December 22, 2014

USDA provided us with a surprise gift right before Christmas. During the first quarter of the year, we see a familiar roadmap of information milestones for the 2015 cotton outlook. These milestones include presentations at the Beltwide Cotton Conferences (early January), the National Cotton Council Annual Meeting (early February), USDA Outlook Forum (February 19), and USDA Prospective Plantings Report (end of March).

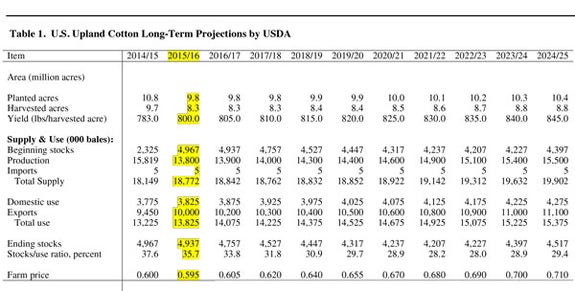

One of the things released by USDA during the Outlook Forum is their official ten-year projection of cotton market supply/demand variables. However, for some innocuous bureaucratic reason, they released this projection on December 18. Table 1 shows a portion of that outlook.

We can make several points about these projections. First, USDA’s tentative numbers for the 2015 U.S. cotton crop are in line with a number of recent analyses. Everybody is expecting reduced planted acreage compared to last year. USDA is suggesting a little under 10 million planted acres of upland cotton. Where I would differ with their 2015/16 projection is I think yield will be a little higher, and abandonment will be a little lower. The reason for the discrepancy is that these projections fall back on assumptions about average abandonment (without considering this year’s greater rainfall) and simple increasing trend yields (again, without considering this year’s greater rainfall). That would give us about a million-bale difference in production, which I think will make ending stocks a little more burdensome than USDA is currently showing. They show stable ending stocks, year-over-year, while I would expect a modest year-over-year increase. Having said that, USDA still has a weak price conclusion for 2015, with a projected average upland cotton price of 59.5 cents.

For the latest on southwest agriculture, please check out Southwest Farm Press Daily and receive the latest news right to your inbox.

The second point about these projections is the value of long term forecasts. Obviously, projections beyond 2015 make a lot of assumptions about average weather, no major shocks to the macroeconomy, etc. There are embedded assumptions about technology improvements (reflected in gradually up-trending yields) and population/economic growth (reflected in gradually up-trending consumption). We all know that is not the way the world works. The cotton market will have its share of surprises, ups, downs, bumper crops, and droughts.

But it would be wrong to think there is no value in longer term projections like those in Table 1. The cotton market, like all commodity markets, is influenced by a complication of many forces. Multi-year forecasts like those in Table 1 force us to explicitly consider our assumptions about many of those forces. In addition, many cotton supply and demand responses have a multi-year dimension. An example would be the four-year draw down in world stocks prior to the price spike of late 2010. Multi-year forecasts provide a likely average path that sheds light on where the industry will be five or ten years down the road. That sort of information is important for strategic planning by the numerous industries that underlie the market for cotton.

About the Author(s)

You May Also Like