In four decades of working with farm families, greed and entitlement are the two factors that have changed the most, says Ron Hanson, Ph.D., professor emeritus at the University of Nebraska.

To that end, Hanson tells audiences: “Your Mom and Dad don’t owe you a farm. They don’t owe you anything.”

As farm transition planners, we see the good and the bad in families. Just last week, I was meeting with siblings who told their Mom that although the farm is important to them, her health, happiness and well-being mean much more. In another family, a Dad asked the kids to think about all of their farming neighbors who have one thing in common: the family members don’t speak to one another – all because of money and the aftermath of a poorly communicated plan for farm inheritance.

Dad went on to read a letter (once read to him and his siblings from his parents):

“Your Mom and I wish to share with you our reasonings for our plans for our estate. But first, we want to be certain you understand the reasonings behind our estate planning:

We believe inheritance is a gift, not a right.

It is our wish to treat our children fairly, but not necessarily equally.

We would rather give all our assets to charity than see our family argue over our estate settlement.”

The great wealth transfer

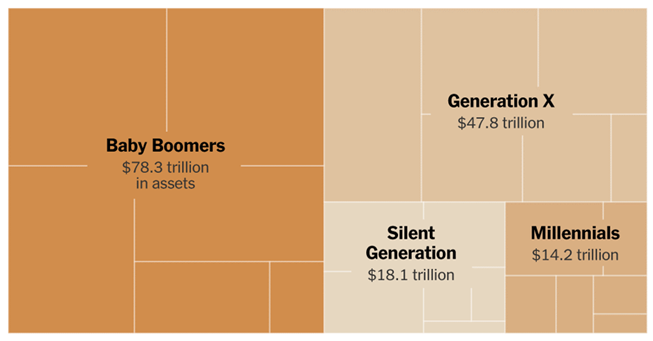

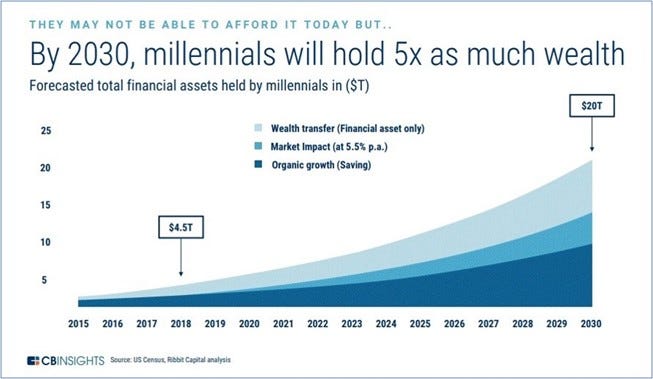

Why is all of this important? You’ve likely heard it before, but it’s worth repeating: Our country is about to experience the greatest transfer of wealth in history. Baby boomers hold over one-half of our country’s wealth, and millennials are estimated to hold, as early as 2030, five times as much wealth as they do today!

Pull in the next generation

The reality is the next generation of landowners will be further removed from agriculture, and surveys suggest one-third of that generation currently don’t have any farm knowledge or experience. Don’t assume the things you know are truly understood by your children.

Certainly, the perception my kids will have of our family farm will be different from mine, and mine are not the same as those of my grandparents. Although this is a little sad, it’s not necessarily wrong; it’s simply a reality we need to be aware of as we strive to preserve family farm legacies.

What can we do to frame a transition that’s preserves the family and helps ensure the farm continues into the next generation. Here are five tips.

Five tips for estate planning

Ask. What factors are important to me and my family farm? Is there a difference between leaving a farm legacy versus a farm inheritance? Every farm has a story; what is yours? A story you hope will carry forward in time?

Consider. I’ve yet to meet a farmer who doesn’t want to see the farm stay in the family. So, why is this such a difficult subject to talk about? I’m guessing it’s because the farm means more to you than simply an inheritance. It’s a way of life, a great way to raise a family – a legacy. Will your children feel the same way one day?

Communicate. As illustrated above, consider holding a family meeting to share the story of your farm’s heritage and what it means to you and the generations before you. Talk about the good times in farming, as well as the sacrifices made by you and the generations before you to hold the farm together. Share your long-term intentions so there are no surprises later. As another memorable patriarch once told me, “I’d rather the kids be mad at me than at each other.”

Educate. Teach the next generation how to own and manage your family farm in ways that complement your shared ideals. Educate them about land rents, land values, land conservation, and other responsibilities of landowners. If you work with a non-family tenant, introduce your family members to the tenant and their next generation.

Train. Bring them into the fold now. If they see it, feel it, and experience it with you, they’ll much more likely appreciate it and carry it forward another generation. Hopefully, one day, they too will share your farm’s story and caring more about preserving a legacy, not simply receiving an inheritance.

Downey has been consulting with farmers, landowners and their advisors for the last 24 years. He is a farm business coach and transition consultant with UnCommon Farms. Reach Mike at [email protected].

About the Author(s)

You May Also Like