January 28, 2019

Despite trade disputes dominating the headlines, the international soybean market is surging ahead. In fact, global demand for soybeans is up 241% since 1990. In that same time frame, demand for corn and wheat has risen by 130% and 37%, respectively.

“Globally, demand for soybeans is growing at rate of 514 million bushels a year,” says John Baize, U.S. Soybean Export Council economic consultant.

With increased demand comes increased supply. In 2000, global soybean production was 6.5 billion bushels. USDA estimates for 2018/19 put that production number at nearly 13.6 billion bushels.

“Thanks to checkoff dollars funding marketing and education programs across the globe, importers in new markets that may not have considered U.S. soybeans might now consider them due to China purchasing much more from South America,” Baize said.

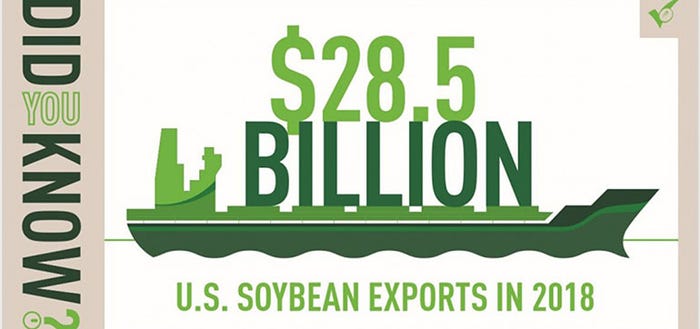

Looking specifically at the value of U.S. soybean exports, that number has risen from $6.8 billion in 2000 to more than $28.5 billion last year. According to USDA data, the U.S. is projected to be the largest soybean-producing country this year with Brazil coming in as a close second, followed by Argentina. In total, the U.S. exports 64.8% of soybean production as soybeans, soy meal and oil.

China is a huge soybean importer, yet demand for U.S. soybeans exists worldwide.

“Brazil’s soybeans have a premium due to increased buying from China. Because of this, U.S. soybeans are seeing an increase in practically every other market in the world,” Baize said. “This year, different markets will see the quality of U.S. soy, and this may spill over into the future, resulting in a much more diversified market — this could benefit U.S. soybean producers in the future.”

“We’re seeing spectacular demand in Egypt, Pakistan, Bangladesh and Southeast Asia,” Baize adds.

Pakistan increased imports of soybeans from just over 20 million bushels in 2014 to 85 million bushels in 2018. Bangladesh’s imports have risen from 20 million bushels in 2013 to more than 42 million bushels in 2018.

“Countries with private sector importers like Iran are growing U.S. soybean imports as well, likely due to less supply from South America,” Baize said.

One important market of note is India which just 5 years ago was a net exporter of soybeans but now domestically demands about four times more soybeans than it exports.

“Soon India will likely be the most populous country in the world and domestic consumption of soybeans is rising fast,” Baize said. “Checkoff marketing programs have been promoting the use of U.S. soybeans to India’s poultry and fish sectors to show advantages of using soy meal in feeds.”

Relationships

In a dynamic global marketplace, relationships remain key to building trust in U.S. soybeans.

“Being there to work with customers is a vital function USSEC performs on behalf of U.S. soybean farmers,” Baize said. “Importers are looking for information and USSEC can often provide data that’s not available to importers in many countries.”

Sustainability

Checkoff marketing efforts also make foreign importers aware of how they can add value to their businesses by buying U.S. soybeans via the U.S. Soy Sustainability Assurance Protocol, or SSAP.

“Importers like that U.S. producers use sustainable practices such as no till and cover crops,” Baize said. “Thanks to less use of energy in transporting U.S. soybeans via an efficient barge and rail system, importers also like to source U.S. soybeans to reduce pollution – this is especially important in markets such as Europe and Japan, as well as Colombia where import companies want to build a brand name and public image.”

Source: United Soybean Board, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like