USDA releases its August 2021 Crop Production and World Agricultural Supply and Demand Estimates reports tomorrow morning. The hot button issue that will resonate the most with markets in this month’s report will be the first look at U.S. corn and soybean yield estimates for the 2021 seasons.

But there are several other key factors to watch for as well. After several months of quiet reports, tomorrow’s latest update could spark a fresh round of price volatility. Here is what our team will be watching in tomorrow’s report.

USDA releases both the WASDE and Crop Production reports at 11am CDT. Farm Futures provides live coverage of the latest estimates and ongoing report analysis in real time on our website, FarmFutures.com, and also via social media (@FarmFutures).

2021 yield and supply projections

The August 2021 Farm Futures survey predicted 2021 corn yields would come in at 178.7 bushels per acre, which would best 2017’s yield of 176.6bpa as the largest on record. Read more details about the supply and demand impacts of those estimates here.

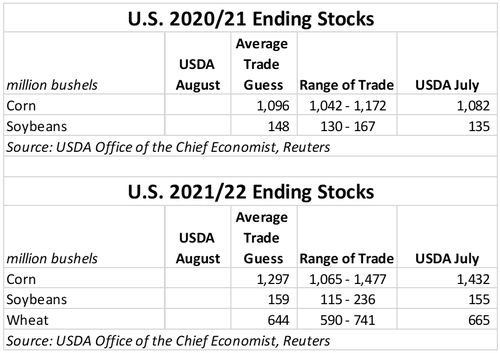

Using USDA’s current estimate of 88.5 million acres of corn expected to be harvested for grain this fall, 2021 corn production is estimated at 15.1 billion bushels – about 63.5 million bushels lower than USDA’s current 2021 production estimate. It will likely trail the 2016 harvest of 15.1 billion bushels as the second largest on record by a margin of 44.7 million bushels.

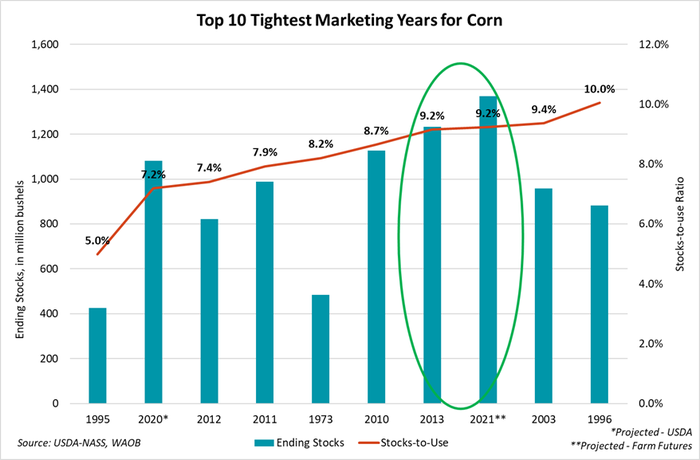

Holding 2021/22 corn usage rates constant at 14.84 billion bushels, Farm Futures’ yield estimate of 178.7 bpa would likely shrink available corn supplies by 63.5 million bushels. That would leave ending stocks at 1.37 billion bushels, shrinking USDA’s current stocks to use ratio for 2021/22 from 9.6% to 9.2%.

Corn stocks are expected to shrink to the second tightest level in the last 60 years by the time the 2020/21 marketing year ends at the end of this month, a result of aggressive 2020/21 exports and two previous years of crop shortfalls.

Farm Futures’ August 2021 survey finds U.S. farmers expect to harvest an average of 51.3 bpa from the 2021 soybean crop. That yield would follow 2016’s rating of 51.9 bpa as the second biggest yield in history.

The success of the 2021 soybean crop will be dependent on how wide the yield variance ends up between the Upper Midwest and the rest of the Corn Belt. Scattered showers have fallen in the Northern Plains in recent weeks, which will likely support peak pod development over the next week though the showers are likely not enough to significantly reduce the region’s drought classifications.

Farm Futures’ 51.3 bpa 2021 soybean yield estimate would place the 2021 soy crop at 4.45 billion bushels, about 41.8 million bushels more than USDA’s current projection. If realized, that total would best 2018’s record haul of 4.43 billion bushels as the largest U.S. soy crop ever.

Provided USDA does not update demand estimates in next week’s WASDE report, leaving 2021/22 usage rates at 4.42 billion bushels, new crop ending stocks will increase from 156 million bushels to 198 million bushels.

The extra bushels forecasted by Farm Futures are not likely to linger long on the market though. With USDA forecasting 2021/22 soybean usage at a record-setting 4.42 billion bushels, exporters and domestic processors are likely to engage in stiff competition as crops are harvested this fall.

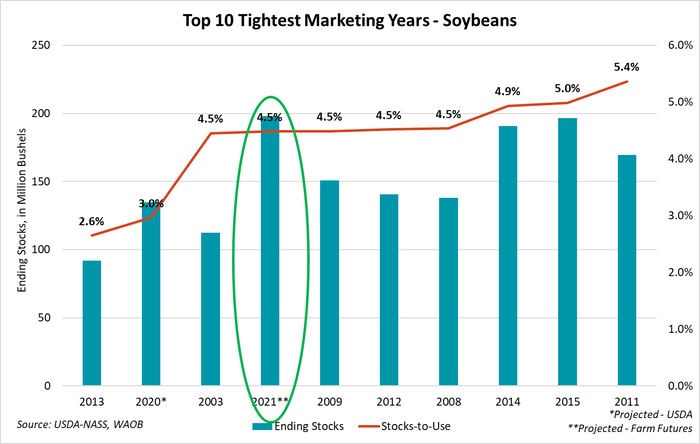

The strong demand projection will keep 2021/22 stocks to use ratio at a tight 4.5% despite the increased production forecast from Farm Futures. Soybean stocks are set to end 2020/21 at the second tightest volume in the past 58 years, while 2021/22’s forecasted stocks to use rating of 4.5% will the fourth tightest during the same time period.

Potential demand adjustments?

Most of the focus in tomorrow’s report will center on updated supply estimates. Though it would not be unreasonable to see USDA make adjustments to usage factors.

For corn, market watchers will keep an eye on any export adjustments USDA decides to make to 2020/21 shipments. Unprecedented Chinese export demand sent 2020/21 corn exports to new heights, with 32% of current year corn shipments destined for China. But over the past five weeks, shipments to Central America and Southeast Asia have eased, which could lead USDA to trim its 2.85-billion-bushel forecast for 2020/21 corn exports.

China and Central American countries continue to book export orders for delivery in 2021/22 at a rapid pace. New marketing year corn export sales are nearly 60% higher than the same time a year ago. So while USDA could trim its 2.85-billion-bushel forecast for 2020/21 corn exports, it is more likely to increase its 2.5-billion-bushel estimate on 2021/22 corn exports, especially as global wheat prices rise.

Soybean crush rates could take another hit in tomorrow’s WASDE report. USDA has already trimmed 30 million bushels from 2020/21 crush rates over the past two months as low supplies and high prices force processors to slow production rates.

Last week’s Oil Crushing report from USDA suggested this trend could continue as the 2020/21 marketing year crawls to a close. The June 2021 crush volume stood just under 162 million bushels -the lowest of the marketing year and the smallest monthly crush recorded since June 2019.

Wheat production to be slashed - again

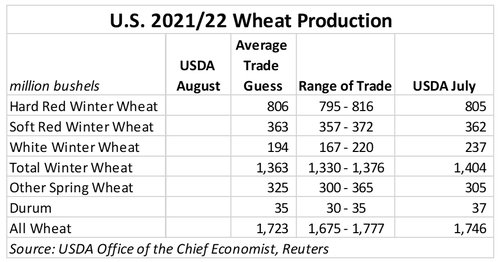

USDA will also release updated wheat production estimates for the 2021 crop. Historic drought in the Pacific Northwest is likely to further erode white wheat production volumes, which will deal a disappointing blow to U.S. wheat exporters and growers who profited off a 33% annual increase in white wheat exports last year on unprecedented Chinese demand.

Over 11% of 2020/21 U.S. wheat was shipped to China, compared to only 2% the year prior. But Chinese and Southeast Asian wheat shipments have been slow out of the gate during the 2021/22 marketing year.

USDA anticipates U.S. wheat exports will shrink by 118 million bushels this year on smaller crop estimates. But if the USDA’s World Agricultural Outlook Board (WAOB) deems the recent lull in peak wheat exporting season to be significant, export volumes could shrink as well, especially in light of smaller white and spring wheat crops this year.

Market analysts expect slightly higher spring wheat volumes as harvest reports moderate expectations of crop shortfalls in the Northern Plains. Minneapolis futures have tumbled slightly in the days following the release of trade estimates showing increased 2021 spring wheat production, so producers will want to keep a close eye on those volumes tomorrow.

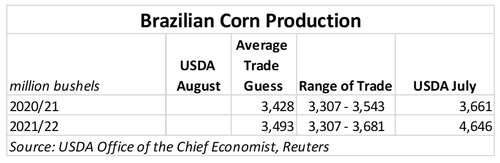

Brazilian corn production

Brazil’s largest corn crop of the 2020/21 year – its second, or safrinha, crop – experienced nearly every obstacle imaginable this growing season. Late planting due to soybean planting and harvesting delays cut yield estimates from the start. A La Niña-inspired drought further slashed hopes for average yields during the growing season.

Market analysts expect USDA will cut Brazil’s 2020/21 and 2021/22 corn production estimates. Market watchers will also pay close attention to USDA’s likely revisions to Brazil’s export forecasts, which are expected to shrink on the smaller crops and rising domestic usage rates. That could potentially be some bullish news for U.S. corn exporters who will likely step in for short Brazilian exportable supplies.

The U.S. and Brazil are expected to be the world’s largest two exporters in the 2021/22 marketing campaign, accounting for over 50% of total global corn exports next year.

Wheat takes center stage

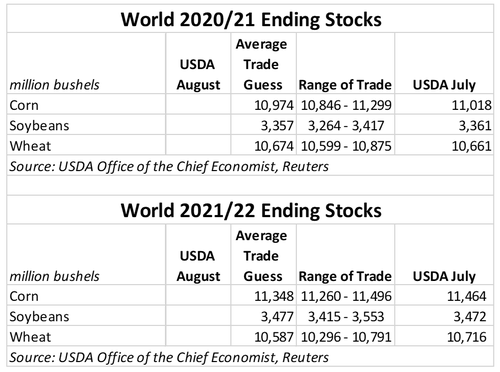

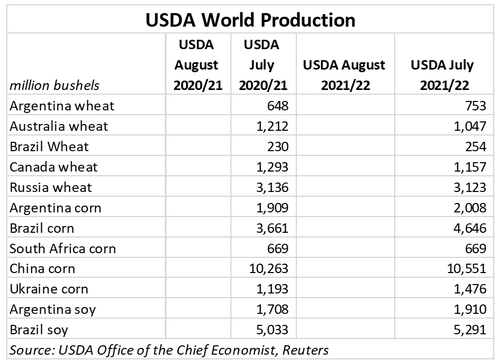

Markets will be keeping a close eye on any USDA-WAOB adjustments to global wheat supplies in tomorrow’s report. Smaller crops expected in Canada, Russia, the European Union, and the U.S. due to a combination of drought and unfavorable harvest conditions are likely to trim global stock volumes for 2021/22.

Those four countries are the world’s largest wheat exporters. They combined last year to account for 61% of global wheat exports, so this year’s crop shortfalls will have a significant impact on global trade flows in the coming months.

With smaller crops and higher prices, it is also likely that USDA-WAOB will reduce global wheat feeding estimates in favor of cheaper and more readily available corn crops. As wheat prices rise, livestock feeders historically turn to corn as a more affordable option for feed rations.

Chinese wheat and corn production will also be closely watched in tomorrow’s report to provide early indicators about new crop corn and wheat export flows across the globe. At the beginning of the year China announced that high priority would be given to increasing domestic grain production and procurement as its domestic usage rates continue to climb faster than its farmers are able to plant. This spring, the Chinese government recommended livestock and poultry producers substitute soy ingredients in feed rations with cheaper grain supplies as high soy prices continue to pressure crush margins.

Recent U.S. corn and wheat exports suggest that Chinese livestock feeders have been taking this advice to heart, but for how long will the shift in trading patterns last? Traders are likely to respond to any significant changes in Chinese corn and wheat import forecasts in tomorrow’s report, which is likely to add to any market volatility resulting from tomorrow’s data update.

Global soybean stocks are not likely to significantly change – unless USDA’s 2021 U.S. yield forecast goes higher than the current estimate of 50.8bpa. Lingering effects from drought in Argentina could see USDA trimming Argentina’s 2021/22 soybean crop by 275 million bushels, though with the crop not even in the ground, this forecast could be premature.

High global demand for soybeans in 2021/22 will keep prices at profitable levels in the coming months. That outlook could shift on any changes to Chinese import forecasts or if Brazil experiences any issues with its crop this year.

Brazil is currently forecasted to harvest a massive 5.3 billion bushels of soybeans next spring, which could weaken U.S. prices at that time if China’s hog herd does not revert back to soy-laden diets.

2021 prevent plant acres released

A couple hours following USDA’s release of the WASDE and Crop Production reports, the department’s Farm Service Agency (FSA) will release a much-anticipated first look at 2021 prevented planting acreages.

Planting season for 2021 prevented much fewer obstacles to farmers – particularly in the Northern Plains – than in 2020 and especially than 2019. Only 6% of respondents in Farm Futures’ August 2021 survey reported certifying acres as prevented from planting for crop insurance, down from 10% a year earlier thanks to dryer conditions earlier this spring.

Profitable row crop futures prices paired with the improved planting conditions paved the way for higher corn and soybean acreages this year. This spring’s total corn and soybean acreage of 180.2 million acres marked the largest combined corn and soybean planted acreage since 2017. That year, the largest combined acreage was planted, totaling 180.3 million acres.

About the Author(s)

You May Also Like