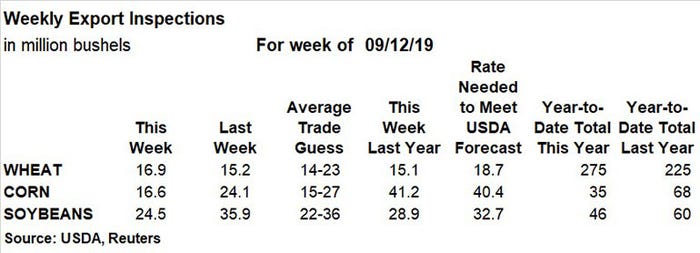

The latest round of weekly export inspection data, out Monday morning, didn’t have a lot of good news to chew on, according to Farm Futures senior grain analyst Bryce Knorr.

“While it was only the second week of the 2019 marketing years for corn and soybeans, totals were disappointing, falling below weekly rates needed to reach USDA’s forecasts put out last week,” he says.

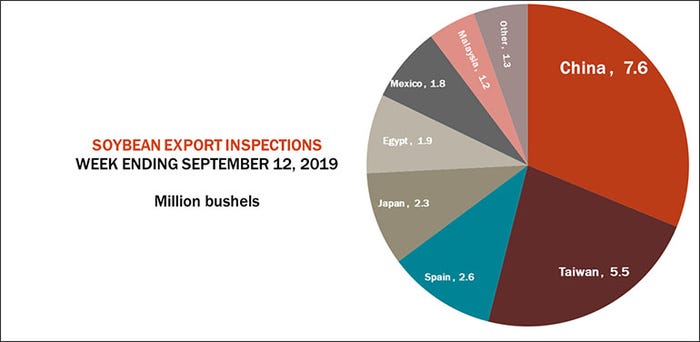

China continues to take delivery of purchases rolled over from 2018 crop delivery, but the new crop book of outstanding sales is thin due to lack of Chinese purchases, Knorr adds.

“Today’s news of another soybean sale to China under USDA’s daily reporting system for larger purchases is a step in the right direction but are only baby step compared with what needs to be done,” he says.

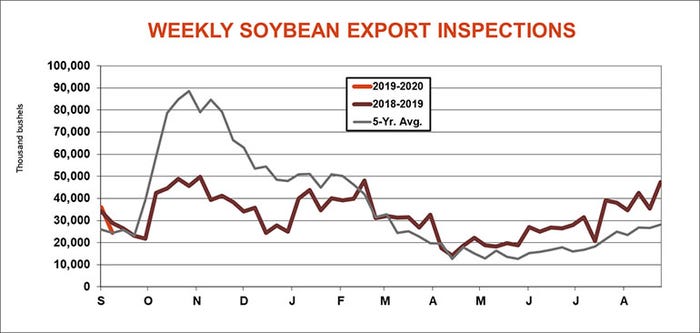

Soybean export inspections reached 24.5 million bushels for the week ending September 12, which was moderately below the prior week’s tally of 35.9 million bushels and on the low end of trade estimates that ranged between 22 million and 36 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 32.7 million bushels. The first two weeks into the 2019/20 marketing year reached 46 million bushels, down 23% from a year ago.

China led all destinations for U.S. soybean export inspections last week, with 7.6 million bushels. Other leading destinations included Taiwan (5.5 million), Spain (2.6 million), Japan (2.3 million) and Egypt (1.9 million).

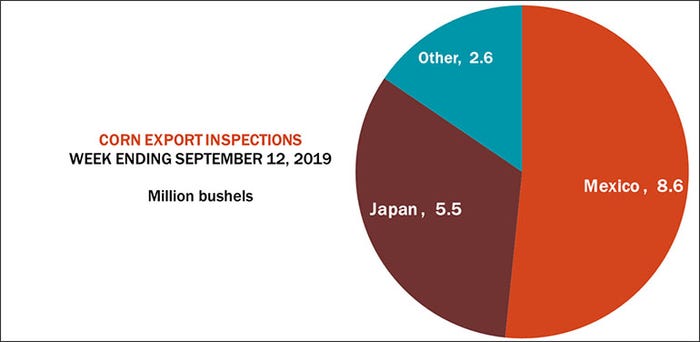

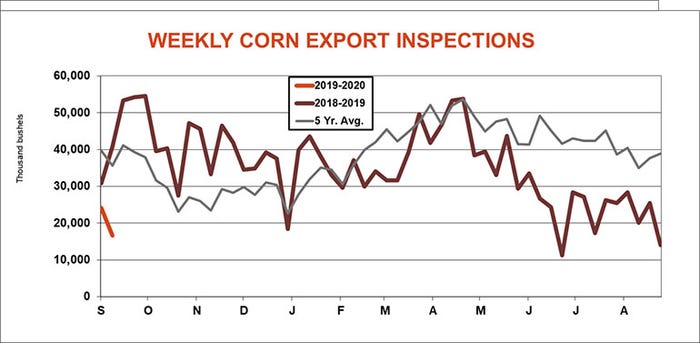

Corn export inspections also slumped week-over-week after reaching 16.6 million bushels, versus the prior week’s tally of 24.1 million bushels. As with soybeans, corn totals fell on the low end of trade guesses, which ranged between 14 million and 27 million bushels. The weekly rate needed to match USDA forecasts moved up to 40.4 million bushels, while marketing year-to-date totals of 35 million bushels are down 48.5% year-over-year so far.

“Corn shipments remain hamstrung by Brazilian domination of world export trade, offering buyers cheaper prices delivered, though the discount to U.S. originations is shrinking slowly,” Knorr says.

Mexico accounted for more than half of all U.S. corn export inspections last week, with 8.6 million bushels. Japan picked up another 5.5 million bushels, with other destinations filling in the final 2.6 million bushels.

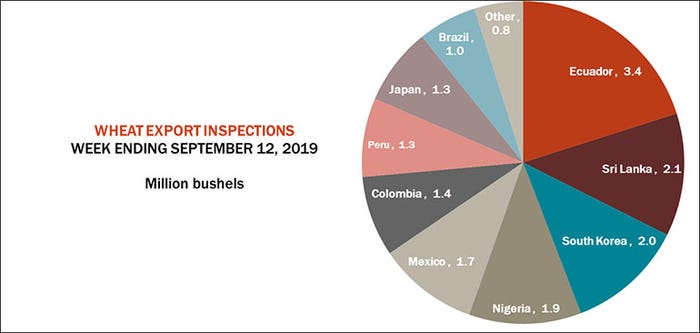

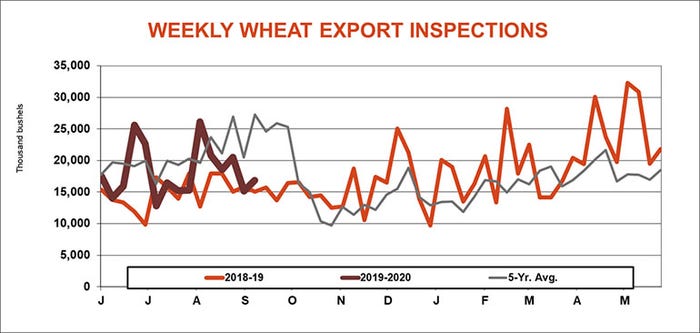

Wheat export inspections managed better totals week-over-week, with 16.9 million bushels, versus 15.2 million bushels for the week ending September 5. However, this week’s tally still landed on the low end of trade guesses that ranged between 14 million and 23 million bushels and failed to match the weekly rate needed to stay in step with USDA forecasts, now at 18.7 million bushels. Still, the 2019/20 marketing year is faring 22% better than a year ago, with cumulative totals of 275 million bushels.

“The wheat trade remains fractured, with a lot of individual buyers taking mostly single cargoes,” Knorr notes.

That includes modest sales to a broad set of countries, including Egypt (3.4 million), Sri Lanka (2.1 million), South Korea (2.0 million), Nigeria (1.9 million), Mexico (1.7 million) and others.

About the Author(s)

You May Also Like