September 9, 2015

It seems a little early to be forecasting the 2016 cotton market — heck, there are still quite a few unanswered questions remaining for the 2015 crop. And furthermore, there is little in the way of hard data to build a 2016 forecast around.

However, the crop choice decision is critically important because it determines both profitability and subsequent risk management outcomes. It is never too early to be thinking about that.

Carry-in. The supply picture for the 2016 crop will first be influenced by how much is left over from the current marketing year. Right now, that is anybody’s guess. As of August, USDA is forecasting 3.1 million bales of carry-in from the 2015 crop. If I had to guess, I think that number will be closer to 4 million bales.

Competing crops — Feed grain and oilseed crop futures are lower than in recent years, and I would characterize corn futures as being at the low end of their recent range. In Texas, the good basis for 2014 sorghum has apparently passed. Soybean prices have declined more on a percentage basis. Winter wheat prices are not great.

Will these price movements stimulate a lot more cotton acreage? I’m doubtful. In other parts of the cotton belt, the competing crops may now simply be more of a toss-up. In Texas, the more normal relationship of cotton to sorghum profitability might attract a few acres back to cotton. This may compensate for reductions in cotton acreage east of Texas. At any rate, my early forecast is for similar cotton acreage, based on relative prices for competing crops.

New Crop Production. NOAA is forecasting strong El Niño conditions through spring 2016, which implies above average moisture during the pre-planting seasons. But the forecast is for a return to “normal” precipitation patterns in May, and then drier-than-normal conditions during the summer.

For the latest on southwest agriculture, please check out Southwest Farm Press Daily and receive the latest news right to your inbox.

The implication of all this is unclear, but it is not unreasonable to think that nine-something million acres of cotton will get off to a decent start, and then who knows. In other words, we may have a weather market situation that either gives us a very tight or average new crop production outcome.

Export Demand. China's lingering influence on demand for U.S. exports will continue to be an issue. The Chinese government’s reserve stocks will still be with us. I expect their presence will continue to create a divergence in terms of an excess world supply of low grade cotton versus a shortage of high grade cotton.

One way to tie all these strands together is to look at 2016 futures prices. The cotton futures market provides a forecast of what supply, demand, and price conditions might be.

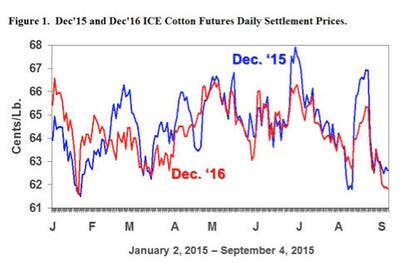

Dec. 2016 ICE cotton futures have traded between 62 cents and 66 cents since January 2015 (Figure 1). This is very similar to futures price levels for the 2015 crop.

Dec. 2016 ICE cotton futures have traded between 62 cents and 66 cents since January 2015 (Figure 1). This is very similar to futures price levels for the 2015 crop.

One caveat to using the futures market is that less than 3 percent of open interest is in the Dec. 2016 contract. In other words, not many traders are putting their money where their mouth is. Still, those who have put money on it appear to be betting that the supply and demand conditions next year will be sort of like this year.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like