There's a new year around the corner, and with it comes no shortage of challenges farmers can expect in the coming months. The good news for farmers is a chance of easing supply chain tensions is more likely in the first quarter of 2022 than at other points in the year. Shipping volumes typically slow following year end, so some price relief for input shipments necessary for spring planting could be around the corner as port backlogs lessen.

But don’t expect too much relief. And if there is any, don’t count on it lasting long. Global natural gas supplies remain tight, and the omicron variant discovery late this year threatened fertilizer and fuel production globally. Spring fertilizer and chemical application is more likely to be susceptible to shortages, delays and other supply chain risks than last fall.

Profit prospects

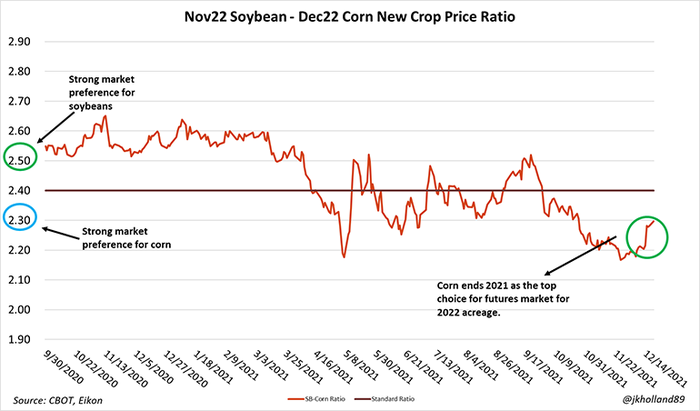

Regardless of soaring inputs costs and ongoing supply chain headaches, the market continues to encourage corn production in 2022. In fact, at press time the new crop price ratio showed its strongest preference for corn acres since early May 2021 when a slow start to planting season triggered shortage fears.

Wheat acres will battle more competitively for corn and soybean acres this year relative to last as tight global supplies have triggered new price records in Russia and Australia and nine-year highs in the U.S. Countryside anecdotes last fall suggest that more winter wheat acres were planted in 2021 compared to the year prior as returns compete with those of corn and soybeans.

For corn producers, current 2022 futures price levels ($5.45-$5.60/bu.) leave some wiggle room in 2022 crop budgets to accommodate further price increases for inputs. My models estimate that growers in most regions across the Corn Belt will have approximately $0.20-$0.75/bushel worth of extra cushion in break-even targets in early 2022.

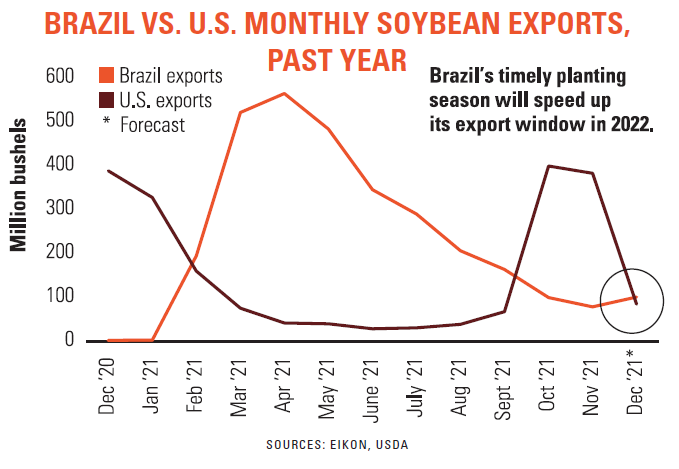

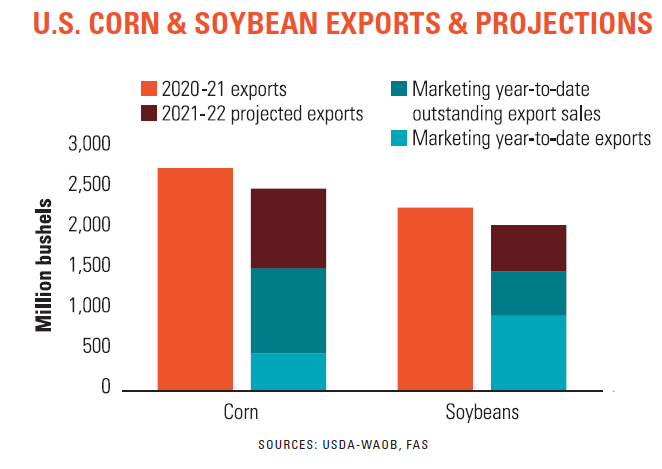

Margins are likely to be tighter for soybean acres, especially amid lower Chinese demand and higher competing Brazilian output on the export market. Brazil expects to harvest 5.29 billion bushels of soybeans in the coming weeks, with no weather delays this year to push back its export window – or for U.S. producers to capitalize on an extended export campaign.

As a result, at press time 2022 soybean futures traded between $12.30-$12.55/bushel.

There is more variation in soybean break-even costs across rotations and geography. My highly conservative break-even estimates range between $11.50-$12.10/bushel are not likely representative of all soybean operations in the U.S., but it does illustrate the growing pressure on soybean margins in 2022.

Focus shift to yields

That means there will be little wiggle room for hitting trendline yields this year. Growers still struggling with low soil moisture levels may face higher production risks in 2022 if the La Niña weather pattern forecasted for 2022 mirrors that of 2021. But that does not leave producers powerless to the fate of their profits.

Making sound decisions about yield potential and soil fertility in the early days of the coming year will help safeguard farmers from price and weather fluctuations. Remember – there is room in the budget for optimal yields, so keeping an eye on new crop prices and booking early sales, if profitable, will be another lucrative way to ensure profit margins are maintained in 2022.

Jacqueline Holland will present the Fertilizer Outlook for 2022 as a featured speaker at the 2022 Farm Futures Business Summit. The Business Summit will take place Jan. 20-21 in Coralville, Iowa. Featuring industry experts and in-depth training sessions, it’s an opportunity to gain clear insights for a profitable future. Learn more and register now!

About the Author(s)

You May Also Like