Cattle producers are taking advantage of the much stronger cattle prices this fall. In numerous meetings this fall, producers have indicated to me that they are selling the majority of steers and heifers; in part to capitalize on higher prices, and in some cases, because of continuing drought and pasture and hay limitations which are making additional sales necessary.

Reported national feeder cattle volumes (auction, direct and video/internet) are up 5.6 percent year over year since Labor Day, with the majority in September (contributing to the large September feedlot placements).

The total volume in October was up 2.4 percent but was down year over year at the end of October and beginning of November. In Oklahoma, feeder cattle auction volumes have been down 13.7 percent year over year this fall. However, there are indications of another month of large placements in the next Cattle on Feed report.

Bigger feeder cattle (600 pounds and higher) prices have fallen about 9-10 percent since September, mostly under the weight of the huge market correction in Feeder and Live cattle futures. Despite the recent decrease, prices for these heavier feeder animals are still 33-35 percent higher compared to the same time last year.

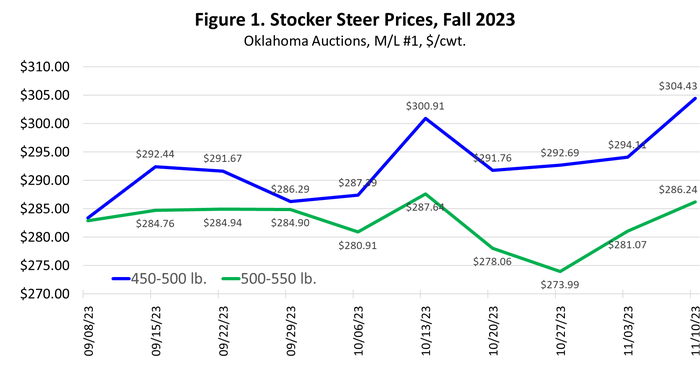

Stocker calf prices in Oklahoma have continued to show strength this fall (Figure 1), helped, no doubt, by recent rains and improved wheat pasture prospects. Producers looking to graze wheat are expecting to have wheat pasture, albeit later than usual in many cases. The latest crop progress report pegs Oklahoma wheat planting and emergence just slightly behind the average pace and rates the crop at 49 percent good to excellent. Stocker steer prices in Oklahoma are averaging 45-50 percent higher year over year.

Strong feeder prices can also impact live cattle imports. Mexican feeder cattle imports, which were at the lowest level since 2008 last year are up sharply in 2023. The January – September total Mexican cattle imports were up 45.9 percent year over year. However, the current year to date total is down 3.6 percent from the 2017-2021 average for the first nine months of the year. Imports of Canadian feeder cattle are down 24.6 percent for the year to date from last year and are down 35.7 percent from the 2017-2021 average level.

Nationally, beef cow slaughter is down 12.6 percent year over year for the year to date. However, the decrease has been smaller, down just 8.4 percent year over year in the last 8 weeks. The current pace of beef cow slaughter suggests a 2023 herd culling rate of 12 percent, above the long-term average rate of about 10 percent and indicates additional herd liquidation.

Taken together, the feeder marketings, feedlot placements and slaughter data all suggest that the industry continues to extract animals from the system in a manner that indicates continued liquidation. Cattle numbers generally will continue to get tighter in 2024. When heifer retention and herd rebuilding begin, cattle numbers will get significantly tighter very quickly.

About the Author(s)

You May Also Like