trading system. In a statement after the news, Tom Sleight, the president and CEO of the U.S. Grains Council, said the measures were “effectively stopping a growth market for U.S. farmers and ethanol producers.”

A statement released by Marquis Energy, an ethanol producer based in Hennepin, Ill., states Chinese tariffs on ethanol and DDGS are expected to cost U.S. agriculture at least $2 billion per year.

China accounts for a whopping 50% of the United States’ DDG sales, according to a report from Deutsche Bank. This is a major blow to U.S. ethanol manufacturers, and the trickle-down effect means already distressed corn prices may be strained even further. It also means that Chinese people will feel the effect, as the squeeze will inevitably impact meat and poultry prices, putting China’s poorest in peril and creating further food insecurity.

During his campaign, Donald Trump waffled on his position on ethanol. But he did say, “Energy independence is a requirement if America is to become great again. My theme is ‘Make America Great Again.’ It’s an important part of it.”

That’s a bit reassuring, as the U.S. ethanol industry closed out 2016 with a new production record. Production reached an average of 1.04 million barrels per day the week ending Dec. 30, according to data released by the U.S. Energy Information Administration.

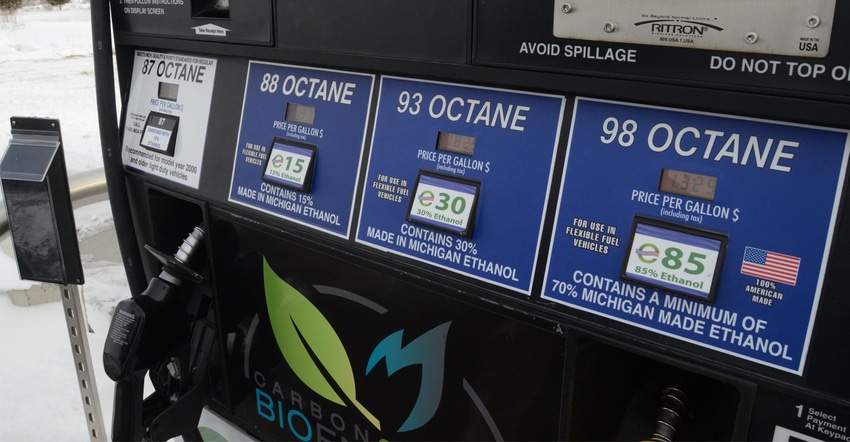

During his campaign, Trump also said, “The EPA should ensure that biofuel blend levels match the statutory level set by Congress under the [Renewable Fuel Standard].” That’s also good news, as nearly 2,000 new E15 and E85 stations are scheduled to open across the country in the next 12 months. And the amount of corn used for fuel ethanol set a new record in 2016, up roughly 3% from last year. Even so, there’s still plenty of wild cards on what the future holds.

Scott Pruitt is Trump’s nominee to lead the U.S. Environmental Protection Agency, which is supposed to encourage the use of higher ethanol blends. Pruitt’s past as Oklahoma’s attorney general is concerning, as he filed a “friend of the court” brief backing a lawsuit by the American Petroleum Institute to overturn EPA’s approval of E15 for 2001 model-year and newer vehicles. Pruitt has also called the Renewable Fuel Standard “unworkable.”

Hang on to your seat; this is going to be a bumpy ride.

You May Also Like