September 14, 2017

As fall weaning time nears, cow-calf producers should assess backgrounding prospects. Likewise, stocker operators who buy calves should size up available margins. Markets are dynamic. Producers should “run the numbers” frequently and consider implementing risk management when good margins exist.

No “best” fall calf crop marketing choice exists for all producers. Deciding factors include type and quality of cattle, cash flow needs, feed availability, and labor and management constraints. No strategy will be best every year. Only time will tell if a strategy proves profitable.

Evaluating your options pits expected cost of gain against expected value of gain. Cost of gain drives the relative value of lighter-weight vs. heavier feeder cattle.

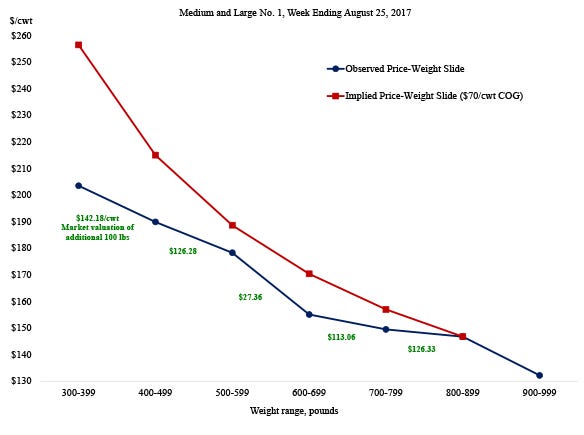

The graph below shows the equivalent price of lighter-weight feeder cattle compared to heavy feeders, assuming an average cost of gain of $70 per cwt. This is the current feedlot cost of gain reported by Iowa State University’s “Estimated Yearling to Finish Returns.” All else equal, a lower cost of gain will make the price-weight slide steeper, implying a sharper discount in feeder prices as weight climbs.

Conversely, higher cost of gain will flatten the price-weight slide demonstrating heavier-weight feeders are worth relatively more. Often and on average, the two price-weight slides will coincide. That means feeder cattle markets are in “equilibrium” — the value of putting weight on cattle roughly equals the cost to put weight on.

Feed costs matter

Late-August average market prices have diverged significantly at lighter weights from what the cost of gain dictates they should be. Lightweight feeder cattle appeared to be underpriced relative to cost of gain. Corn prices matter in this relationship. Continuing relatively low-priced corn should make the price-weight slide steeper, because lightweight feeders are worth more relative to heavyweight feeders when cost of gain is lower.

Feedlots and stocker operators alike will prefer lightweight cattle, as operators will want to capture the value by putting on the gain themselves, rather than buying it. This should lift lightweight calf prices.

The slump in lightweight feeder prices is simultaneously an opportunity for cow-calf producers to background and a purchase signal for stocker producers.

The observed value of gain for lightweight cattle is higher than the current cost of gain and is averaging from $126 to about $142 per cwt. The observed price weight slide is not a smooth line but includes a kink from 500 to 600 pounds. This translates into the highest value of gain at weights between 300 to 500 pounds and 600 to 900 pounds.

Understand market fundamentals

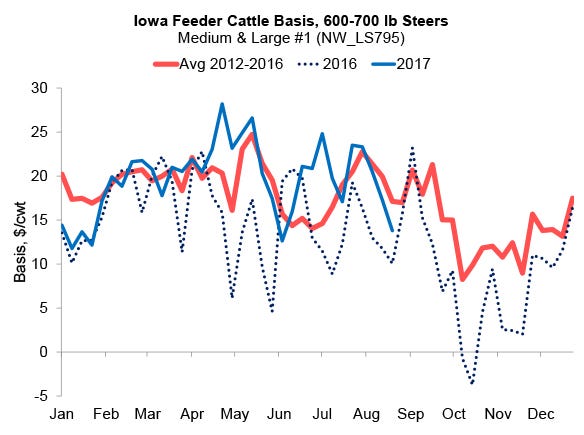

Feeder cattle price relationships help producers understand backgrounding and purchase signals. Of course, the ultimate value of gain depends on market values for cattle at the time of purchase (or at the time of the decision to background) versus at the time of sale. Feeder price adjustments over time may be unequal across cattle weights, like the example of the current weakness in six-weight steer prices relative to prices for other feeder weights.

Projected value of gain is largely driven by cattle market fundamentals and can be assessed using available futures market and basis information. The broader cattle market conditions indicate that feeder cattle supplies will build over time but demand appears to be strong. Feeder prices look to be somewhat flat through 2017 but may begin to soften in 2018.

Producers with a specific weight gain and feeding duration in mind can project value of gain. As an example, on Sept. 5, suppose an Iowa producer was planning to sell steer calves weighing 550 pounds on Oct. 15 at $167.21 per cwt. October 2017 feeder cattle futures are trading at $142.50 per cwt and a five-year (2012-16) historical October basis for 500- to 600-pound steers is $24.71 per cwt. Further, suppose this producer was considering retaining ownership by backgrounding the calves to 650 pounds by November. The projected value of gain would be $87 per cwt.

Alternatively consider a stocker operator who is assessing buying these October weaned calves with a planned sale date in January or February. A value of gain between $74 and $84 per cwt may be expected for ending weights in the 750- to 850-pound range.

Note these projections presume no premium at marketing, such as for preconditioning. Premiums for preconditioned calves sold in Iowa have ranged from $2 to $7 per cwt in recent years. Producers who can capture a premium by proactively marketing preconditioned calves capture more value per pound of gain.

Besides expected value of gain, you need to know expected cost of gain to assess dollar-per-cwt and dollar-per-head margins for all backgrounding and stocker placement possibilities. Producers with some insight on their own cost of gain can compare those estimates directly with the value of gain to estimate margins. If selling preconditioned calves, include the cost to precondition in your cost-of-gain calculations.

Projections here hinge on historical basis levels accurately predicting the future. Risk management will be important in the coming months but is challenging due to basis uncertainty. After producers choose to background or buy calves, they should repeat value-of-gain projections and derive updated values post-placement to identify optimal marketing times.

Any effort at delaying cattle sales, or purchasing cattle for later sale at heavier weights, exposes an operation to both down- and upside price risk. Both production and price risk considerations of owning cattle over time and the challenges of managing those risks are additional considerations beyond the retention and purchase opportunities in the current market. Carefully consider market conditions, production plans and costs, and value-added opportunities this fall.

Schulz is the Iowa State University Extension Livestock economist. Email [email protected].

About the Author(s)

You May Also Like