For all the headlines about trade disputes and weak demand, production and supply will still be major influences on the 2020 U.S. cotton market. First there is the carry-in from 2019. As of this writing, the size of the 2019 U.S. crop is still uncertain, and will influence the supply of next year’s balance sheet in the form of potentially large carry-in stocks.

Then there is the question of 2020 production. The lingering farmer sentiment about growing cotton is probably mixed. Certain parts of the eastern Cotton Belt had very good yields in 2019.

On the other hand, the southern plains region had a cold/wet start, then a hot/dry summer, and finally an early freeze. This experience may give pause to recently converted cotton farmers in the Texas Panhandle, Oklahoma, and Kansas.

PRICE

All cotton growers got a taste of price volatility and weakness during 2019. The combination of low prices and poor yields may financially stress some farmers into planting less cotton in 2020. Yet, the strongest influence may still be the relative prices for competing crops in 2020.

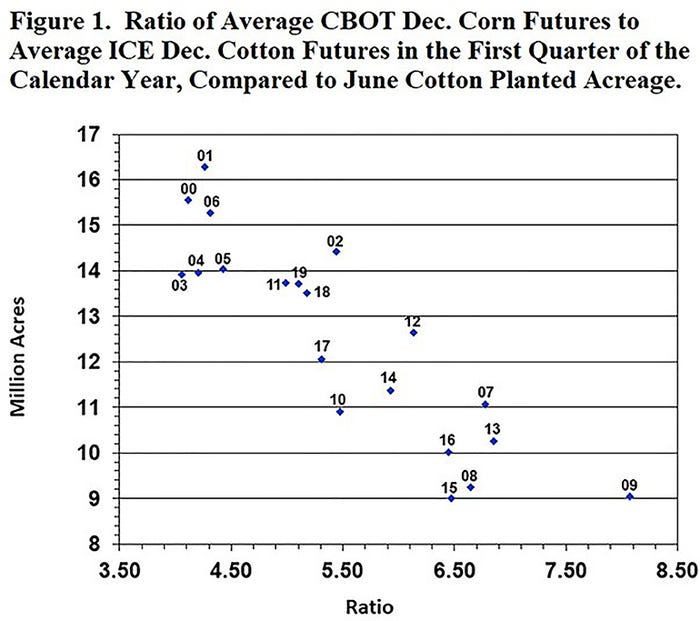

For example, when the winter-time cotton futures price was high relative to corn prices in 2018 and 2019, the result was over 13 million planted acres of cotton (Figure 1). That’s when the ratio of CBOT corn futures to ICE cotton futures was between four and five. But now the ratio is between six and seven, suggesting that more feedgrains may be planted at the expense of cotton acres.

PLANTINGS

History suggests that when corn futures prices are higher in relation to cotton futures, as they are currently, we could expect cotton planted acres between nine and ten million acres (see Figure 1).

Since the National Oceanic and Atmospheric Administration is not currently forecasting either El Niño or La Niña conditions going in to 2020, we can probably expect average yield and abandonment. When applied to about 10 million acres, this suggests 14 to 15 million bales of production, and a U.S. supply around 21 million bales.

Conservatively assuming 16 million bales of exports, it should be easy to cut 2020 ending stocks in half, relative to 2019. Decreasing ending stocks is historically associated with price strength. We might then expect ICE cotton futures prices for the 2020 cotton crop to range in the 60s and 70s.

There is still a lot of uncertainty in this outlook, even just on the supply side. Good yields and productivity in the Delta and Southeast may prevent a large swing out of cotton, leading to more acres planted than what we’ve projected above.

The uncertainty in crop markets is unavoidable. You can only act with certainty on what the market is showing you today. So be very intentional and go into 2020 with your eyes wide open.

You should have realistic estimates of your expected yields and per unit costs of production that you must cover if you plant cotton.

For additional thoughts on these and other cotton marketing topics, please visit http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like