“Well Naomi, we’ll know in two weeks if this is a full-blown drought or not,” quipped a client recently. “There are chances of rain in the forecast this weekend, but I just don’t know if it’ll be enough to help my corn crop. It’s already curling up, and it’s June!”

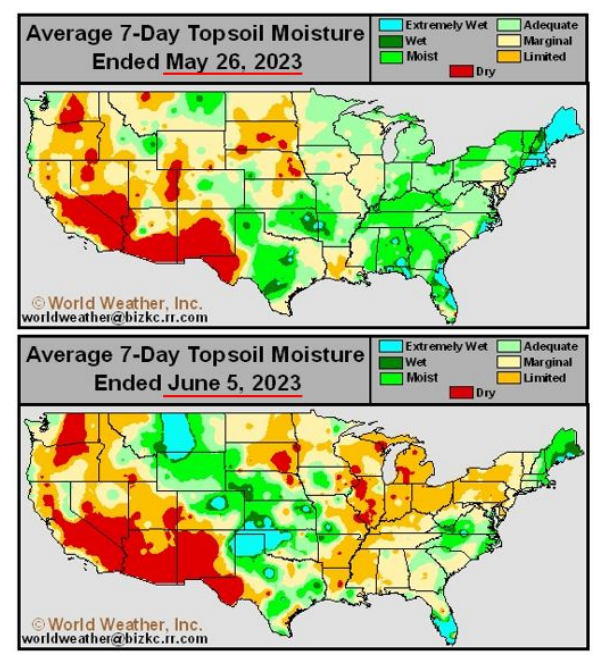

The lack of rain over the past week for much of the Midwest has decreased topsoil conditions dramatically. It is said moisture deficits for much of the Midwest are now between 1 and 3 inches, meaning we need to see widespread coverage of 1 to 3 inches in order to get "caught back up" to where we ought to be, to help produce a record corn crop.

Precipitation turning point

I’m definitely not a meteorologist, and weather forecasts can change on a dime. But keep in mind, with the recent 50 cent rally in corn, the market has likely traded in the current dry weather.

Bearish traders point out that corn hybrids have improved, and some rain coverage is better than no rain coverage. With rain expected for much of the Midwest this weekend, it may be that the market would like to assume a near-record crop (until truly proven otherwise down the road).

How does a farmer manage this?

An uncertain size corn crop growing in the fields is nerve wracking for any producer. It is hard to market what you are unsure will grow. It makes forward contracting potentially uneasy, because if the crop doesn’t grow, you’re still on the hook to deliver corn to the elevator.

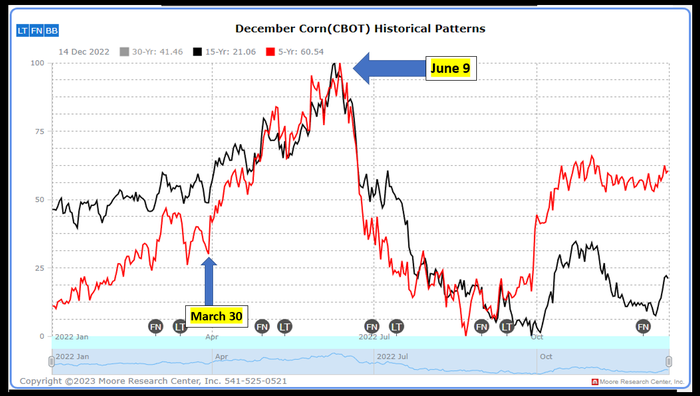

But what if the expected rain this weekend is just enough to keep the crop hanging on for another week or two? Rain on the radar this weekend might weigh bearish on trader mindset, and push prices lower next week. Also keep in mind the new crop seasonal market price tendencies that suggest December corn prices have a strong tendency to trade lower after the June 9 time frame (in conjunction with the June USDA WASDE report).

When you consider that December 2023 corn futures have rallied 50 cents over the past two weeks, there is reason a producer may want to protect this recent rally, especially if the weather forecasters switch to a rainier pattern for mid-June.

One way to do that is to buy a put. Remember, if you’re buying a put, you’re protecting a price floor for your grain. And if the market should instead trade higher due to drought, you are not dealing with margin calls, you are able to take part in the rally with your cash sales. However, if the rains occur, you’ll be thankful you have a price floor protected.

Consider price protection with a short-dated put

Short-dated options are gaining more relevance and importance as a tool you might employ to help shift risk or manage opportunity. As with any marketing tool, there are pros and cons that need to be measured. Let’s first explain what a short-dated option is and how it works.

The term “short-dated” refers to a shorter window before the option’s traditional last trading day, otherwise known as option expiration. You’re able to protect new crop December 2023 corn futures prices, yet with a shorter window of time.

For example, if you were to buy traditional December 2023 corn put, it would expire on November 24, 2023. With the short-dated options, you are still protecting December 2023 corn futures prices, but they cost less, because they expire much sooner than November 24, 2023. Therefore, you’re paying less time value in the cost of the option premium itself.

The July short-dated option expires on June 23, 2023

The August short-dated option expires on July 21, 2023

The September short-dated option expires on August 25, 2023

Strategize with your grain market advisor

Full visibility of how short-dated options work (puts or calls and whether it is purchased or sold) and the associated risks are critical to understand for proper implementation. A big benefit is that short-dated options can provide farmers an opportunity to reduce out of pocket costs and still protect a price floor.

They may be useful for such events as upcoming USDA reports, near-term weather events, or any other situation where protection for a shorter period of time may be warranted. Because you’re buying a shorter time period of coverage, they cost less, and you’ll save money (relative to a traditional option).

We can never outguess what a market will do, or what Mother Nature has in store for us, but using risk management and being prepared to protect value is something within your control.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like