November 16, 2023

by Chad Zagar

As a farmer, you can donate commodity inventory to charity. Instead of selling that commodity, then giving the charity cash, this approach comes with tax advantages.

Due to the increased standard deduction in the 2018 federal tax law changes, many individuals are not receiving any benefit from their charitable contributions. Donating commodities allows you to still deduct the cost of producing commodities against your farm income.

It provides for lower sales on the farm and may save you income tax and self-employment tax, and it provides for lower farm income and a lower AGI, which may help you when it comes to credit and deduction phaseouts.

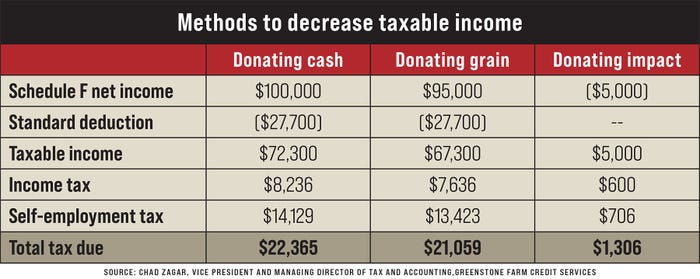

As a simplified illustration, assume that farmer David and his wife, Megan, generally donate 5,000 a year to a local charity and can’t itemize their deductions.

As you can see in the chart, the tax savings is $1,306 by changing the process in which you make your donation.

Zagar is vice president and managing director of tax and accounting for GreenStone Farm Credit Services.

Source: GreenStone Farm Credit Services

You May Also Like