Worldwide, corn demand is strong and corn stocks are projected to decline in the year ahead (a bumper U.S. crop may hold them steady). That would make two years in a row of modestly declining stocks. Bear markets are a product of large and growing stocks, but world corn stocks are falling – we should be celebrating the end of a bear market.

Soybean supplies are also declining. It is hard to overstate the disaster suffered by Argentina in 2018. Final production was 20 million metric tonnes less than original projections from late last year. For perspective, that figure is nearly 20% of the U.S. soybean crop. The soybean market needed a supply shock and Argentina provided it. Demand remains strong. We should be celebrating the end of a bear market.

After two consecutive years of booming wheat crops, Russia – the world’s leading exporter of wheat – is returning to Earth with a more normal crop. The Russian wheat crop will be 16 mmt smaller than last year’s whopper. For perspective, that’s one-third of the total U.S. wheat crop. The European crop is also smaller. World ending stocks of wheat will decline in 2018, following five consecutive years of building stocks.

Smaller stocks of corn, soybeans and wheat. We should be celebrating the end of a bear market. Instead, we have decided to embark on a trade war. And trade wars feed the bear.

Would you like me to tell you what this means? I won’t be very helpful - there are too many variables. How long will it last? How far will it spread? How, exactly, do you win a trade war?

Here is what I know.

(1) Exports are critical to U.S. agriculture. The Corn Belt makes us a land of abundance and we need exports to move the surplus. We export half of the soybeans and wheat produced in this country. We export more than 2 billion bushels of corn. We export about 20% of the pork and poultry produced, and $billions in beef and dairy products.

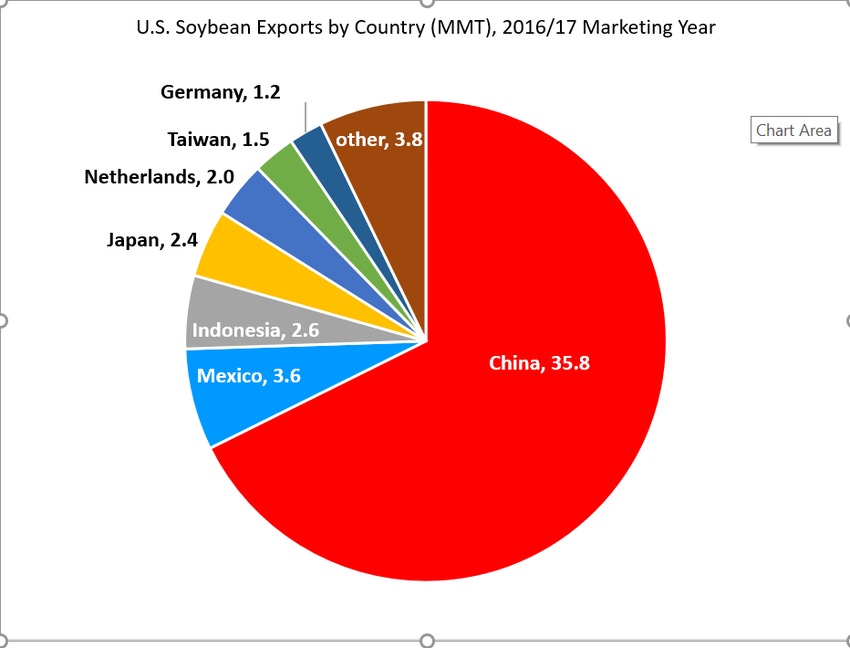

(2) Commodities are different - small changes in demand have large impacts. Nobody believes that China can eliminate their demand for U.S. soybeans, as one-third of our production and two-thirds of exports go to China (see accompanying chart). However, if exports fall by just 10%, the impact on grain prices and revenues will be devastating.

(3) The American farmer is the front line of this trade war. Corn and soybean producers will endure the hardest hits and suffer the greatest casualties.

Market fundamentals are slowly turning favorable. We should be celebrating the end of a bear market. Instead, we have a trade war. I am searching for the positives in this action, but they are hard to find when exports markets are so important to agriculture.

About the Author(s)

You May Also Like