November 29, 2023

by Glennis McClure and Larry Van Tassell

You may have heard it said many times that enterprise budgeting provides information to assist with decision-making. Some of the easiest and most useful computations that can be obtained from enterprise data are breakeven values.

As the name suggests, a breakeven gives the price or yield required for the revenue obtained from the enterprise to equal the costs encumbered to produce that revenue.

Here, we’ll use information from one of the 2024 Nebraska crop budgets to figure breakeven calculations and discuss how the enterprise budgets created in the Agricultural Budget Calculator (ABC) program, and accompanying analysis features in the program, can assist.

How to calculate breakeven

A breakeven price, assuming a particular yield, can be used in developing a marketing plan as it presents the price the producer must receive to cover all costs. When all costs are included in the enterprise budget, including opportunity costs of using the producer’s capital and time, a breakeven price will provide a return to just cover all contributions in the production process.

When not all costs are included, the breakeven value will provide a return to cover whatever costs are included. A breakeven yield, assuming a particular price, identifies the yield the producer must obtain to cover costs involved in producing the enterprise.

The formulas to determine these breakeven values are: (1) breakeven price = total cost/expected yield, or (2) breakeven yield = total cost/expected price.

Corn example

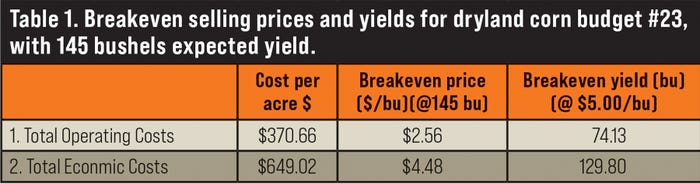

For example, using data from a 2024 Nebraska Corn Budget No. 23, Ag Budget Calculator Enterprise Report, breakeven prices and yields are presented in the table for total operating and total costs, including overhead.

The per-acre total operating costs (including seed, fertilizer, pesticides, custom services, paid labor, fuel and energy, repairs and maintenance, and interest of operative capital) total $370.66 per acre.

Adding general overhead, equipment depreciation and opportunity cost, and land opportunity cost, brings the total economic costs to $649.02. Note that opportunity cost for the producer’s time is not included.

The breakeven corn price to cover operating expenses is $2.56 ($370.66/145 bu.), while the breakeven corn yield is 74.13 bushels ($370.66/$5.00). Likewise, the breakeven price to cover total economic costs ($649.02) is $4.48, and the breakeven corn yield is 129.80 bushels ($649.02/$5.00).

Profitability goals and breakeven analysis

The formulas for breakeven price and yield are derived from the economic identity: (3) profit = price x yield – costs.

Setting profit = 0 (price x yield – costs = 0) and solving for price gives the breakeven price given in equation (1). This formula can be useful in finding the breakeven price or yield when profit equals a specified number other than zero, such as a profit that includes living expenses.

For example, to determine a breakeven price that not only covers the cost of production, but also includes a family living expense of $100 per acre, profit in equation (3) would be set equal to $100, and solving for breakeven price, would give: (4) breakeven price = (total cost + 100)/expected yield.

In the previous corn example, breakeven price given total economic costs would be $5.17.

Using breakeven analysis for input decisions

This same breakeven concept can be used to assist in other decision-making activities, such as the additional yield required to break even when adding an additional amount of nitrogen to the cornfield at varying prices of nitrogen and at varying prices of corn.

For example, in the corn enterprise budget being used in this article, 80 pounds of 32-0-0 is applied to the field with 6 gallons of 10-34-0 applied at planting (69.6 pounds N).

To determine the increased yield that must be obtained to cover the marginal cost of applying an additional 20 pounds of nitrogen, the following formula may be used: (5) (additional pounds of N x price of N per pound) / price of corn per bushel.

If nitrogen is priced at $0.60 per pound, increasing nitrogen by 20 pounds per acre requires an additional corn yield of 2.4 bushels per acre, assuming the price of corn was $5 per bushel. As the price of nitrogen increases, a greater yield must be obtained to break even.

As the price of corn increases, a lower yield is required to make the additional fertilizer break even at any given price of nitrogen. These results mirror the economic principles that say when the price of an input increases, less should be used in the production process, and as the price of the output increases, more inputs should be used to maximize profit.

Process made simple

To create the enterprise budget necessary to determine breakeven prices and yields requires time and effort. Fortunately, the Center for Agricultural Profitability has developed the Agricultural Budget Calculator to make this process much easier.

ABC can be accessed for free at agbudget.unl.edu. The schedule for online and in-person training sessions can be accessed at cap.unl.edu/abc.

The base ABC program guides the user in developing economic and cash enterprise budgets. Breakeven tables and several reports useful in decision-making are available from completed enterprise budgets in ABC.

McClure is a Nebraska Extension educator and farm and ranch management analyst. Van Tassell is director of the University of Nebraska Center for Agricultural Profitability.

Read more about:

Enterprise BudgetsYou May Also Like