It’s decision time, for both farmers and traders.

Those who buy and sell for a living must decide how much prices should change in the wake of USDA’s surprising report on corn and soybean planting intentions. Farmers, of course, then must decide whether to alter their plans for spring – assuming the weather cooperates.

For the record, the government’s first survey of growers found them ready to put in 89.5 million acres of corn, down 4% from last year, and 91 million acres of soybeans, a record and 4% more than 2021. And as expected, the other report, out breaking down inventories at the end of February, came in close to expectations with no surprises.

Here are the implications of the estimates, and how much prices could increase, or decrease, to change those planting choices.

Door opened to $7 handle

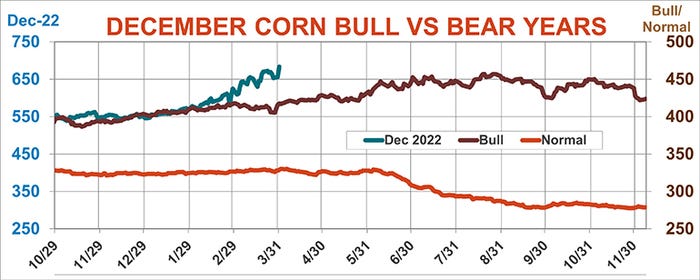

December corn futures surged to a new contract high of $6.91 after the March 31 reports dropped, closing 27.75 cents higher on the day. The rally was within a penny of the average futures change forecast by my pricing models when 450 million bushels are chopped off USDA’s recent estimate for a 15.24 billion bushel crop. That took futures well into my predicted “top third” selling range for the crop of $6.63 to $7.48. Futures added to gains at the end of last week

My estimated selling range uses USDA’s current yield forecast of 181 bushels per acre, which assumes normal weather and planting conditions. The yield projected by the statistical trend of production over the past 20 years is a more conservative 178.1 bpa. Using a lower yield would knock another 230 million bushels off the crop, raising the selling range to $6.79 to $7.67.

A rally to $7.48 would be 92 cents above the pre-report close of $6.56, with a $1.11 move needed to hit $7.67.

Planting pace important

How many acres would be bought by a big rally? History provides some clues.

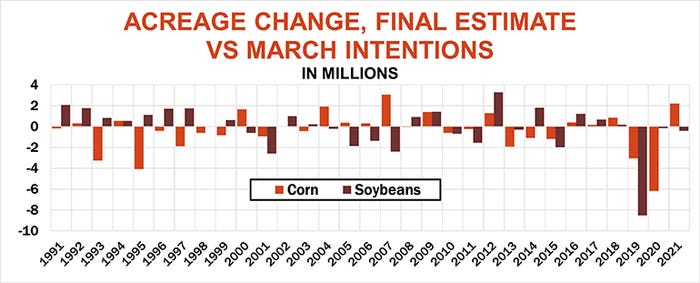

First there’s USDA’s track record for March planting intentions. On average the agency reports lower final seedings, though in any given year it’s pretty much a coin flip whether acreage will grow or decline. So “buying acres” must overcome a statistical headwind at the starting gate.

A rally of 92 cents would buy another million acres, but fast planting would add even more -- another 1.2 million to the total assuming farmers can find the seed, chemicals and fertilizer to keep putting in corn as long as they can. But only the bigger rally target of $1.11 would take acreage above USDA’s earlier 92 million estimate.

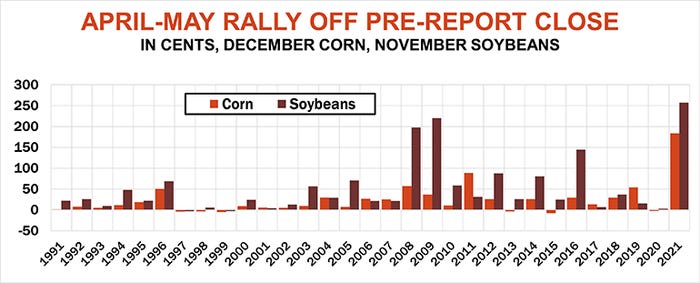

Gains that large after the March reports are rare, but not unprecedented. Last year’s December corn rally was even more dramatic, jumping more than $1.50 before the market topped out May 8, 2021. By contrast, the average April-May rally is just 20 cents.

Even in bullish years with rising prices, futures tend to turn choppy after an initial post-report surge, with the market’s final push waiting for summer pollination and harvest confirmation of crop damage.

Too many soybeans?

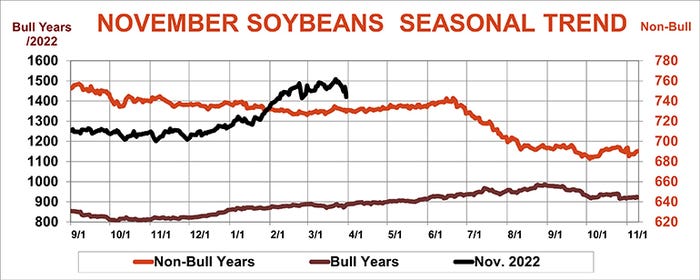

Last year’s spring rally of $2.575 by November soybean futures was also easily a record. This time around is starting out in the opposite direction. November lost more than 75 cents after the report came out before finding a little chart support. That by itself might not be enough to cut seedings much with normal planting progress. But coupled with a buck rally in corn, the combination could cut 3.5 million off soybean seedings.

Big losses after the March reports have occurred, but average prices tend to be steady or higher during the spring after some weakness in the first two weeks of April. That could provide some stability for beans – prices can’t get too cheap too soon or corn might win back some ground by default.

Soybean demand is key

Even the record soybean plantings found by USDA don’t preclude rallies as long as demand holds up. Coupled with the 51.5 bpa “normal” yield used by the government, the crop would come in at a huge 4.63 billion bushels. But having more bushels to sell – a lot more – normally increases usage, which could help stocks from becoming too excessive.

Under this scenario, the “top third” of my projected selling range is $14.65 to $15.80. November spiked to $15.55 in February after Russia invaded Ukraine, though the high close is $15.08. A sharp reduction in seedings could move the top of the selling range to $16.65, even with normal yields, assuming South American growers can find all the fertilizer they need in a world market that’s short on supply. But following this year’s March 31 report, that type of rally would take growing season weather scares or another black swan event.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like