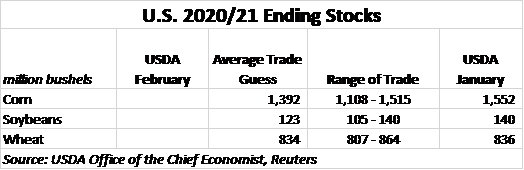

With 2020 crop estimates largely out of the way following January reports, USDA’s February World Agricultural Supply and Demand Estimates (WASDE) report typically focuses more on domestic demand and South American crop projections. Tomorrow’s report will be no different from previous years. Here is what the markets will be watching for tomorrow when USDA releases the updated figures at 11am CST.

It’s no secret that demand for U.S. grains has been lightning hot so far in the 2021 calendar year and will be the driving factor in a potential stock reduction. For all the recent chatter of demand rationing, a weak dollar and supply shortfalls have offered little incentive to slow buying paces over the past month. Here are a few hot items to watch in tomorrow’s report.

Corn:

Cattle on feed inventories remain at historically high volumes, but updated December 2020 figures also found a decrease in cattle placements. High corn prices and dry pasture conditions in the Plains and West could reduce cattle supplies in the coming months – a move that would reduce corn usage for livestock feed.

Corn consumption for ethanol demand remains largely flat during the winter months. Marketing year to date corn consumption for ethanol through December is 5% lower than the same time in 2019/20. Coronavirus vaccinations will help speed up the recovery to the ethanol sector – if vaccinations rates can increase under a new presidential administration.

Exports will likely be the primary culprit for shrinking 2020/21 corn stocks. Marketing year to date corn exports are nearly 25% higher than the five-year average due in large part to Chinese demand.

China booked record-setting export old crop corn sales over the past couple weeks. In fact, China has surpassed Mexico as the top destination for U.S. corn over the past weeks as loading paces to the world’s second largest economy intensify. Chinese and unknown buyers currently account for over 46% of all U.S. corn export commitments nearly halfway through the 2020/21 marketing year.

Soybeans:

Soybean crush rates continue to soar to record levels. The last three months of 2020 saw three of the four largest soy crush volumes on record amid economic turmoil in top soymeal exporter, Argentina. USDA has raised crush estimates in five of the last eight WASDE reports, suggesting there is little to deter them from extending that streak out for another month.

Chinese demand has driven marketing year to date soybean export commitments to 97% of USDA’s January 2021 estimate for 2020/21 soybean export demand. Despite a handful of new sales announced in recent weeks, the U.S. has already shipped nearly 92% of China’s total 2020/21 soybean commitments to China.

The Brazilian soybean shipping season is about a month behind due to planting and harvesting weather delays. U.S. soy export loading paces have slowed in recent weeks as Chinese buyers await the cheaper Brazilian crop. But loading paces over the past five weeks are nearly double than those of the five-year average. About 172 million bushels remain on the books left to be shipped to China, an amount China could easily exhaust in the next few weeks without any new sales.

Bottom line: Chinese soy exports are shattering records. It would be surprising if USDA didn’t adjust U.S. soy export targets based on the available data.

Wheat:

Wheat usage for flour milling during the 2020 calendar year rose nearly 1% from 2019 as the pandemic encouraged more at-home meal preparation. But flour consumption has largely leveled off as the second year of the pandemic approaches, suggesting food consumption for wheat will largely remain unchanged.

Wheat stocks are more likely to see a cut on increased livestock feed usage estimates in tomorrow’s report. Rising corn prices and dry pastures in west of the Mississippi could drive livestock feeders to find a cheaper feed alternative. The July 2021 wheat-corn parity of 1.16 currently favors using wheat as a more economical choice in cattle rations.

Wheat exports are unseasonably high for the time of year – loading paces in the past four weeks are 1% higher than the same time a year ago and 41% higher than the five-year average. An increase to U.S. wheat exports is possible in USDA’s updated reports tomorrow, though it will likely be a minor uptick.

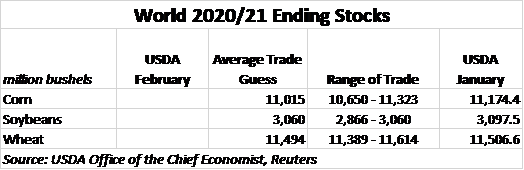

Global stocks are expected to shrink in tomorrow’s report. Here are a few factors to keep an eye on.

A USDA attaché in China reported that corn imports are expected to hold steady at the attaché’s previous estimate of 866.1 million bushels. The estimate remains nearly 177.2 million bushels higher than USDA’s January 2021 WASDE estimate of 688.9 million bushels.

Growing feed demand and increased corn ethanol production, coupled with a crop shortfall in 2020 has tightened Chinese corn stocks in recent months. China surpassed its 283.5-million-bushel tariff-rate-quota (TRQ) during 2020. A 65% out of quota duty is expected to be applied to incoming corn shipments for volumes over the TRQ benchmark, but there is little evidence to suggest this has been applied.

After record-smashing corn export sales by China over the past two weeks, it seems likely USDA will revisit China’s corn import estimate as well.

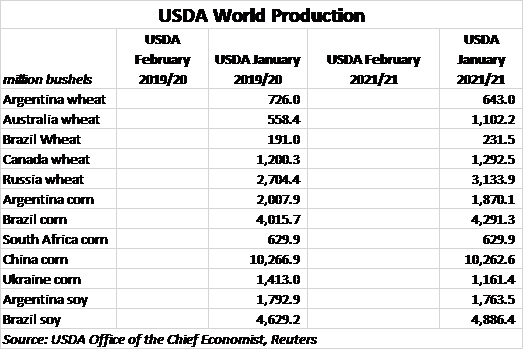

Russian wheat exports are likely to shrink as the government figures out how to reduce exportable supplies amid rising domestic food prices.

A USDA attaché report from Argentina expects wheat exports from the South American country to fall 6% from January 2021 estimates after a dry growing season due to La Niña weather patterns scorched the 2020/21 wheat crop. The attaché forecasts Argentina's 2020/21 wheat exports to total 415.2 million bushels. Argentina is the world’s seventh largest exporter of wheat.

The 2020/21 Australian wheat crop thrived amid rains that quenched a three-year drought in the land down under, according to a USDA attaché in Canberra. The attaché reports Australian wheat output will likely top 1.139 billion bushels – the second-largest Australian crop on record, behind 2016’s 1.169 billion bushels. Current USDA estimates peg the Aussie’s crop at 1.102 billion bushels, suggesting an increased likelihood for an upward revision in tomorrow’s report.

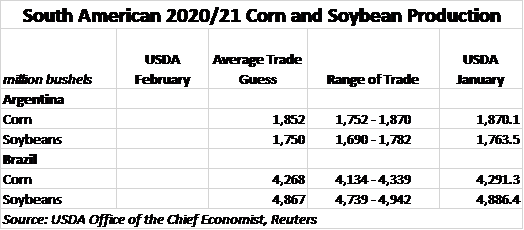

Besides increased U.S. grain demand, the other factor that will move markets in tomorrow’s report is crop shortfalls in South America.

Harvest is underway on the Brazilian soybean crop. It may be too early for USDA to make any changes to 2020/21 yield estimates, though not impossible.

A USDA attaché in Buenos Aires, Argentina reported that drought damage is expected to cause corn production forecasts to drop 1% from USDA’s January 2021 estimates to 1.85 billion bushels. The South American country will likely reduce domestic consumption to account for the crop shortfall with the attaché projecting a 23.6-million-bushel reduction in 2020/21 to 566.9 million bushels. Argentina is the world’s third largest exporter of corn.

A USDA attaché in Brazil estimates the 2020/21 corn crop to yield 4.134 billion bushels, down from January 2020 WASDE estimates of 4.291 billion bushels. The attaché cited drought stress to the Brazilian first crop of corn, as well as delayed planting of the second crop, or safrinha, of corn as key drivers behind reduced yields.

Despite planting delays, the USDA attaché expects the acreage for the safrinha crop to grow by 2.47 million acres to 48.2 million acres. The report notes that corn prices flirting with record highs is the key reason for Brazilian corn acreage expansion during the 2020/21 marketing year, which spans from March 2021 – February 2022 in Brazil.

About the Author(s)

You May Also Like