August 10, 2023

by Austin Weaver

The recent flood events in the Northeast have been devastating to some producers. As a result, the IRS has released tax relief information for individuals, households and businesses.

This tax relief is applicable to anyone located in a FEMA-declared disaster county, along with state tax relief specific to those located in Vermont’s 14 hard-hit counties.

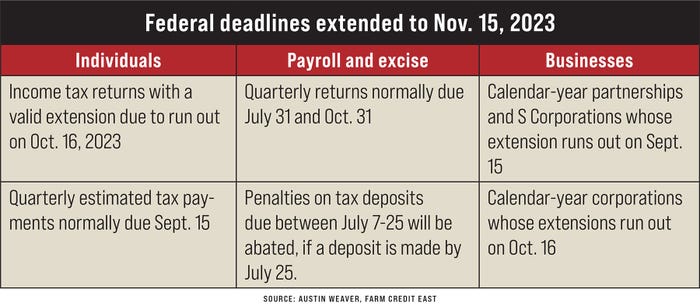

The Internal Revenue Service has postponed various tax filing and payment deadlines. The chart below summarizes the filings that have been extended until Nov. 15, along with other available relief:

While individuals have relief in terms of additional time to file their returns, the IRS noted that because tax payments related to these 2022 returns were due April 18, 2023, there is no relief available for those payments as the disaster had a start date of July 7, 2023.

In addition to this relief, which is automatic to taxpayers with an IRS address of record located in the disaster area, the IRS will work with any taxpayer who lives outside the disaster area but whose records are located in the affected area.

State tax changes

Following the IRS announcement, Vermont Gov. Phil Scott directed the Commissioner of Taxes to extend Vermont state tax deadlines for those affected by the flood events.

Taxpayers affected by the flood do not need to contact the Department of Taxes to request extensions to Nov. 15 for the following tax types with original due dates between July 7 and Nov. 15, 2023:

corporate and business income tax, including estimated payments

sales and use tax

meals and rooms tax

payroll withholding tax

estimated personal income tax payments, originally due Sept. 15, 2023

filing of 2022 Vermont personal income taxes with a valid federal or Vermont extension

Vermont tax obligations beyond those listed may be eligible for extension, but taxpayers will need to contact the Taxpayer Services Division and may be asked to provide proof of hardship.

Unlike the federal relief, which is granted by address of record, the governor’s office noted in a press release that Vermonters not affected by the flood are expected to file and pay their state tax obligations by the original due dates.

Claiming disaster losses

FEMA has issued a disaster declaration for all 14 of Vermont’s counties. Additional declarations may be made in other Northeast states.

As a result, individuals and businesses who suffer uninsured or unreimbursed disaster-related losses may be able to claim these losses on their income tax returns. Claiming a disaster area loss requires navigating many rules around when to deduct the loss, calculating the loss and where to report the loss on your tax return.

Be sure to write the FEMA declaration number — 3595-EM — on any return claiming such a loss.

Donations available for losses

After devastating flooding in Vermont and other parts of the Northeast, Farm Credit East has announced its Farm Credit East Cares Community Fund will make available up to $250,000 in flood relief to affected Northeast producers.

Farm Credit East Cares is funded by employee contributions with a Farm Credit East match. In addition, CoBank, Farm Credit East’s funding bank, and FarmerMac are contributing to this effort.

Affected producers are eligible for $500 individual donations. This financial assistance is not intended to replace equipment or business losses, but instead will help cover personal losses and other expenses.

Funds from CoBank and FarmerMac will be contributed to the Farm Credit East Cares Community Fund, which will work with The Center for an Agricultural Economy to distribute. In addition to the direct assistance, any additional funds available will be contributed to organizations providing direct relief to producers in the region.

“We know many farmers and forest product producers have suffered significant losses and damage,” says Craig Pollock, senior vice president and coordinator of Farm Credit East Cares. “We hope these donations can provide some short-term relief, whether to replace personal items or pay expenses in the short term while families begin the recovery process. We truly appreciate CoBank and FarmerMac’s generous contributions to this effort.”

Farm Credit East Cares was established following the devastation of Hurricane Irene in 2011. Since inception, this employee-led charitable fund has distributed more than $1 million in direct assistance to farm families and charitable organizations.

Impacted producers interested in receiving Farm Credit East Cares support can apply online at farmcrediteast.com/floodrelief. Financial assistance is not limited to Farm Credit East members. Any farm, forest product or fishing business affected by the July flooding in Farm Credit East’s eight-state territory is eligible for this aid. Depending on available funding, applications will be considered on a rolling basis until Sept. 15.

Farm Credit East members and Crop Growers crop insurance customers affected by the flood should reach out to discuss their individual situation with their representative. Farm Credit East is committed to working with borrowers impacted by the flooding on a case-by-case basis to find the best solution.

Weaver is a tax specialist for Farm Credit East in Burrville, N.Y.

Source: Farm Credit East

You May Also Like