Trading has been exceptionally volatile this past week in December corn and November soybean futures. Weather forecasts are changing by the minute with some suggesting a warmer and drier pattern may soon affect more of the Midwest, while others believe a near-normal trend may develop late in the month.

The USDA releases the July supply and demand report at 11 a.m. central today (July 12). Beyond the acre adjustments to reflect the June acre report, only limited changes are expected. With markets and fundamentals in this current state, flexible marketing strategies that manage price volatility—whether higher, or lower—can be a highly effective tool.

Changing weather forecasts highlight rising market uncertainty

The past week has seen yet another significant shift in psychology in the corn and soybean markets. For example, December 2022 corn futures plummeted to $5.66 ½, which is the lowest price since Feb. 3 (three weeks prior to Russia’s invasion of Ukraine).

The same trend was evident in the November 2022 soybean futures: the contract traded to $13.02 ½ on Wednesday, which was the lowest price since Jan. 25. Both markets have at least temporarily “reversed course,” however, by posting higher settlement prices for each of the past three days.

While the critical pollination period for corn is at hand, the important pod set and pod fill stage of development for beans is still several weeks away.

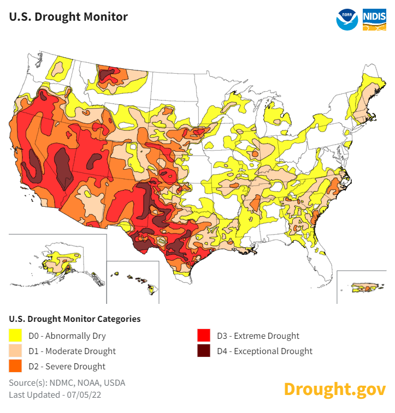

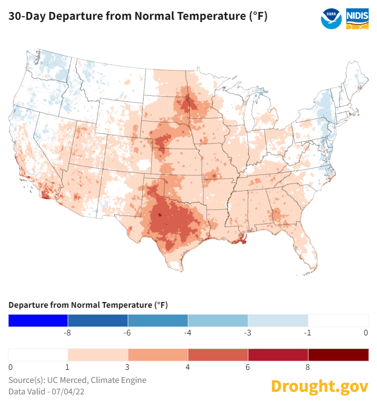

Weather forecasts are changing by the minute with some suggesting a warmer and drier pattern may soon affect more of the Midwest, while others believe a near-normal trend may develop later this month. Needless to say, market volatility goes hand in hand with this type of uncertainty—particularly as it relates to the weather.

The foundation for the upcoming 2022/23 marketing year will be the size of U.S. crops, so weather forecasts are garnering quite a bit of attention. Something like a slight—and unpredictable—shift in the position of a high-pressure ridge could potentially result in a several bushel swing in the national average yield of corn and beans.

USDA supply and demand

U.S. 2022/23 corn ending stocks are estimated at 1.437 bbu versus the 1.400 number from the June WASDE report. The 2021/22 corn ending stocks is estimated at 1.489 bbu versus 1.485 in June. The U.S. corn crop is estimated at 14.523 billion bushels versus 14.460 in June. The U.S. corn yield is estimated to be unchanged at 177.0 bushels per acre as in June.

The U.S. 22/23 soybean ending stocks is estimated at 0.207 billion bushels versus 0.280 in June and the 2021/22 is estimated at 0.210 v 0.205 in June. The U.S. soybean crop is estimated at 4.522 billion bushels versus 4.640 in June with an unchanged yield from June of 51.5 bushels per acre.

As a student of the market, you understand that rather than attempting to predict weather (and price) trends, a much more productive use of your time is to implement flexible strategies that manage price volatility—whether higher, or lower. With uncertainty rising, now is the time to maintain close contact with your advisor, stay disciplined, and focus on executing your marketing strategy.

Contact Advance Trading at (800) 664-2321 or go to http://www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like