June 2, 2023

Farms and ranches come with many types of risk, but insurance can help manage them.

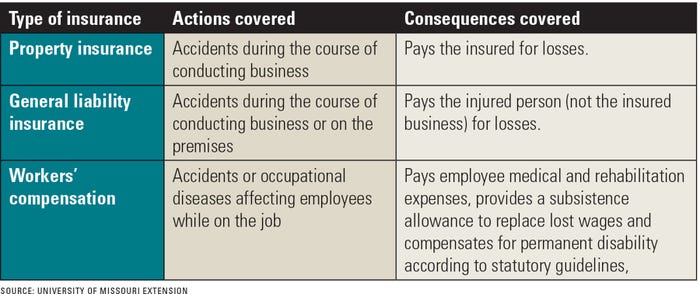

Insurance needs to cover an action that could potentially occur, as well as the resulting negative consequence. The table below gives a brief overview of common types of farm insurance.

Various types of insurance cover different actions and consequences. These types of insurance are not mutually exclusive, and farmers should carry insurance for any area of risk.

What insurance covers

General liability insurance covers the insured person or business when they are legally responsible for damages to others caused by the insured person's negligence.

Common coverage categories include property damage, third-party bodily injury and liability for compensatory damages in a personal injury case. The insurance policy states the maximum dollar liability per occurrence and maximum dollar liability for all occurrences of each coverage category.

The insurance company providing the liability coverage pays the legal obligations for harm unintentionally caused to other people or property by the insured person or business. The cost of defense can include attorneys, discovery, trial preparation and other costs. The policy will also typically indemnify, or compensate, the insured against the amount of any judgment obtained.

One question for the insurance agent is whether the legal defense costs are considered part of the maximum dollar liability or in addition to the maximum dollar liability.

Three requirements must be met when a claim is made on liability insurance:

Did something happen?

Did damage or injury result from what happened?

Is the policyholder legally liable for the damages?

Beware, however, that misrepresenting or omitting facts on the application can cause loss of liability coverage. Also, certain activities may void a liability insurance claim, including illegal activities committed intentionally or recklessly, fraud and intentional damage.

Know what’s not included

Liability insurance specifically covers accidents, defined as "unexpected events or circumstances without deliberate intent."

Farmers are often surprised by things not covered by insurance. Bodily injury to a family member that occurs on the farm may not be covered; bodily injury to a friend visiting the farm might be covered.

Fieldwork, such as planting or spraying on your own farm, might be covered; it may not be covered if done for a neighbor as part of a custom farming activity.

Other common exclusions in general farm liability insurance include:

farmers market sales

agritourism

boarding dogs or horses

nonfarm activities such as snow removal or landscaping

custom farm work

spraying chemicals on your own farm

spraying chemicals under contract for others

In most cases, it is possible to buy an endorsement or a rider to cover activities typically excluded from coverage. Ask your insurance agent which works best for your farm.

Talk with your agent

Communication with your insurance agent is important. The agent needs to understand your farming operation and the risks to be insured.

Changes in farming operations should be shared with the insurance agent, such as farms rented. Each insurance agent and company are slightly different, so ask questions.

More details on farm liability insurance can be found in the MU guide G455 at extension.missouri.edu.

Source: University of Missouri Extension

Read more about:

Farm LiabilityYou May Also Like