November 1, 2022

Sponsored Content

We are now in the fourth quarter of the year, and you should have already started, or at least begun thinking about your fiscal budget for next year, as well as a profit center budget. These two budgeting items are related but distinctly different for your operation. Before we dig into the differences between the two budget types, let us define what a budget is.

Budgeting is an estimation of the revenue and expenses for your farm over a specified future period. To successfully manage the business, your farm needs to have a budget. It is important to monitor the actual to budget information to see where you farm is at financially. Budgeting lets you look at "what-if" scenarios. What if you purchased a new asset? What would be the change in your cash flow? Making decisions based on the answers to these “what-if” scenarios can lead to better financial management.

Historical data is one of your farm’s greatest assets. The data is full of information that can be used to improve your management and increase your profits. When you use historical data to budget future periods, you can make better management decisions. It is important to anticipate the coming year rather than replicating the previous year, as expenditures and income will vary.

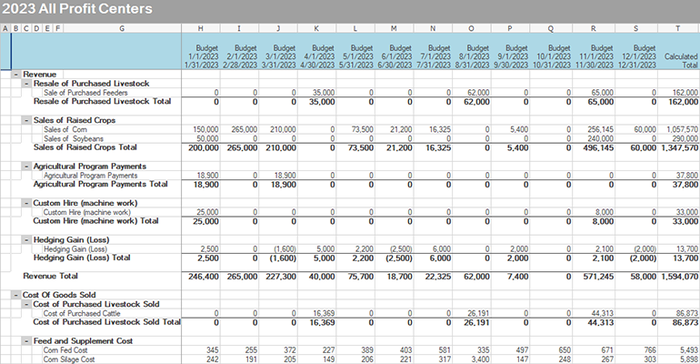

Your fiscal year budget will include all income and expenditures throughout your tax year to generate yearly income statements and cash flow budgets. The budget will be a 12-month cycle and will likely run from January to December, but some businesses vary on their fiscal year start and end dates. You will want to start by setting realistic revenue goals and anticipated expenses for your operation.

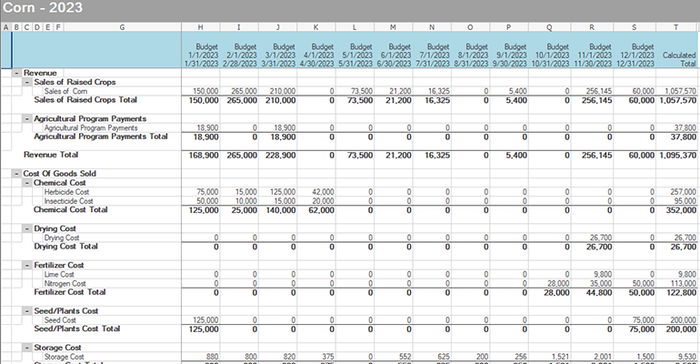

The profit center budget will likely be a different date range from the fiscal year budget. Crop and livestock cycles cross over fiscal years, and budgeting separately for that cycle provides you with better management information. This budget will typically include income, and expenses, associated with each profit center. This budget could cover a year and a half or more, depending on the commodity.

It is recommended you create a separate budget for each profit center. Once all the individual profit center budgets are created, you should also create a total company budget that includes all the data from the individual profit center budgets. (Creating this additional company budget can be done in CenterPoint Accounting for Agriculture by importing the individual profit center budgets, so re-entry of information is not necessary.) This budget will allow you to monitor varying input costs and prices and help control overall spending.

You should also use the budgets you created to monitor the differences to your actual income and revenue routinely. Monitoring these results will help you reach your profitability goals. Once you have established your budgets over time, you will be able to budget more accurately for future fiscal and production years.

Many software programs allow operations to easily create budgets and compare them to actual information. CenterPoint Accounting for Agriculture has a highly customizable budgeting system, and getting it set up can be done with the help of training and the Red Wing Software support team. Whichever budgeting system you choose, the goal is to get your budget created and monitor it for a successful operation.

About the Author(s)

You May Also Like