By Tim Loh

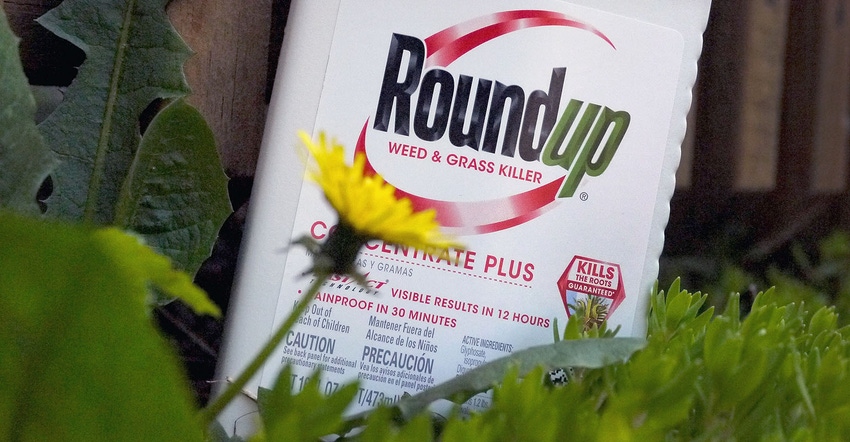

Bayer AG faces a surge in lawsuits from people alleging that its weedkiller Roundup causes cancer, ratcheting up the legal pressure as the company engages in settlement talks.

There are now 42,700 U.S. plaintiffs suing over Roundup -- the herbicide inherited from Monsanto -- following a blitz of advertising by attorneys seeking new clients that began after Bayer entered mediation discussions in May. The German company last reported facing 18,400 plaintiffs in July and said earlier this month that it expected a surge.

The crisis has cost Bayer more than $30 billion in market value as the inventor of aspirin lost three U.S. trials, suffered an unprecedented shareholder vote of no confidence and faced speculation about a breakup. The German drugs and chemicals maker has appealed the rulings and insists that Roundup is safe.

The company also reported better-than-expected earnings on Wednesday and confirmed its outlook, allaying concerns from investors that weak crop-science sales earlier this year would force a guidance cut. The stock rose as much as 2.9% in Frankfurt trading.

The avalanche of new Roundup cases means Bayer may be inclined to push for a settlement more swiftly before the ranks of legal foes swell further, Carl Tobias, a University of Richmond law professor, said in an interview before Bayer released the latest figures.

Bayer could also opt to stall, hoping for a court victory to gain some leverage in the discussions, according to Tobias. “It’s risky when you’ve lost three in a row,” he said. “That’s the gamble. What if they lose cases four, five and six?”

TV Ads

Aimee Wagstaff, who helped persuade a jury to award $80 million in damages to a Roundup user earlier this year, said at a convention in Las Vegas on Oct. 23 that she “wouldn’t expect any settlement in the near future” and that lawyers are preparing for about a dozen trials next year.

Television advertising from the plaintiff attorneys’ side seeking clients was about twice as high in the third quarter as in the first half, Bayer said, adding that the number of lawsuits “says nothing about their merits.” The next trial is scheduled to begin Jan. 15 in California, followed by one in Missouri later that month.

Bayer’s hand was strengthened by a U.S. Environmental Protection Agency decision in August to no longer approve labels claiming that glyphosate -- Roundup’s active ingredient -- is known to cause cancer, Holly Froum, an analyst at Bloomberg Intelligence, said in a note. Froum is maintaining her estimate for a potential settlement value as high as $10 billion.

Bayer Chief Executive Officer Werner Baumann has staked his credibility on last year’s $63 billion takeover of Monsanto, claiming the company is better off balancing its portfolio between agriculture and health care. He said in July that he’d consider a “financially reasonable” settlement as long as it resolves all Roundup litigation.

Dennis Berzhanin, an analyst at Pareto Securities, is now modeling 8 billion-euro ($8.9 billion) in potential damages, twice as much as his old estimate, he said in a note Monday.

Bayer on Wednesday also confirmed its sales and earnings estimates for the year, adjusted for the sale of its animal health business and stake in the Currenta chemical-parks venture.

To contact the reporter on this story:

Tim Loh in Munich at [email protected]

To contact the editors responsible for this story:

Eric Pfanner at [email protected]

Marthe Fourcade, Frank Connelly

© 2019 Bloomberg L.P.

About the Author(s)

You May Also Like