By next week the planting report will show us that most of the U.S. crop will have been planted. Then we can turn our attention to crop progress. Our main focus will be growing this crop as the market is going to need every bushel that it can get.

For the USDA’s initial 181 bushel per acre yield goal to be reached, planting conditions needed to be near perfect – and that hasn’t happened. We are already off to a rocky start with snow and heavy precipitation delaying planting in North Dakota and Minnesota.

Meanwhile, NOAA’s seasonal drought outlook shows drought lingering in most of Iowa this summer. Furthermore, there is no end in sight to the war in Ukraine. The country’s export capabilities have been greatly compromised to the point that it will not have enough storage capacity for the crop it just planted.

They may be forced to idle acres next season if nothing changes between now and then. There is no point in planting a crop if you are unable to sell the one from the year before.

Was USDA being optimistic?

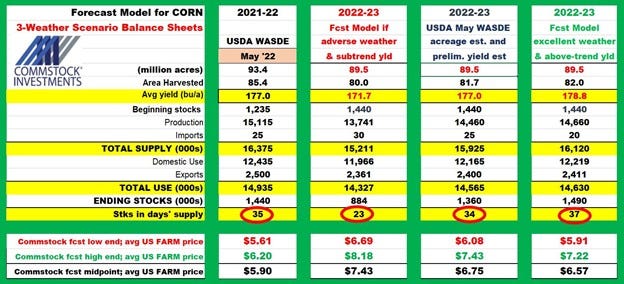

We view the USDA’s May WASDE report showing 1.36 billion bushel carryover as optimistic. It is our view that we are likely headed towards a scenario where the corn carryover falls below 1 billion bushels and soybean carryover below 200 million bushels. This would provide plenty of justifications for why we see the bull market continuing well into 2023. The market will need more acres but it is having a hard time finding them. Apparently $8 corn and $16 beans were not enough to do it for 2022 so what will it take for next season? Where will we get those acres from?

One possibility is taking acres out of CRP. USDA announced that CRP participants who are in the final year of CRP contracts expiring October 1 can request voluntary termination of their CRP contracts. There is potential for an additional 1.7 million acres that could theoretically be withdrawn from the program, but these are by and large marginal production acres that were put into CRP for a reason. They are heavily concentrated in the Pacific Northwest and Northern Plains states which have below trendline yields.

Brazil’s fertilizer problem

The fertilizer shortage in Brazil will impact its production as well. While it may expand acres, all signs indicate that it will reduce fertilizer investments to offset the price increase. This will keep a lid on Brazil’s yield prospects.

This might happen in the U.S. as well to a certain extent. Although most farmers paid more for their inputs than last season, they bought their inputs early and avoided most of the surge. They likely won’t be able to dodge that bullet in 2023, so U.S. farmers will also be more sensitive to rising costs, looking for ways to shave inputs any way they can.

Demand destruction?

The main argument for lower prices is that these high prices could be causing demand destruction. However, we have not really seen any evidence of that anywhere. Ethanol plants remain profitable and livestock market weights have yet to fall as feeding periods are shortened. China will continue to buy grain from us as we are one of the few countries that has it to sell.

USDA’s projection of ample carryover is an illusion that will be revealed – in time.

Matthew Kruse is President of Commstock Investments. You can sign up for their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like