The latest USDA-NASS Cattle on Feed report pegs the September 1 feedlot inventories at 11.094 million head, down 2.2 percent year over year. The September feedlot total was up slightly from the August summer low, which was the lowest monthly on-feed total since September of 2019. Feedlot inventories have been lower year over year for the past twelve months.

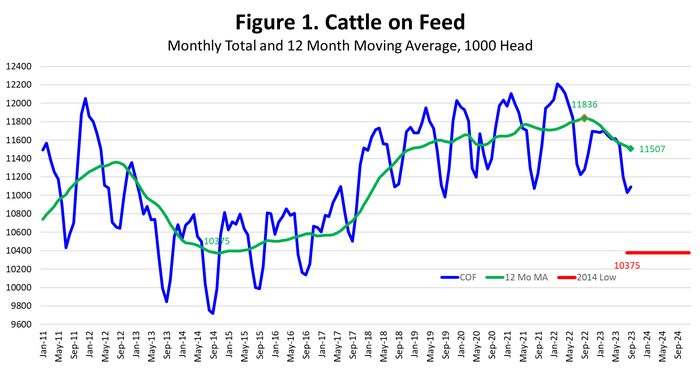

Figure 1 shows monthly feedlot totals and a 12-month moving average, which provides a good measure of the underlying trend for the past year. The 12-month moving average peaked in September 2022 at 11.836 million head. The September 2023 12-month moving average is 11.507 million head, down 2.8 percent from the peak. Figure 1 also shows the 2014 cyclical low of 10.375 million head, a likely target for feedlot inventories in the coming months. Following the drought a decade ago, the 12-month moving average dropped below 11 million head in April 2013 and remained below that level for 58 months through January 2018. This was the period of rapid herd expansion in the last cattle cycle and a similar situation is likely going forward, beginning in 2024.

Monthly feedlot placements in August were down 5.1 percent year over year; the lowest August placements since 2019. Placements have decreased year over year for ten of the last twelve months, with total placements down 897 thousand head in the last year. A 12-month moving average of placements shows that the peak annual average monthly placements occurred in December 2019, consistent with the cyclical peak in the calf crop in 2018. However, pandemic delays from 2020 into 2021and drought enhanced placements in 2021 and 2022 have kept feedlot placements high until the last few months. The current 12-month moving average of placements for August just dropped to the lowest level since May of 2017. Average placements are expected to continue declining for the foreseeable future.

Feedlot marketings in August were down 6.0 percent year over year. Total marketings for the year to date are down 3.4 percent. Feedlot marketings are, of course, highly correlated with slaughter. Monthly feedlot marketings are 90 percent correlated with yearling (steer plus heifer) slaughter and account for an average of 86.6 percent of monthly federally inspected steer and heifer slaughter. Marketings from small feedlots, with less than 1000 head capacity, make up the difference. Yearling slaughter for the first eight months of the year is down 3.2 percent year over year. The year over year decrease in yearling slaughter consists of a 4.9 percent year-to-date decrease in steer slaughter and a 1.1 percent year-to-date decrease in heifer slaughter.

Heifer retention is expected to increase sharply at some point in the coming months which will drop the number of heifers in feedlots and decrease heifer slaughter. The July quarterly data showed that heifers currently make up 39.9 percent of feedlot inventories. When heifer retention begins in earnest, this percent will drop to about 32 percent. This suggests that average feedlot inventories will likely drop another 1.0 - 1.2 million head at least in the next 8-18 months. Feedlot inventories will likely decline to a level close to the 2014 low in Figure 1 and stay relatively low for many months.

About the Author(s)

You May Also Like