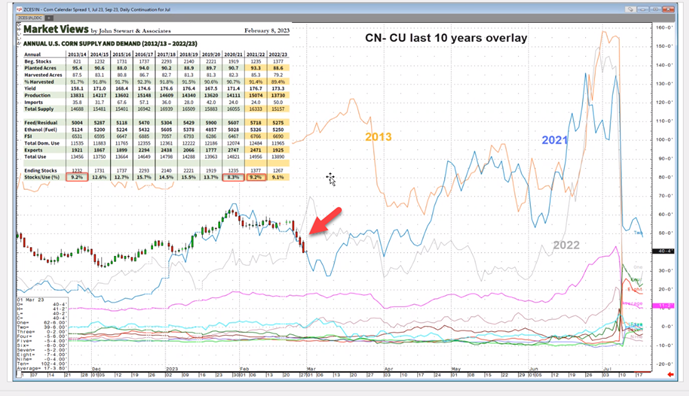

Brian Burke, President of JSA, says the amount of corn available for delivery in July should be very tight. This means owning old crop July corn into delivery might pay off.

But with a huge new crop production suggesting it will stabilize end stocks, maybe buying old crop and selling new crop is a good hedge for basis traders and possibly a speculative trade.

World supply and demand

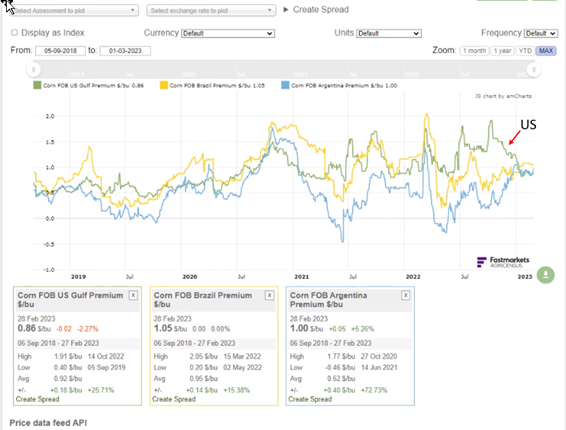

As seen in the chart below, the U.S. now has the cheapest corn in the world. Exports are significantly behind normal but should start to pick up as economics push demand to the U.S.

In addition, the Argentina corn crop is possibly 3-5 million metric tonnes below USDA projections. The Brazil crop might also be rated too high by USDA. Downward adjustments of 3-5 MMT would bring total South American production to 0-3 MMT more than last year. Original expectations showed a 10 MMT year-over-year increase and USDA currently forecasts a 6 MMT increase.

That puts a lot of pressure on the U.S. crop to assure world stocks increase and stabilize. Thus, the competitive price of the U.S. corn market is a key factor and should attract a lot of demand if South American production does in fact get reduced and their prices respond to that tightening supply.

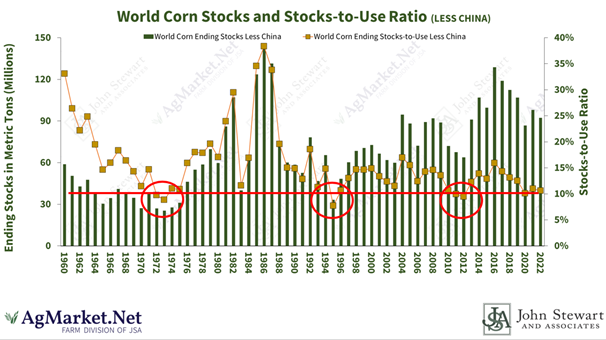

With old crop world stocks to use ratios (excluding China) still at levels only seen three times in history, it is easy to expect a very bullish move in price if the U.S. starts to have a problem. However, flat price of corn is not bullish at all if the U.S. production cycle is successful.

Looking at the possibility of 91+ million corn acres in 2023 and a 2.0+ billion bushel domestic carryover, that would add nearly 1 billion bushels or about 25 MMT to world ending stocks. Having said that, if there is a “bias” to the market, you would think it might struggle and eventually work lower. In that environment, the new crop prices could fall more than the old crop.

2023 marketing strategy

It is for this reason that all our farm clients have been advised to be significantly hedged for the 2023 crop. In a bullish weather situation, all months would work higher. But with normal weather, we expect new crop prices to move lower.

At the same time, if old crop stocks are really as tight as USDA quarterly stocks say they are and we are the cheapest corn on the market, then real demand for U.S. corn will likely push old crop values up faster than new crop. Hence, buying old crop corn and selling new crop could work.

Based on the history of how this spread traded in other years, you can see it has worked to buy this spread and hold it into the last half of June – or even into delivery (July). That does not mean it will work this year.

Anything could happen. USDA could revise quarterly stocks up, or export demand might not come to the U.S. and downward revisions in demand would be warranted. But if export demand does pick up, then inventory around the tributaries and the Mississippi river will decline. That is the delivery market.

These inventories are already tight due to rail demand to the cattle belt. Thus, by the time July deliveries begin, registered receipts might be drawn down and market participants that are short might not be able to source cash inventory to deliver. Their only alternative would be to buy at the market price to offset their short position.

If you are an end user, basis trader, or speculator, consult with your AgMarket.Net/JSA broker to discuss how this position might work in your operation or portfolio.

Reach Bill Biedermann at 815-893-7443 or [email protected].

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like