March 4, 2024

U.S. beef output varies year to year, so building and maintaining consumer demand for a product becomes more difficult.

Recent years provide a reminder of how drastic annual changes in U.S. beef output can be.

While the average annual increase in beef production over the past eight years has been 1.7%, growth in 2016 (+6.4%) and 2017 (+3.8%) whipsawed to a decline of 4.7% last year. USDA is projecting a further decline of 2.9% this year.

As we continue with declining beef supplies for the next couple of years, it is expected that changes to exports and imports will continue to provide their historical shock absorber effect.

USDA currently projects a 10.7% increase in beef imports this year, along with an 8.3% decline in beef exports. These combine to lower net beef trade by 651 million pounds, offsetting a large portion of the projected 779-million-pound drop in production.

While at first glance it might seem discouraging to see the U.S. lose global beef market share in periods of beef production declines, it is important to remember that the types of beef cuts that are exported are much different from those that are imported.

Meeting consumer demands

U.S. consumers love their hamburgers, and about half of domestic beef consumption is accounted for by ground beef. Meanwhile, most of U.S. exports consist of higher-valued muscle cuts.

This shows itself most clearly when examining the value of beef traded in relation to the quantity of beef traded.

In the past 10 years, there has been seven times when the quantity of beef imported into the U.S. has been larger than the quantity exported. But the value of beef imported has only topped the export value three times.

Stated another way, import quantities were 9.4% above export quantities from 2014 to 2023, but the export value was 10.1% larger during these 10 years.

Although our beef net trade situation will likely weaken further until beef production begins to grow again, there are positive economic realities to consider, both in the short and long term.

Trade helps at home

The impact of output variability in the beef industry has been moderated by changes in exports and imports, which have helped mitigate the changes that U.S. consumers experience in the retail marketplace.

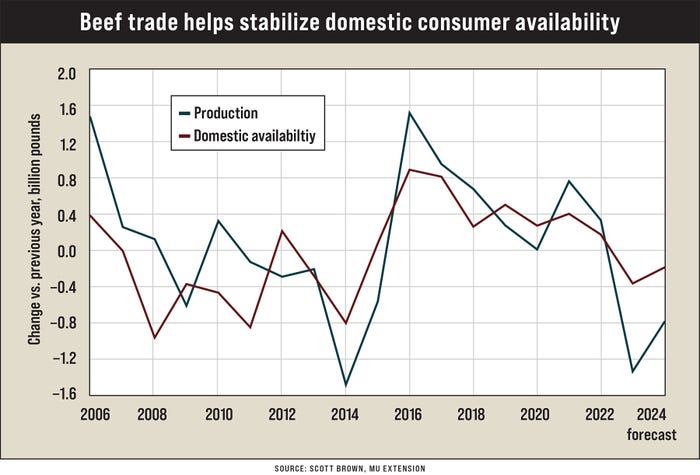

In the past 18 years, annual changes in beef production ranged from a decline of 1.5 billion pounds in 2014 to an increase of 1.5 billion pounds in 2016.

On four occasions, output changed from the previous year by 1 billion pounds or more. But because of net trade changes, consumers have not experienced any billion-pound domestic availability swings.

Domestic consumers can continue to have sufficient quantities of the cuts of beef that they prefer available to them. Beef producers will see the value of each carcass maximized as U.S. beef traders find the maximum amount that will be paid for every part of the animal, whether at home or abroad.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like