January 2, 2024

Tight cattle supply recently allowed the cow-calf segment of the industry to capture 40% of the consumer dollar, but increasing that percentage depends on net returns for processors and feedlots.

The cow-calf segment of the cattle industry has been in the driver’s seat recently when it comes to the portion of the consumer dollar spent on beef it is capturing today. However, much happens between when a feeder steer is sold and a consumer walks away from the grocery store with beef from that animal.

Every participant in the marketing chain incurs costs from their role in the value-adding process and receives a portion of the retail dollar that is spent on the finished product. And that share fluctuates over time, with many factors coming into play.

Breaking down beef dollar

Looking at historical values for fed steers, feeder steers, steer byproducts, wholesale boxed beef and retail beef sheds light on how different sectors of the beef industry fared over time.

Assumptions must be made regarding sale weights, slaughter weights, dressing percentages, and the yield and composition of retail cuts that come from each carcass — and calculations of these shares will vary depending on the methodology used.

But examining how these shares have changed over time with a consistent set of assumptions gives a good snapshot of the financial health of different beef industry sectors.

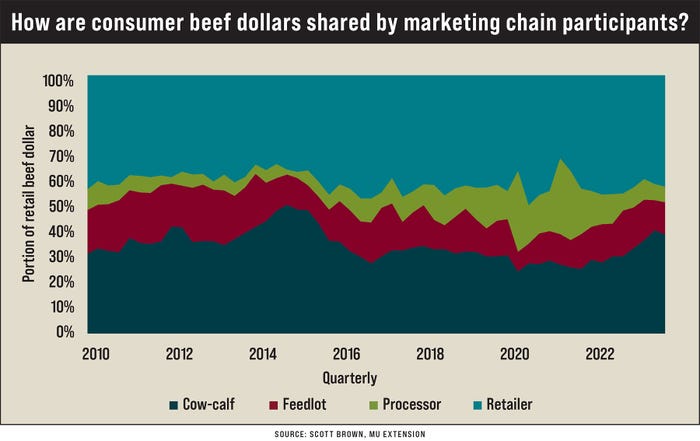

The share of each consumer dollar received by cow-calf operators has shown a lot of variability since 2010, ranging from just over 50% in late 2014 when calf supplies were extremely tight to below 25% in the second quarter of 2020 when COVID-19-related market disruptions were at their peak.

As available calf supplies have been on the decline in recent quarters, cow-calf operators are again receiving a larger share of each beef retail dollar. There is potential for more increase in the next couple of years, especially if a transition to beef cow herd rebuilding further limits the number of animals available to feedlots.

Where processors and feedlots fit

Other segments of the marketing chain have shown less variability, although processor shares spiked in 2020 and 2021 in large part because of pandemic-related challenges.

Recently processor shares declined into the range that was common for a good part of the prior decade. Keep in mind that feedlot profitability is highly dependent on the price of corn, and that relatively high corn prices result in feeders needing a larger share in order to maintain similar net returns. The average percentage of each dollar accruing to retailers stayed relatively constant despite labor cost increases.

Many in the industry have rightly been concerned about the recent declines in cattle prices. (Note that this article only focuses on the share of each consumer dollar, not the entire pot of available dollars.)

As retail beef prices increased during the first half of 2023, all sectors received more dollars as the total amount spent on beef increased. As retail prices cooled since July, the only way for a sector to increase total dollars received was to take share from another industry segment.

With net returns for processors and feedlots relatively weak compared to recent years, it will become increasingly difficult for the cow-calf sector to continue to increase its share of consumer dollars in the next year unless corn prices see further sharp declines.

The best outcome for all involved in the cattle industry will be for continued strong beef demand that allows the total pie of consumer dollars to increase.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like