I was so mad at myself for not selling beans when they hit the Jan high at 1548.5 in March and 1415 in Nov (the highs were made in Jan on different days). Then I sat there and watched prices move down – and my confidence of waiting for another rally fell as fast as the market.

I mean really?

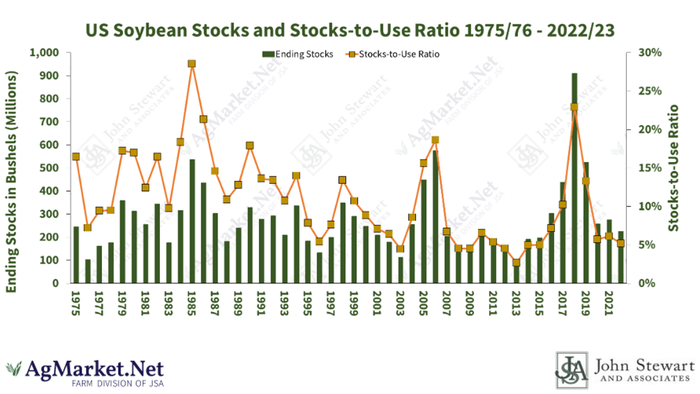

With stocks-to-use at 5% and only a few times in history have supplies been this tight, some cash people are even saying U.S. stocks are less than reported, a war disrupting shipping lanes, and a drought that has ravaged Argentine production, and how about biodiesel demand that is going to be huge? How could you NOT be bullish?

But the market doesn’t always agree with me for some reason. The market has been trading these stories for nearly a year.

The South American story is bullish compared to what it could have been. Yet when we look at Brazil, Argentina and Paraguay combined soybean production, USDA is currently estimating 204 mmt versus 177.6 mmt last year, or a 14.8% increase in available supply. Even if we all agree USDA will reduce the South American crop to more realistic levels and pull another 6 mmt off the top, that still leaves 198 mmt production or an 11.4% increase.

Conclusion on South America is that it looks like increasing supplies, no matter how you run the numbers at this time.

If the U.S. also has a reasonable crop in 2023, then we have both South and North American supply stabilization. Combine that with a restrictive and “designed to deflate” Fed policy, a CRB index that has technically topped, and the possibility of the Funds coming out of their long positions, and it is reasonable to assume a rally will require new bullish news.

What’s next?

Does that mean we top and see a sharp decline in price? Not necessarily. The market first needs to be convinced the South American crop is stable. Then, it needs assurance that U.S. farmers will plant a crop.

Good weather in the U.S. or assurance of a trend yield will be needed to make the numbers work and for traders to turn really bearish. If funds turn to a deflationary posture, then they may also go short futures and drive futures lower than any of us feel is fair.

Bull signals

In the really big picture, prices will only go down so much. We are increasing demand worldwide. We are going to see a new demand sector in the U.S. with biodiesel. So there is value and the market’s job is to find the value that reflects an equilibrium between supply and demand. Both in the big picture of acreage and usage, and the smaller picture of what I call cash flow – getting the monthly needs met so plants, barges and trains operate.

Right now, unless a supply problem develops, the upside is limited. Since profits on the farm are available, we suggest locking these profits in now. We prefer our clients do this in a way where delivery is not required and upside market direction would add to the net price received.

Reach Bill Biedermann at 815-893-7443 or [email protected].

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like