August 7, 2023

The recently released July USDA Cattle Report is painting a picture of tighter beef supplies ahead — certainly in 2024, and perhaps even through 2026. All of this is happening despite record or near-record cattle prices and an improving drought picture for much of the country.

The information contained in the biannual January and July USDA Cattle Report provides a more robust view of trends in animal numbers at all segments of the supply chain, making it the most sought-after indicator of where the beef and cattle industry is heading.

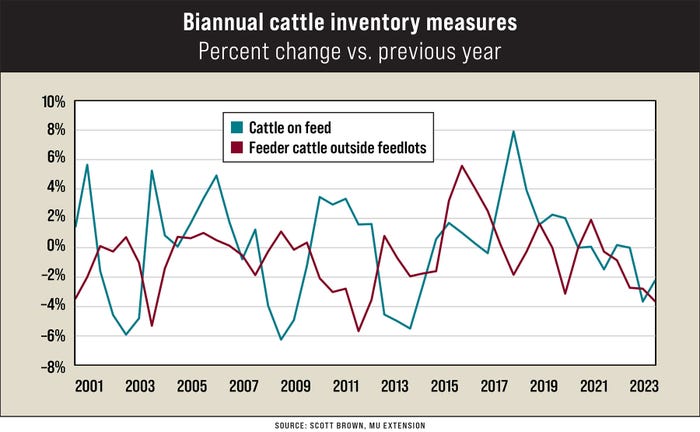

The graphic shows change relative to the previous year for both cattle on feed and available feeder cattle outside of feedlots (i.e., animals that are candidates to be placed into a feedlot at some point in the future).

Graph explained

There are a few instances of missing data because no July cattle reports were published in 2013 and 2016. Still, observations since 2001 point to the fact that while these two inventory measures often follow a similar track — more volatility in animals on feed, and a wider range than the count of potential feeder cattle.

The 3.6% decline in the number of available feeder cattle outside feedlots as of July 1 marked the third consecutive biannual observation that was down by at least 2.5%. It is the fifth consecutive observation posting an annual decline. This matches the consecutive string of declines registered from 2010-12 and 1999-2001.

Those historical periods of continuous herd liquidation eventually led to multiple years of beef production declines. The result was a bottoming out at levels that were 9% to 10% below the production peaks in the cycle.

Expect a similar retracement of beef output in this cycle, which will eventually result in a year (likely 2025 or 2026) with production down 2.5 billion to 3 billion pounds from the 2022 high-water mark.

And this assumes that U.S. producers can turn around the recent trend of liquidation and begin to build back cattle numbers.

What’s on beef’s horizon?

While cattle prices and aggregate weather conditions greatly improved in recent months, supporting potential expansion, costs of production remain high. Many cow-calf operations still face difficult pasture and forage conditions because of localized severe drought.

It appears that although the end of herd liquidation may be coming in the next 18 months, the time for that to translate into higher beef output levels is still a few years down the road.

Lack of supply will continue to push prices higher in the medium term. If demand holds near recent levels, most cow-calf producers should see profitable times for the next few years.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like