April 30, 2012

On April 21, 2012, what is called the Chair Mark for the 2012 Farm Bill was released by Senator Deborah Stabenow, Chair of the U.S. Senate Committee on Agriculture, Nutrition, and Forestry. This is the first publically released draft of the 2012 Farm Bill. The Chair Mark will form the basis for deliberations by the Committee as it completes writing the farm bill. This article summarizes provisions in the farm bill that concern the safety net for U.S. crops: The provisions are in Title I, Commodity Programs, and Title XI, Crop Insurance.

2012 Farm Bill Crop Safety Net for 2013-2017 Crop Years

1. Marketing Loans retained.

Loan rates remain the same as for the 2012 crop year, except cotton’s loan rate can be lowered.

2. Agriculture Risk Coverage (ARC) program created.

Farmer makes a one-time, irrevocable election to participate in individual farm ARC or county ARC if county has sufficient data.

3. Crop Insurance retained and adds new Supplemental Coverage Option that allows individual insurance to be supplemented with county insurance to cover all or part of the individual insurance deductible.

-Makes 2008 Farm Bill pilot program for enterprise crop insurance permanent.

-Insurance APH yield will be calculated using 70%, instead of 60%, of insurance transitional yield.

-Irrigated and non-irrigated enterprise insurance is to be made available in counties.

-Any future Standard Reinsurance Agreement should be budget neutral.

-Separate insurance program is created for cotton, called the Stacked Income Protection Plan (STAX).

Program Parameters that apply to both Individual and County ARC Programs

Crops covered: wheat, corn, sorghum, barley, oats, long grain and medium grain rice, pulse crops, soybeans, other oilseeds, peanuts

Payments are made on an individual crop basis.

The election is for the entire farm operation, not for an individual FSA farm.

Coverage is for losses between 11% and 21% relative to the benchmark value.

For a covered crop, eligible acres are all acres planted or prevented from being planted to the crop on a farm during a crop year. -A farm’s total eligible acres cannot exceed its average eligible acres for the 2009-2012 crops.

Election decision applies to all acres under operational control of the farmer, including acres added after the election. -Acres that change farms are subject to the election decision of the new farmer. -Conservation Reserve acres converted back to cropland can be added to eligible acres.

Benchmark values are calculated to the extent practicable for irrigated and non-irrigated acres.

Limit on payment per payment entity per year is $50,000 for peanuts and $50,000 for all other covered crops. -In general, the rules for determining a payment entity are the same as in the 2008 Farm Bill.

No payments can be received if a payment entity’s average adjusted gross income over the 3 preceding taxable years exceeds $900,000 (Adjusted Gross Income Limitation).

Conservation compliance and wetland protection must be met to be eligible for ARC payments.

Summary Observations

This farm bill draft clearly moves the U.S. farm safety net in the direction of risk management. The elimination of direct payments, creation of ARC, and enhancements to crop insurance all support this observation.

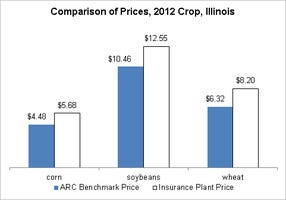

A commonly expressed desire for this Farm Bill was to reduce overlap in farm programs. This objective is clearly accomplished by limiting the ARC program to losses between 11% and 21% as compared with the larger range of losses covered by both ACRE and SURE. However, because different prices and yields are used to determine the ARC benchmark value and the insurance plant guarantee values, overlap continues to exist. For the 2012 crop year, the estimated benchmark price for ACR for Illinois corn, soybeans, and wheat is less than the insurance plant (expected) price. Thus, the programs would cover some of the same losses. The only ways to eliminate all overlap is to more formally merge the insurance and commodity programs or to make the ARC program effective only if its benchmark revenue exceeds the crop insurance guarantee revenue. At present, neither of these two options is likely to be politically acceptable.

Should ARC come into existence, farmers will have to decide if they want to enroll in the individual or county ARC program. In addressing this question, a key question will be whether, over the 2013-2017 crop years, farmers expect the greatest risk to be (1) low yield on their farm or (2) low market price. The individual farm ARC provides protection for yield losses on the individual farm. However, the county ARC has a higher coverage rate (75% vs. 60%). Thus, the county ARC provides more protection for losses that occur due to yield losses over larger areas or because of low prices (i.e., losses not due to individual low yields). Future farmdoc articles will look at this decision in more detail, as well as how expected payments will vary across the U.S. by crop and region.

Should ARC come into existence, farmers will have to decide if they want to enroll in the individual or county ARC program. In addressing this question, a key question will be whether, over the 2013-2017 crop years, farmers expect the greatest risk to be (1) low yield on their farm or (2) low market price. The individual farm ARC provides protection for yield losses on the individual farm. However, the county ARC has a higher coverage rate (75% vs. 60%). Thus, the county ARC provides more protection for losses that occur due to yield losses over larger areas or because of low prices (i.e., losses not due to individual low yields). Future farmdoc articles will look at this decision in more detail, as well as how expected payments will vary across the U.S. by crop and region.

From the perspective of managing risk, the $50,000 limit on ARC payments per payment entity is a key issue. Risk management programs like ARC will make large payments when a farm experiences a sizable loss. However, occurrence of such a loss is not known until after the crop is planted. To limit payments when they are most needed undermines the program and makes the management of farm risk much more difficult. From the perspective of helping farmers manage risk and assuming there is a desire to help small farms more than large farms, it would be better to reduce the share of losses covered for larger farms. For example, a farm with less than 100 acres could receive payment on losses between 11% and 21% while a farm with over 2,000 acres could receive payment on losses between 16% and 21%. This type of limit would not restrict payments when a large loss occurs, thus providing assurance to the farmer that ARC will cover these losses. As important, the farmer can then make other risk management decisions knowing what losses will be covered.

Farmers also will have to decide if they want to use the Supplemental Insurance Option to replace individual insurance with a combination of individual and county coverage through this new program. The only observation I feel comfortable making at the present time is that this option could be an important tool to better allow a farmer to customize risk management to the risks his/her farm confronts.

Last, this is a draft farm bill. The bill must be passed by both the House and Senate and signed by the President. In addition, as part of the agreement to address the Brazilian cotton case with the World Trade Organization, Brazil will have to decide if it finds the proposed cotton program acceptable and what actions they will take if they find the cotton program unacceptable. In short, there are lots of steps yet to be taken before the farm bill is finalized. Much discussion will occur and changes will be made.

This publication is also available at http://aede.osu.edu/publications.

You May Also Like