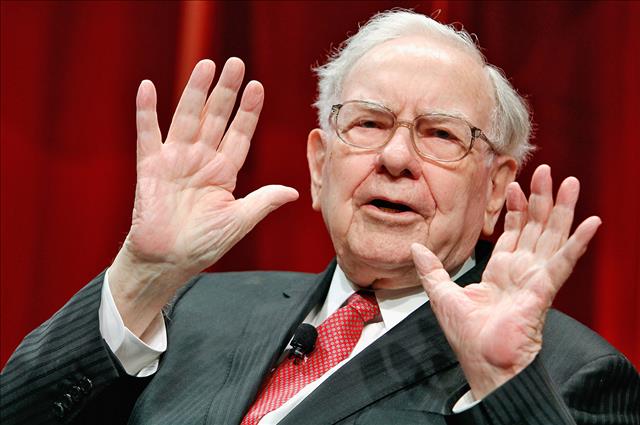

Scott Anderson, an Andover, S.D., farmer who once worked on Wall Street, attended a Warren Buffet investment seminar recently and picked up the following seven business management tips that he says could be applied to farming and ranching:

1. Read ferociously. “Buffett reads 5-7 hours a day -- 4-5 newspapers, annual reports, books and more,” Anderson says.

2. Work with people you like and who love their jobs. If your partners and employees aren't passionate, you shouldn't work with them. Buffett’s advice was to look for people who would pay to do their job. “Think about Sam Walton. He drove an old pickup truck with dog kennels in the back. And today, if he were still alive, he’d be worth almost $200 billion. He just loved what he did every single day and so did his employees. If you find employees like that, you’re in an incredible place to succeed.”

3. Have fun showing your passion. When you’re passionate about what you do and you have fun doing it, people want to do business with you. “[Buffet says] people will call you with deals — they want to work with you.”

4. Focus on adding earning power. When you’re adding earning power, you’re reinvesting any profits into things that are going to grow your business. Only invest in things that shows a nice positive return on investment.

5. Be capital-efficient. “This is Warren Buffett’s secret weapon. He only buys (or at least tries to only buy) capital-efficient businesses. Think about it. If you start at $100 make 20% of that in a year, you’ll make $120. Then the next year you should be able to make 20% of $120, which is an added $24 for $144, and then 20% of that next year, and so on. See how fast it compounds? That’s how Buffett became one of the richest guys in the world for most of his career. With the money his businesses make, he looks at buying other capital-efficient businesses and it compounds and compounds.”

6. Run each field like it is its own business, and make sure it’s adding profit to the pot. “Buffett makes sure that each business he buys is adding to the pot. Applying that principle to your farm, make sure you break your farming operation down into individual fields and know the production costs on each. Then you can say, “These fields are losing me money… Why?” You’ll have two options: turn them around to produce profit, or get rid of them.”

7. Be greedy when others are fearful and fearful when others are greedy. “Anytime there’s a market crash, Buffet is lining up to buy all those companies he’s wanted to buy for years, because they are now on sale. Buffett will wait 10-20 years to buy a company, holding off until their stock plummets to an affordable price.”

You can watch the Berkshire Hathaway conference online. You can also follow Anderson, who developed an accounting program called CashCow Farmer, at https://cashcowfarmer.com. You can also follow Anderson on Snapchat (CashCowFarmer).

About the Author(s)

You May Also Like