July 6, 2017

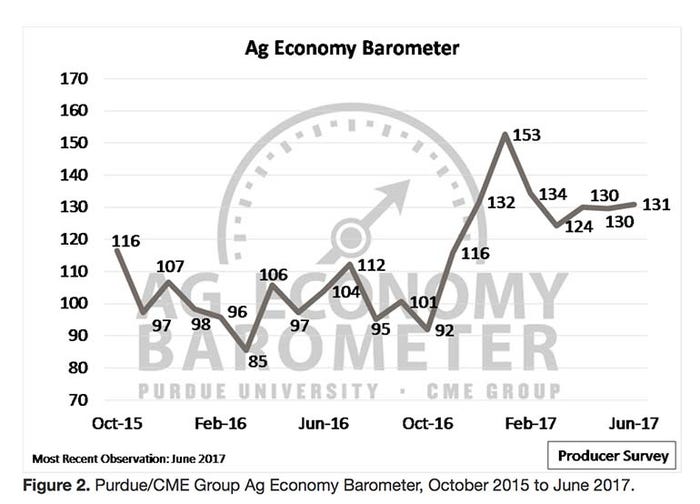

The Purdue/CME Group's June Ag Economy Barometer has held steady for three months in a row.

The producer-based sentiment index of 131 remains well above levels recorded prior to November 2016. The barometer is a survey of 400 U.S. agricultural producers.

Perspectives

The shift in producers’ perspectives regarding their financial positions is part of a long-term trend. In June 2016, just 3% of survey respondents felt their operations were financially better off than a year earlier. That percentage increased to 10% last fall, then declined somewhat in early winter before rebounding to its current reading of 13%, the highest reading since Purdue/CME Group began surveying producers in October 2015.

A similar pattern emerges when examining the percentage of producers indicating their farms’ financial positions declined compared to 12 months prior. The percentage of farmers indicating that their financial positions were worse than a year earlier was 46% in June 2017, little changed from May’s 44%, but well below the 67% recorded as recently as February. The shift in perspective compared to last summer is even more noticeable as 81% of respondents in August 2016 said their farm was financially worse off than in the prior year.

The long-term shift in producers’ attitudes about their operations’ financial conditions is likely reflective of several factors.

Revenues on many farms increased as a result of record, or near record, crop yields in 2016. The revenue improvement was further supported by the fact that corn and soybean futures prices strengthened from late summer through early winter.

Production costs moderated for most crop operations compared to the prior year. Fertilizer prices in particular were weaker than a year earlier, helping to improve margins.

As the long-term adjustment to tighter crop operating margins continues, farmland rental rates continue to adjust downward, helping to brighten the financial picture for many farm operations.

Looking ahead

In addition to the monthly questions measuring sentiment, the barometer survey also asks producers about the key drivers affecting their farms and the broad farm economy.

On the June survey, producers were asked to compare current expectations about their farm financial performance in 2017 to their initial budgets or plans. Most producers — 60% — indicated that current expectations are “about the same” as their initial expectations.

However, for farm operations whose expectations changed, a turn towards “worse than” planned (28%) was more common than ‘better than’ budgeted (12%).

Respondents indicating they expect their 2017 financial performance will be worse than originally planned could be reflective of the difficulties some farms have experienced this spring with respect to planting and poor growing conditions, especially in the Eastern Corn Belt.

Weather challenges

One of the challenges producers faced this spring has been an oscillation from cool/wet periods to hot/dry spells. Respondents were asked about extreme weather conditions. Compared to previous surveys there was an uptick in the share of respondents rating it likely that extreme weather events would have widespread, adverse impacts on crop yields over the next 12 months. The June 2017 survey was the first time a majority of producers (52%) indicated they expected extreme weather events to impact crop yields.

Producers were also asked if they made changes in their farms’ marketing plans as a result of their weather expectations. In this month’s survey, one-third of respondents indicated they had made changes, up from 22% in March 2017 and 29% in June 2016.

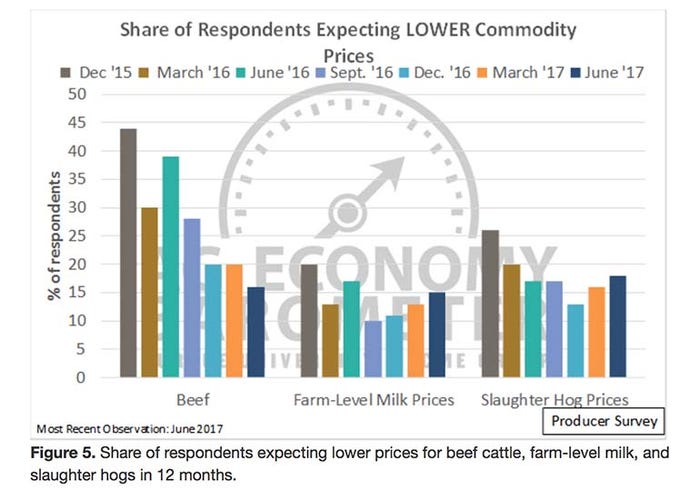

Cattle price optimism

Since last fall, cattle prices have significantly increased. The increase in prices has resulted in producers being less pessimistic about beef cattle prices over the next 12 months. Cattle price expectations were most negative in December 2015, when nearly 45% of respondents said they expected beef cattle prices to be lower 12 months out. Expectations for cattle prices have changed markedly since then as just 16% of respondents on the June survey expect weaker cattle prices in the year ahead.

Business climate outlook

A theme observed in late 2016 and throughout 2017 is an expectation that the business climate for agriculture will improve. Previous surveys revealed that producers are more optimistic about the broad U.S. economy than prior to November 2016, 40% of producers expect a more favorable regulatory environment in the upcoming five years, and a majority of survey respondents think efforts to renegotiate the North American Free Trade Agreement (NAFTA) will prove beneficial to U.S. farmers.

In this month’s survey, producers were asked about their expectations regarding expected changes in taxation to learn whether that is one of the drivers behind their outlook for an improved business climate.

When asked about the taxes affecting agriculture 12 months from now:

18% of producers expect taxes to decline,

30% of respondents expect taxes to increase,

52% expect taxes to be about the same as they are today.

When asked about taxes affecting agriculture over five years:

18% expected lower taxes

52% expected higher taxes

Source: Purdue/CME Group

You May Also Like