At the end of March and beginning of April, USDA released several reports that pointed to some bearish undertones for the domestic wheat market, even as global supplies remain somewhat constrained due to the ongoing Russian invasion of Ukraine. But it’s not all bad news – and not a done deal, either.

Wheat prices trended lower following the April 2023 World Agricultural Supply and Demand Estimates report, largely due to reduced 2022/23 U.S. feed and residual usage. USDA added an extra 5 million bushels to beginning year supplies from lower 2021/22 export volumes.

And it wasn’t just domestically that lower wheat usage took a bite out of wheat prices. Top global importers in the Middle East and Southeast Asia reduced their import forecasts due to higher prices by a combined 125 million bushels – a 7% reduction from last month’s import estimates for both regions.

Russia and Ukraine added 92 million more bushels to global exportable supplies for the 2022/23 marketing year, which further reduced supply pressures on the global wheat market, especially with top buyers slowing down their purchasing rates.

But there was one bullish highlight for the wheat market from the April report – China’s wheat import forecasts were increased by 73 million bushels to 441 million bushels, making it the largest global buyer of wheat. However, recent trade agreements with Australia suggest that most of these additional bushels are likely to be sourced from the Land Down Under’s third consecutive bumper crop and not U.S. supplies.

Acreage disbelief

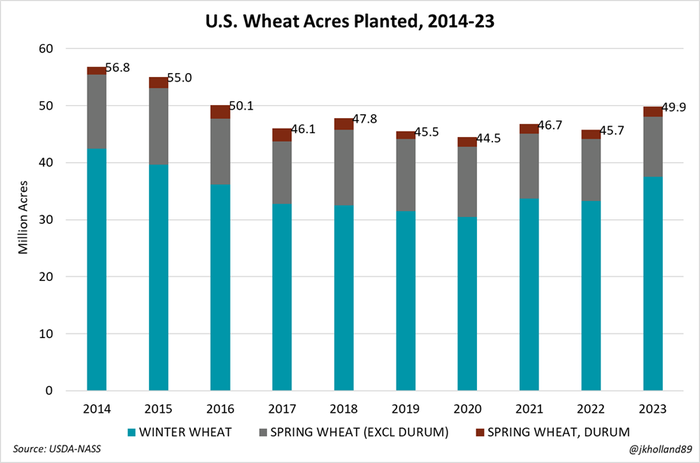

The market seems skeptical of USDA’s reported rise in winter wheat acres, especially considering how worrisome crop ratings on the Plains have been reported through early spring. As of early April, winter wheat conditions had fallen to only 27% good to excellent – the lowest rating for this time of year since USDA began reporting winter wheat ratings in 1986.

Spring wheat acres are fighting off lucrative prospects for canola, corn, and soybean seedings in top producer North Dakota this spring. But acreage in the Northern Plains also faces heavy snowpack and cool forecasts through April, which could limit any spring wheat acres that can compete against alternative crops this year.

Even with a large soft red winter wheat crop expected this summer, there are enough “what if” factors at play in the U.S. wheat market that are offsetting potential losses from USDA’s projection of the largest wheat acreage since 2016.

Quarterly Grain Stocks

Two years of crop shortfalls continue to keep U.S. wheat stocks tight, as March 1 inventories fell 8% lower than the same time last year. Third quarter usage rates were high (366M bu.), but not quite as high as what the trade had been hoping to see. USDA found nearly 32 million more bushels of off-farm wheat stocks as of December 1, 2022, reflecting slower than expected usage rates during the September 1 – December 1 reporting period.

Wheat prices seem to be deriving more of their price action from expectations for the upcoming year’s crop production and global trade flows. Expect prices to remain responsive to weather trends in the U.S. until more market intel is available about international wheat production this year.

About the Author(s)

You May Also Like