May 10, 2017

The march toward a final day in ChemChina's acquisition of Syngenta is nearing. In mid-April, China approved the deal - with no remedies or divestitures required - and soon after India came on board. That got the ball rolling toward finalizing the deal. Earlier officials in the United States and the European Union gave the nod, but with some conditions.

In early May, ChemChina tendered for shares in the company from Syngenta shareholders. The goal was to hit the minimum of 67% of shares, in fact the total was 82.2%. ChemChina recently announced that it was tendering to purchase all outstanding shares and American Depositary Shares of the company as well. ChemChina has set a final date for May 24.

New board members are being lined up as part of the new ownership with four Independent Directors, and four members proposed by ChemChina. Those will be approved in a June 26 Annual General Meeting. As part of the announcement, the companies noted that Independent Directors must weigh in on any reduction in the Syngenta R&D budget below a specified level, or any change in the location of headquarters. If those would be proposed, two Independent Directors have to vote in favor.

This legal and corporate wrangling has been going on for months, but appears to be winding down. Late last year, Penton Agriculture spoke with Erik Fyrwald, CEO of Syngenta, about the opportunities ahead. He pointed out that when the dust settles from the merger, Syngenta remains an ag-focused company that is a "leader in crop protection products, number three in seeds worldwide and a leader in seed treatment products."

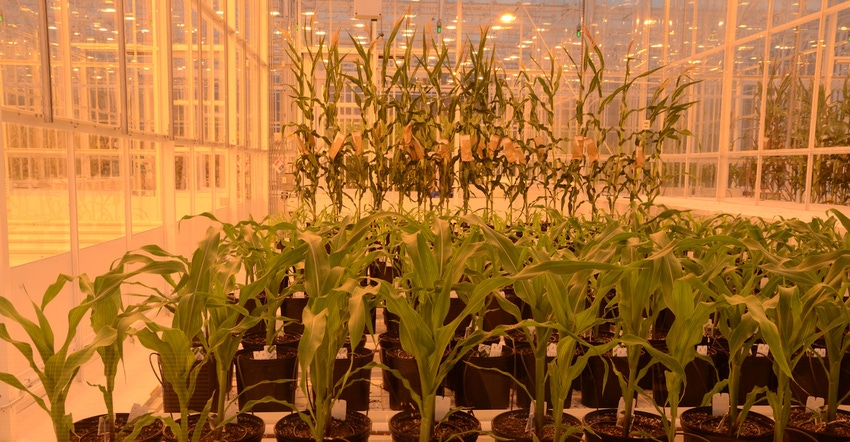

Fyrwald acknowledged that Syngenta has opportunities in the seed business going forward as well. A former DuPont Pioneer executive, he knows the competitive landscape - even as other mergers and acquisitions reshape the market. For Syngenta, he said there's potential for seed market share growth. He noted that the company has a strong pipeline of seed tech and traits for the future, and will work to build on that.

Earlier in the decade, Syngenta had brought crop protection and seed together under one marketing organization. That's been unwound and each side will focus on their priorities. For crop protection that means Acuron and Trivapro - two new tools for farmers. Acuron is a herbicide launched in 2016 that has seen solid performance. Trivapro is a new fungicide product that also got solid first-year traction in 2016. And more crop protection tools are in the pipeline.

Fortune recently had a feature offering more background about why China is interested in Syngenta. The country has long been focused on keeping its people fed, so investments in ag and technology make sense. The country has dealt with famine as recently as the early 1960s, and its leaders remember those times. They don't want to see them again.

Historically, as the Syngenta deal comes to a close, it will rank as the largest non-Chinese investment in the country's history. At $43 billion it's more than double the next largest - CNOOC's purchase of Canadian energy company Nexen in 2013 for $15.2 billion.

There are future deals that have to be made by Syngenta and ChemChina to meet the requirements of countries that put restrictions on the sale. Adama, a ChemChina-owned marketer of post-patent products will be sold; as will some other assets as required by the U.S. and EU. But the prep work is about finished, the real work of moving forward has already begun.

Fyrwald came in as CEO in mid 2016, and hit the ground running. And he's confident about the new ownership: "ChemChina has no interest in cutting back. We'll lean into our pipeline." After the late-June annual meeting, with a new board in place, the new ownership structure of Syngenta will be complete. Then the real work of remaining competitive in a market where other merger and acquisition deals are still in the works, begins.

About the Author(s)

You May Also Like