By James Attwood

Dean Foods Co. agreed to sell a large chunk of its business to Dairy Farmers of America Inc. after the top U.S. milk processor went broke amid declining consumption and competition from Walmart Inc.

After filing for Chapter 11 bankruptcy in November, the maker of Dairy Pure products has agreed to divest 44 of its fluid and frozen facilities as well as assets necessary to operate them, it said in a statement Monday. Separately, DFA said it would pay a base price of $425 million for the assets, as well as taking on various liabilities, without elaborating.

Dallas-based Dean’s losses piled up after its biggest customer, Walmart, built its own milk plant, with the rising price of raw milk further eroding margins. Demand for cow milk has been weak, too, with nut milks and even bottled water cutting into its popularity. Another large dairy processor, Borden Dairy Co., filed for bankruptcy shortly after Dean.

The DFA cooperative will be betting on the benefits of vertical integration to turn around the financial performances of the operations. Still, the arrangement requires approval from the bankruptcy court and the U.S. Department of Justice. If approved in a March 12 hearing, DFA would serve as a stalking-horse bidder in a court-supervised sale process for the assets.

When Dean filed for bankruptcy in November it said it was in “advanced” talks with DFA regarding a potential sale. At the time, some Dean bondholders expressed concern that the company was rushing into a combination with DFA at the expense of other options. According to Dean’s website, it has more than 60 local processing plants.

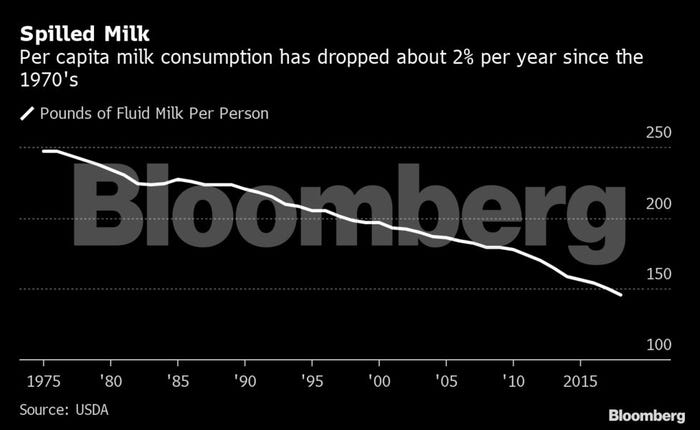

U.S. consumption of cow milk has fallen about 2% each year since the 1970s. The industry has been saddled with consumer concerns over health and environmental impact.

To contact the reporter on this story:

James Attwood in Santiago at [email protected]

To contact the editors responsible for this story:

James Attwood at [email protected]

Eduardo Thomson

© 2020 Bloomberg L.P.

About the Author(s)

You May Also Like