December 21, 2019

The 2019 growing season is one most corn producers will only be too happy to have behind them. Severe and extensive flooding spread across the Missouri River Valley late winter followed by a cool, wet spring all across the Corn Belt. Planting progress was the slowest on record.

On May 26, USDA’s Crop Progress report showed 58 percent of the corn crop planted. The average for that week of the growing season is 90 percent. Planting in many areas extended into late June. In addition, farmers reported over 11 million acres of corn as prevented plantings to the Farm Service Agency.

With much of crop going in late, harvest progress was one of the slowest on record. Harvest of a late-planted crop means high moisture, low test weights, higher drying costs, market discounts, grain in less than optimal condition for long-term storage, and less field work done in preparation for next year.

So even when the crop is finally in, the impact is felt well into the next growing season.

SUPPLIES

In addition to the lingering uncertainty regarding the 2019 crop, the 2020/2021 growing season will begin with prospects for much larger supplies and expectations for moderate increases in consumption.

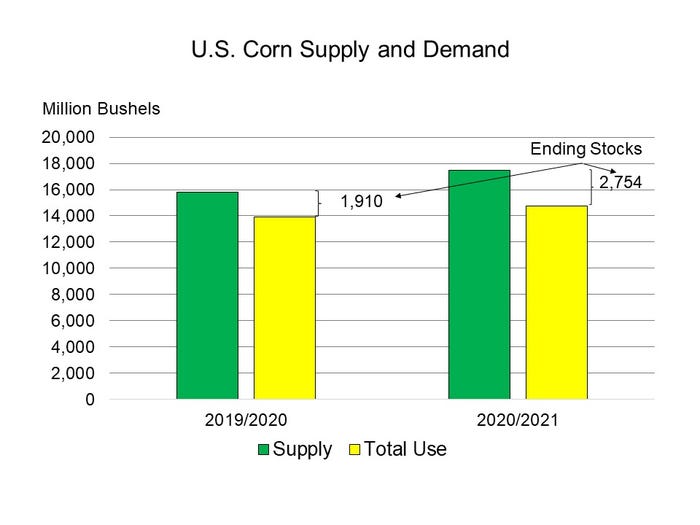

The most recent crop information from USDA puts total corn supplies in the 2019/2020 marketing year at just under 16 billion bushels and total use at about 14 billion bushels. This leaves about 2 billion bushels in ending stocks(Figure 1).

If conditions in the spring of 2020 are back to normal, corn planted area could be back up to 93 to 94 million acres, up 5 million compared to last year. A normal expected yield would be back up to 176 to 178 bushels per acre, 10 bushels higher than the latest estimate of the 2019 crop.

LONG-TERM PROJECTION

USDA’s preliminary long-term outlook (https://www.usda.gov/oce/commodity/projections/) pegs planted acres in 2020 at 94.5 million and a 178.5 bushel per acre yield. This would produce a record 15.545 billion-bushel corn crop. Add in beginning stocks, and the corn supply in 2020 is an all-time record high 17.499 billion bushels. This supply number is 1.674 billion bushels above the corn supply in 2019/20.

The same long-term projection does include increases in domestic use and exports for 2020/21, an increase of 830 million bushels total. These production and consumption estimates would result in ending stocks at the end of the marketing year of 2.754 billion bushels, an 844 million bushel increase over last year. U.S. corn ending stocks have not been that high since the 1980s.

Of course, many factors combine to shape the price of any farm commodity: general economic conditions, farm policy, trade, returns from competing crops, to name a few. When it comes to the price of corn, ending stocks and the stocks to use ratio are highly important. Given these early season projections, the price of corn in 2020 could be under significant pressure, all else equal.

You May Also Like