The August USDA crop report estimated that the U.S. soybean crop would reach record yields for soybeans of 53.3 bpa. The analysis for this estimate was likely done in late July.

Since then, the crop ratings have begun to take a nosedive and are expected to drop further as the season closes. It is hard to find a year where crop quality has changed in such a short amount of time. It seems the crop condition are changing so much that the crop reports cannot keep up. By the time they get the information out, it is already outdated.

My late grandfather spoke about a year in the mid-1950’s like this one. The crop had a really good start to the season and everything seemed to be going well -- until it wasn’t.

Without rain

Much of Iowa has gone without rain in the second half of the summer, forcing crops to rely solely on subsoil moisture. Accelerated maturity is now being forced on it very prematurely.

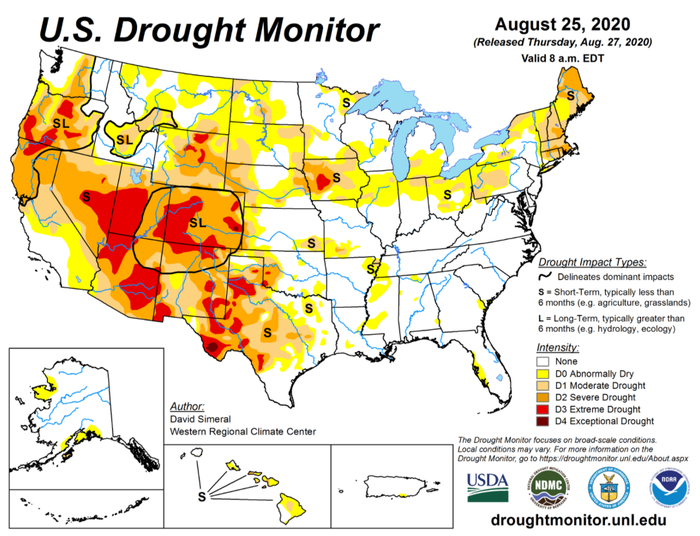

According to the latest U.S. drought monitor map, at least 90% of the state of Iowa is experiencing some form of abnormally dry weather. The epicenter of this drought has begun in the west central Iowa region where one producer told me they didn’t get a single substantive rainfall after they planted.

The drought radius expanded from there to where it now covers most of the state, reaching into eastern Nebraska and parts of South Dakota.

This is when high quality land earns its premium. You can clearly distinguish between the $12,000/acre, the $10,000/acre and the $8,000/acre soil type.

Where I farm in Northwest Iowa, the $8,000 per acre land gave up a while ago. It went into August already on edge. The $10,000 per acre has been mixed, with some areas holding on but has hence begun to deteriorate more swiftly.

The $12,000/acre land is on the edge and may take a slight hit, but has still managed to keep most of its yield potential.

Much of this deterioration seems to have happened in a matter of weeks --and continues to happen! And this point, damage from the drought is irreversible and rainfall would not do much. The primary benefit of rainfall at this point is to begin refilling subsoil reserves for next year which have surely been depleted.

Price turnaround

It has taken a while, but we have begun to turn this ship around. In the case of soybeans, new crop has rallied $1 per bu. since our summer lows. It is currently trading above $9.50.

I would point out that while not a great price, I believe we have entered back into profitable price territory for most regions. Even with a basis of 90 cents in Northwest Iowa, we can make money at that level assuming a decent yield.

November beans are going to encounter some pretty heavy resistance at the $9.75 area which will require some further confirmation of bullish news to break through. The market will need to see what USDA comes up with in their September report.

This week was about the last chance to pull the soybean crop out of the fire. August was make-or-break for the soybean crop, and it was mostly break.

If average soybean yields drop back to July estimates of 49.8 bpa, ending stocks could be reduced by 290 million bushels. This could provide the ammunition we need for the market to break above the $9.75 area and get us back to $10 beans.

Get your price targets in place and be prepared to take advantage of potential opportunities.

Matthew Kruse is President of Commstock Investments. He can be reached at [email protected] or call 712-227-1110.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like