The next 12 months will be a challenging time for agricultural lenders and farmers, says Bryon Parman, Mississippi State University Extension agricultural economist.

BRYON PARMAN

“Many farmers who are in precarious financial situations may face forced sales, and a depressed equipment market certainly won’t improve matters.”

The analysis is based on a May survey of agricultural lenders, appraisers, farm managers, and agricultural economists, conducted by the MSU Department of Agricultural Economics and the MSU Extension Service.

Despite the shaky outlook for some producers, Parman says, “most are still in favorable debt-to-equity positions, and interest rates are still low enough that new loans are relatively cheap. It doesn’t look like a 1980s magnitude correction is going to happen — but if agricultural financial conditions worsen, things could start moving in that direction.”

The past two years “have been challenging for producers and their partners in the agricultural lending sector,” he says. “The precipitous fall in commodity prices left producers facing high costs without the revenue to cover those costs. While production costs have come down some moving into 2016, and a spring rally in corn and soybeans has helped soften the blow, many producers are still looking at a market where their projected revenue is below break-even.”

The decade leading up to 2014 was generally favorable for producers, Parman notes, and many farmers opted for expanding their operations over paying down debt or creating an operating capital cushion for inevitable tough times.

“Also, much of their newly purchased assets was paid for in cash — and with no cash reserves, lenders must count on producers being able to borrow against those assets, or sell them to meet debt payment obligations.”

Weakness in the value of farm equipment has affected lenders’ willingness to collateralize debt with farm equipment, Parman notes. “Some survey respondents reported that their financial institutions allowed 89 percent of farm equipment book value to be used for new loans, while the majority of institutions are allowing between 40 percent and 75 percent. On average, lenders were allowing 62.7 percent of the book value to be used as collateral on new loans.”

High farmland values and cash purchases of agricultural assets have resulted in favorable debt-to-asset ratios over the last decade, he says. “However, equity in the form of land or machinery is less liquid, so when costs exceed revenues farmers must either borrow against those assets, or sell, to meet future repayment obligations.”

Producers who bought land to expand at peak prices increased their financial exposure during times of poor commodity prices and high costs. “Increased exposure means that large, high cost farms will hemorrhage money faster than their smaller counterparts if net revenues are negative

Operating debt carryover

“With more than 20 percent of Mississippi farmers carrying 2015 operating debt into 2016, and most producers having less than one year of operating capital available, the carried-over debt will need to be collateralized either by owner equity or sale of assets.

“Producers with low debt-to-equity ratios should provide lenders with some much-needed flexibility moving forward, but the only option for highly leveraged producers is forced sales, which will reduce asset values across the board and begin putting less highly leveraged clients in jeopardy.”

Historically low interest rates over the last few years have also helped soften the blow of producers needing to increase term debt during a period of negative margins, Parman says.

“Recent comments from the Federal Reserve indicate a very gradual increase in interest rates over the next few years — positive news for lenders and producers during difficult financial times.” A sudden jump in interest rates “would be devastating,” he says, because it would make borrowing much more expensive, and would also cause a reduction in land values, reducing producer credit flexibility.

The MSU survey asked lenders the percentage of borrowers with varying amounts of operating capital. Lenders across Mississippi reported that, on average, 61 percent of farmers had less than one year’s operating capital available to meet financial obligations, while 39 percent had one to two years’ operating capital available.

Lenders were also asked the percentage of 2015 operating loans that required a significant portion to be carried into 2016, as well as the change in the number of distressed agricultural loans compared to 2015.

“They reported a range of 2015/2016 loan carryover of from 5 percent to 50 percent,” Parman says. “The overall average of carryover across the state was nearly 21 percent. A full 87 percent of lenders said they expect the number of distressed loans to increase from 2016 to 2017, and 76 percent said they expect Mississippi farm income to decline again in the next 12 months.”

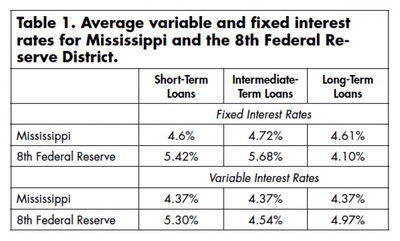

Statewide, the survey indicated, interest rates for prime borrowers are lower than those for the 8th Federal Reserve District for each length of loan, and variable rates are also lower, indicating that borrowing in Mississippi is cheaper than in the district as a whole.

Lender outlook for interest rates

For the most part, fixed interest rates for the state’s borrowers remained unchanged from a year ago. Short term and intermediate term loan rates were identical to the 2015 survey, and long term fixed rates were actually down 0.4 percent in 2016. But in the fall of 2015, the Federal Reserve increased interest rates 0.25 percent and indicated that, at some point, there will be further increases. As a result, variable interest rates — which are often pegged to the federal funds rate — are up 0.25 percent in 2016 from the same time a year ago.

The survey asked lenders their outlook for interest rates over the next 12 months, and 66 percent of respondents said they expect rates to increase, while 34 percent said they expect no change.

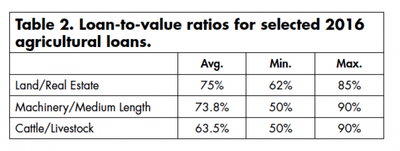

The loan-to-value (LTV) rate is the percentage of new purchases lenders are willing to finance. “The higher the percentage,” Parman says, “the more risk the lender is taking on. High LTVs indicate lender optimism regarding repayment or asset appreciation.

“Average LTV rates for three typical Mississippi term loans were 75 percent for agricultural land or real estate loans, 73.8 percent for medium term machinery-type loans, and 63.5 percent for cattle and livestock loans.

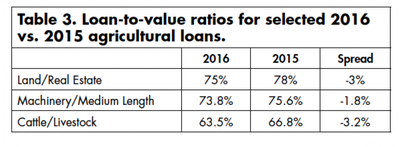

“LTV ratios for 2016 loans are down from the rates in the 2015 survey. For 2015, LTV ratios for land and real estate averaged 78 percent, for machinery (medium length) 75.6 percent, and for cattle/livestock, 66.8 percent. For 2016, the ratios were 75 percent for land/real estate, 73 percent for machinery (medium length), and 63.5 percent for cattle/livestock.

“The decline in LTV ratios, although small, indicates both a worsening in farmer creditworthiness and repayment capacity from a year ago, and pessimism among lenders regarding the future of agricultural asset values.”

Nationally, the USDA says 2016 farm income is expected to be below 2015, continuing the free fall from the record high in 2013. Direct farm program payments are expected to increase by $3.3 billion, which would be a 31.4 percent increase from a year ago.

“Farm income in 2016 has been helped to some extent by a modest two-year decline in crop production costs for 2015/2016,” Parman says, along with a spring rally for corn, soybeans, and other commodities. “But there are still many high cost farmers who are hampered by high cash rents and equipment payments who will fail to break even without a major price rally.”

The 8th Federal Reserve District, which includes portions of Arkansas, Mississippi, Tennessee, Missouri, Illinois, and Kentucky, reported in its quarterly survey of lenders that demand for loans was up, while the rate of loan repayments had fallen. The report showed 9 percent of first quarter loans in 2016 had “major or severe repayment problems, resulting in forced sales or long term workouts.”

A total of 14 percent of current loans had minor repayment problems, with 78 percent having no repayment problems going into spring 2016. The report listed 34 percent of clients having borrowed up to their limit, “prompting major reductions in household spending and capital spending.”

About the Author(s)

You May Also Like