Tuesday’s grain market direction was largely influenced by macro developments. The Bank of Japan raised the rate ceiling to 0.5%. This is significant because the BOJ has been the sole anchor in the western and developed financial world that kept rates and fiscal policy unchanged.

This move suggests BOJ will follow suit with the rest of the world by raising rates and tightening fiscal policy in order to rein in inflation. As such, Japan’s stock market plunged over 700 points while the yen rallied and thus the U.S. dollar fell towards 103.50 vs 104.34 the previous day, and down from the 114 September high. This lower dollar sparked more interest in US commodities.

More bullish news

Adding fuel to the bullish side was a change in the Argentine weather forecast that limited the coming 7 day rain potential to 0.35-1.5 in the central and northern growing area, while southern areas would remain mostly dry. Bottom line: less rain than hoped.

There was also a private forecast estimating the upcoming corn crop would only reach 47 million metric tonnes (mmt) versus our estimate of 49.25 and the last USDA projection of 55.0 mmt. If accurate, the total South American corn production would be reduced to 172 mmt versus 181 USDA and 167.6 mmt last year.

With U.S. corn inventories down to a 31-day supply, any South American production number below 168 mmt could have significant impact on the U.S. market as world traders switch their buy orders to U.S. origin when our supplies are already tight.

U.S. policy headwinds

The bullish side of the market can be quickly erased if weather were to turn out more favorable and the focus of the market turn toward the macro U.S. fiscal policy and Chinese economic risk. With a deflationary fiscal policy, it is most likely that without a major supply disruption, commodity prices will generally trend lower. But in addition to the intended consequences of a deflationary Fed fiscal policy, the Chinese government’s decision to relax covid policy in order to calm social unrest related to shutdowns, the Chinese have opened the door to potential covid outbreaks.

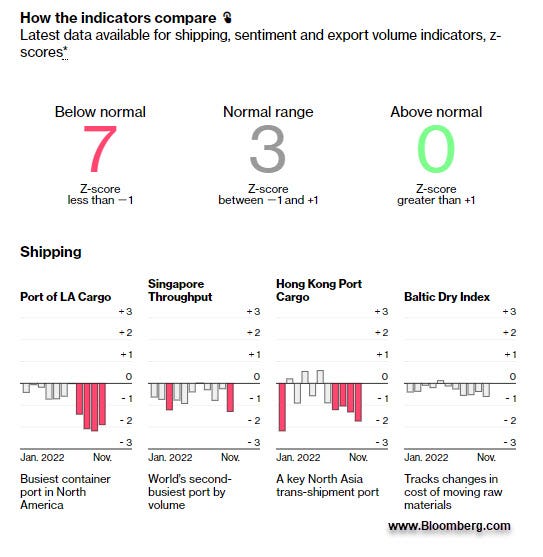

If this health risk does in fact happen, then the economic contagion risk is also very high. Any further slowdown to the rate of port activity would further restrict the ability of the world to normalize supply chains.

This could become a factor derailing any hopes of a soft landing and could exacerbate the negative impacts of a deflationary fiscal policy. However, if a covid-related extension of a supply chain problem would be accompanied by an adverse South American production cycle, it would increase the risk of another major battle against food inflation.

What’s the bottom line?

Fiscal policy and macro-economic factors typically guide the ship in the intended direction. All of those macro issues are bearish economic activity and commodities. However, until we see a successful South American and U.S. crop cycle, tight stocks of grains and oilseeds will likely mean prices will not succumb to major bearish news until the trading crowd has a better handle on the upcoming crop.

And if the production cycle looks to be threatened, buyers would be forced to seek ownership in a very limited supply environment.

Is the supply chain Improving?

As we have said in nearly every blog, selling at current levels generates huge ROI (if not record) for most of our clients. Spending a few cents on options allow you to sell but also keep you in the game in case we see a production cycle problem. If you have any questions, please contact our team at www.AgMarket.Net or come meet us in Nashville on February 6!

Contact Biedermann at 815-893-7443 (office) or 815-404-1917 (cell).

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like