March 13, 2024

At a Glance

- To participate, a farmer should be under one of the individual plans, YP, RP or RP-HPE.

- Any crop on a farm that is under the Agricultural Risk Coverage program is not eligible for SCO coverage.

- The program offers high subsidy rates.

by Molly Sears and Sungmin Cheu

The Supplemental Coverage Option is an area-based crop insurance plan that can be added on to an underlying individual crop insurance policy.

Available since 2015, SCO offers additional protection from the coverage level of an underlying plan up to 86%. The federal government subsidizes 65% of the premium cost for SCO.

Eligible underlying individual plans include Yield Protection (YP), Revenue Protection (RP), or Revenue Protection with the Harvest Price Exclusion (RP-HPE).

The coverage of SCO follows the coverage of the underlying plan. For example, if the underlying plan is YP, SCO covers yield loss. Similarly, if the underlying plan is RP, it covers revenue loss.

Eligibility of SCO

There are two main eligibility criteria for SCO. First is that a farmer should be under one of the individual plans mentioned above: YP, RP or RP-HPE. Secondly, any crop on a farm that is under the Agricultural Risk Coverage program is not eligible for SCO coverage.

Therefore, farmers who are willing to elect SCO need to weigh between ARC and Price Loss Coverage with SCO when they make decisions for their commodity programs.

How does SCO work?

SCO indemnities are determined by losses at the county level, whereas payments of YP, RP and RP-HPE are triggered based on individual farm-level losses. This difference in triggering criteria results in cases where SCO makes payments when the underlying plans do not, and vice versa.

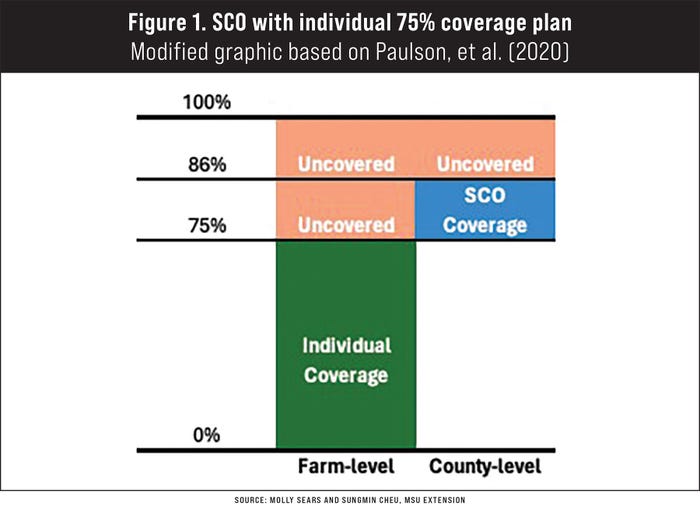

Figure 1 below illustrates a case where a farmer enrolls in a 75% coverage individual plan, either YP, RP or RP-HPE, with SCO. Farm-level risks are protected up to 75% and the remaining farm-level risks are not covered even with SCO.

SCO, however, provides protection from 75% to 86% of risks at the county level based on county revenue or yield.

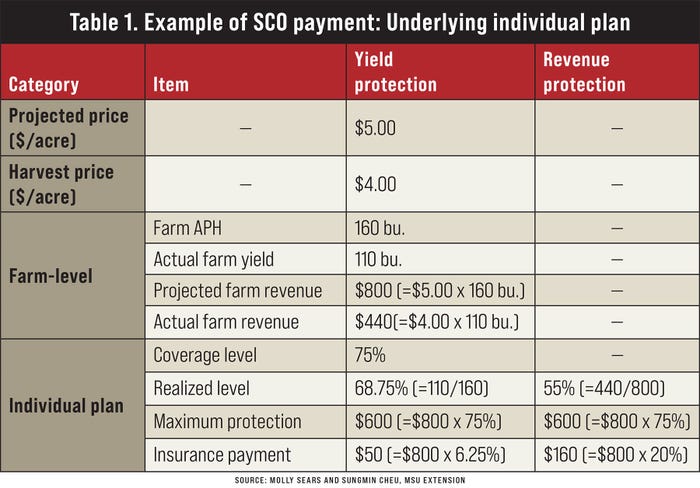

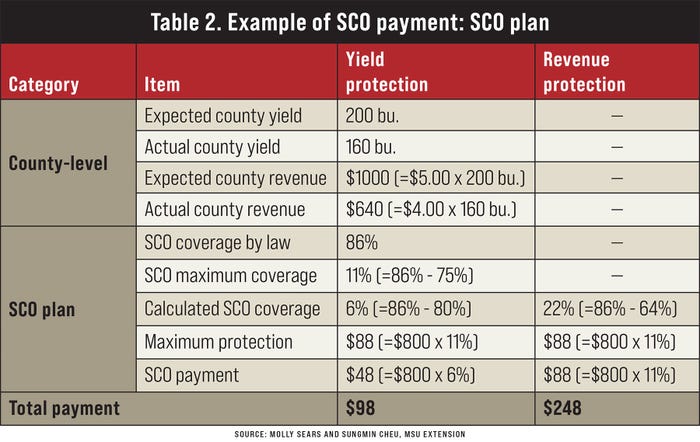

The SCO payment is limited by the difference between 86% and the farm-specific coverage level of the underlying policy. The examples provided in Table 1 and Table 2 offer a detailed illustration of cases with YP and RP at a 75% coverage level. Table 1 displays the payments from individual plans, while Table 2 illustrates the payments from SCO for each individual plan.

In the example in Table 1, the indemnities for YP and RP are $50 per acre and $160 per acre, respectively. The indemnity for RP is larger than the indemnity for YP in this case, because we assume the harvest price ($4.00) is lower than the projected price ($5.00) and YP does not provide protection for this price decrease.

With SCO, as presented in Table 2, a farmer can obtain additional coverage based on the county-level outcome. In our example, the limit of SCO for both YP and RP is $88 ($800 x (86% - 75%)). SCO for YP provides additional protection of 6% to the projected farm revenue, totaling $48 ($800 x 6%), as the actual county-level yield is 80% (160 bu./200 bu.) of the expected county yield.

For RP, the actual county-level revenue is $640 ($4 x 160 bu.), which is 64% of the total $1,000 ($5.00 x 200 bu.) of the expected county-level revenue. The calculated indemnity of SCO for RP is $176 ($800 x (86% - 64%)). However, the actual SCO payment would be $88, as the calculated indemnity exceeds the SCO payment limit of $88.

In total, YP with SCO would pay $98 ($50 + $48) and RP with SCO would pay $248 ($160 + $88).

SCO use in Michigan

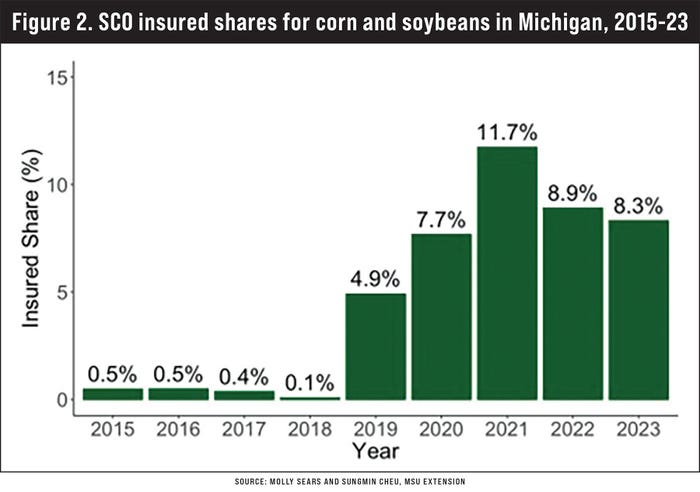

Figure 2 shows the trends on insured shares of SCO in Michigan. The insured share is defined as a proportion of insured acres with SCO or ECO over the total insured acres with YP, RP and RP-HPE. The use of SCO remained below 1% since its introduction in 2015 through 2018.

From 2019-21, SCO use increased, reaching a high point of 11.7% in 2021, followed by a decline to 8.9% in 2022. In 2023, the share remained stable at 8.3%. The sudden surge in SCO use in 2019 was likely due to the late passage of the 2018 Farm Bill, which allowed acres enrolled in PLC to purchase SCO.

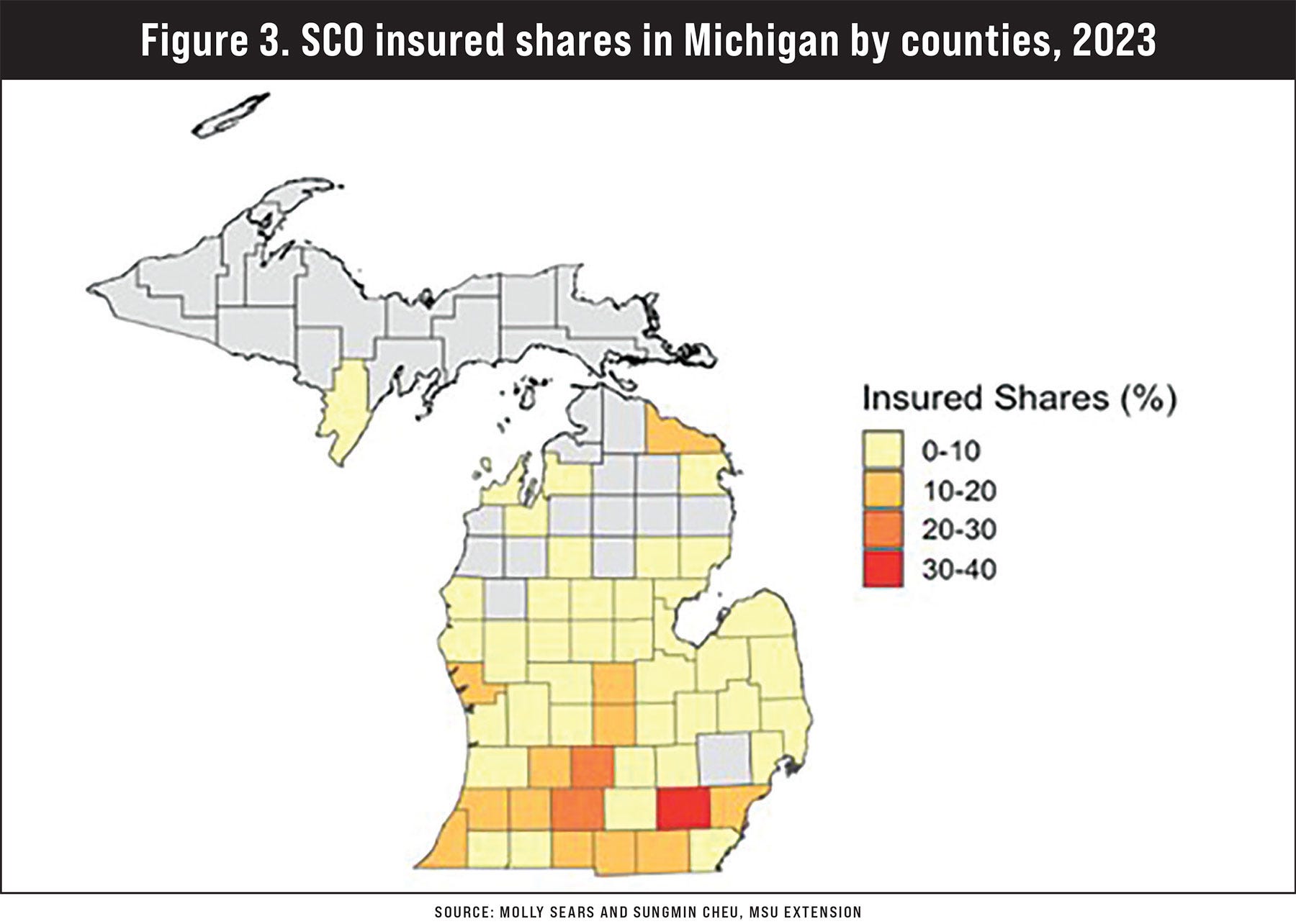

Figure 3 illustrates the insured shares of SCO by counties in 2023. Across most counties, the insured shares of SCO remain below 10%. Notably, the southern part of the state shows a higher use of SCO compared to other parts of the state.

SCO is a relatively new insurance option that is gaining some traction in Michigan. The high subsidy rates and the possibility of diversifying coverage with county-level protection rather than farm-level has made SCO an attractive choice for many growers.

However, SCO is one option in a suite of choices that producers will need to make this season. As many commodity producers make the decision to choose between ARC and PLC, it is important to keep in mind that SCO can only be added to PLC, as it too closely resembles ARC-County.

For more information on the choices to make this season, see MSU Extension resources on the farm bill.

Sears and Cheu write for Michigan State University Extension.

Read more about:

Federal Crop Insurance ProgramYou May Also Like