March 24, 2016

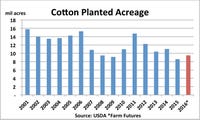

Cotton acres could see something of a resurgence across the traditional Cotton Belt in 2016, according to producers responding to the latest survey by Farm Futures Magazine. Farm Futures is a sister publication to Delta Farm Press.

Farmers in the South appear ready to boost cotton seedings almost 11 percent to 9.5 million, after cutting back dramatically due to low prices and adverse weather a year ago. The increase isn’t being driven by more favorable prices.

Click to enlarge

“Cotton prices aren’t profitable either, but growers don’t have many alternatives that look good in 2016,” said Bryce Knorr, Farm Futures grain market analyst, who conducted the survey. “That’s why overall acreage could continue to fall among major crops besides cotton and corn again this spring.”

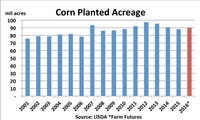

The survey found poor profit margins could force growers to cut back crop acreage by almost 2 percent in 2016. Only corn and cotton could see gains among five major row crops and even those increases would keep seedings below levels from just two years ago. USDA releases its first survey-based estimate of Prospective Plantings March 31.

Click to enlarge

Farm Futures sees corn plantings at 90 million, up 2.3 percent from 2015, when adverse weather kept farmers from planting some 2.6 million acres. Some of the biggest gains could come in Illinois and Indiana, where yields suffered last year, while growers in the northwest Midwest, who enjoyed record yields, could also post increases.

Farmers appear ready to cut back on soybeans, following back-to-back record crops and yields. Farm Futures sees acreage of the oilseed falling to 82.2 million, down about .5 percent from 2015.

Grain sorghum declining

Seedings of grain sorghum, another popular crop in 2015, also look ready to fall. Sorghum, a feed grain planted primarily on the central and southern Plains, saw acreage surge in the Delta region last year after Chinese buying took prices to record premiums over corn.

But with a surplus hanging over the market this year, prices are back to their traditional discount. Growers said they plan to cut acreage by almost 13 percent to 7.4 million.

Further north on the Plains, spring wheat seedings could also be lower. The survey found farmers cutting acreage of the high protein grain by around 5 percent, to 12.6 million. That could bring all wheat seedings to 51.6 million, 5.5 percent lower than 2015.

“Corn appears to be gaining ground by default, because farmers are a little more optimistic about rallies during the growing season, thanks to a lot of talk about potential for the El Nino to end soon,” said Knorr. “Our research shows that would increase potential for at least modest gains.”

Growers put their average price target for 2016 corn at a futures price of $4.12. By contrast the average futures price target for soybeans was only $9.27, a dollar or more below break-even levels.

Lot of crop left

“Farmers are banking on rallies because they still have a lot of 2015 production unpriced,” says Knorr. “Growers told us they have more than 40 percent of last year’s corn still in storage, with 30 percent of the soybean crop still unpriced.”

Farm Futures surveyed 1,246 growers from March 7 to March 23. Growers were sent an invitation by email, with results recorded by an online survey form. Over the last eight years Farm Futures March survey has deviated from USDA’s estimate by an average of 1.2 percent. For soybeans the deviation is 3 percent.

You May Also Like