May 18, 2016

The economic value generated by the beef industry has been on an uptrend during the last decade. And feedlot owners and packers may be on the verge of recovering from recent beef industry economic losses.

FEEDLOTS SEE GAINS: Feedlot owners could recover from recent losses if calf and grain prices remain low.

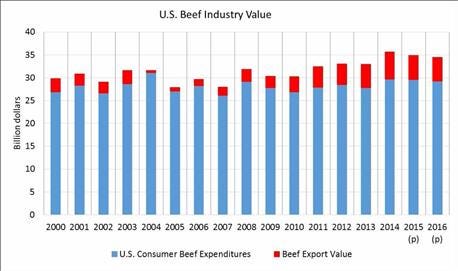

According to the Bureau of Labor Statistics consumer expenditure survey, the average U.S. consumer unit (consisting of 2.5 people) spent $232 on beef in 2014, the highest level since 2008. When combined with the growth in U.S. population, the 2014 value of U.S. consumer expenditures at $29.6 billion is the second highest ever, trailing only 2004. It is worth noting that the larger U.S. consumer spending figure of 2004 was offset by the fact that the value of U.S. beef exports, which eclipsed $6 billion in 2014, struggled that year in the wake of the December 2003 BSE case.

Though data from the 2015 consumer expenditure survey will not be available until later this year, projections through 2016 suggest that the total dollars spent on beef will only decline modestly from the 2014 record level. There is no doubt that the cattle industry value has been growing for the U.S. beef industry over time from both a domestic and international standpoint as the attached graph shows. However, given the current cattle market environment the shares of the pie appear to be in the midst of change.

Challenges in each segment

Even as cow-calf returns decline from the recent record levels experienced in 2014 and early 2015, the situation for many feedlots and beef packers has been improving. While the positives of the financial situation for cow-calf producers has received a lot of attention over the past couple of years, the difficult environment for feedlot operators and beef packers has been just as pronounced.

Why the dichotomy within the cattle and beef industry in recent years? Much has boiled down to the economics of supply. As the U.S. calf crop declined for 18 consecutive years from 1995-2013, each calf became more valuable for a feedlot sector that must manage large fixed costs and therefore prefers to operate near full capacity. This helped keep bids for feeder cattle relatively higher, even as many feedlots dealt with record financial losses during much of 2012, 2013 and 2015. The added pressure on feedlots from corn prices over $5 per bushel from early 2011 through the summer of 2013 was also a significant blow.

~~~PAGE_BREAK_HERE~~~

Beef packers have faced some tough times as well. The live to cutout beef spread spent nine of fourteen quarters from late 2011 through early 2015 below the 2000-2015 average, with three of the poorest quarters since the late 1990s in that span. This spread is calculated purely by accounting for boxed beef, by-product and cattle values, and therefore does not incorporate any rise in costs that may have been faced by packers over this period. This has resulted in many beef packing plants to cease operating in recent years.

Leveling out profitability

But as the number of available calves has begun to increase, profitability is showing signs of evening out across sectors. Calf prices have fallen substantially in the past year, corn prices have remained at more manageable levels and beef demand has remained relatively strong, allowing feedlots and packers more tolerable financial outcomes.

With the U.S. beef cow herd expected to continue rebuilding for at least the next couple of years, the bargaining power of cow-calf and stocker operations relative to feedlots will continue to lessen. Calf prices will likely fall further, and feedlots and packers may be in a better position to recover more of their losses from recent years.

While each industry participant is correct in maximizing the profitability available to their particular enterprise, it is important to realize the need for all cattle and beef industry segments to thrive in the long run. The first step in making this happen, increasing the total value of beef through realizing strong demand from both domestic and international customers, is currently being accomplished. A continuation of this trend moving forward will eventually be a positive boost for all industry players. However, due to the differences in cost structure and production lag time among the various segments of the cattle industry, we will likely continue to see changes over time in which segment of the industry holds the upper hand in terms of short-term profitability.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

You May Also Like