October 8, 2020

In 2016, more than 156,000 farms used marketing contracts and more than 47,000 farms used futures or options contracts to hedge price risks, according to a USDA Economic Research Service report, "Farm Use of Futures, Options and Marketing Contracts."

What's the issue?

Farmers may use a variety on-farm strategies to manage risks, and they may also draw on federal risk management support programs. Market mechanisms are also available to farmers who can use agricultural derivatives, such as futures and options contracts, and marketing contracts to protect against price fluctuations.

Futures, options and marketing contracts each have pros and cons. Strategies to manage risk can vary, with ranges in upfront costs, flexibility of contract terms, risk of default by the other party, and ease of closing out a contract. This study describes these risk management strategies and describes the use of futures, options and marketing contracts by producers, with a primary focus on corn and soybeans.

What did the study find?

Farmers used futures and options contracts across a range of commodities, with corn and soybeans accounting for the bulk of farmer use.

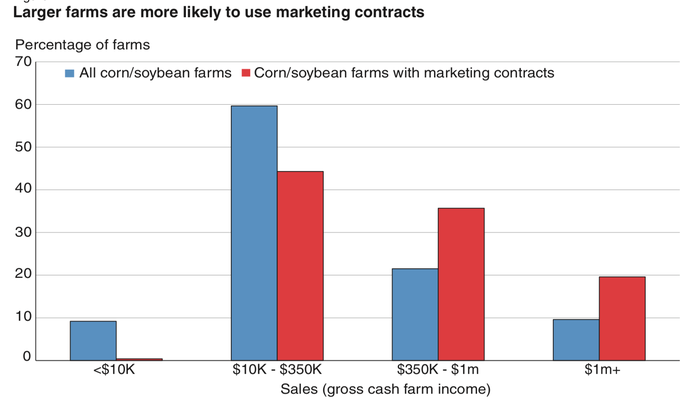

About 10% of corn and soybean farmers traded in futures contracts, with those who did covering more than 40% of their production. Similarly, while only 20% to 25% of corn and soybean farmers used marketing contracts, those who did covered more than 40% of their production.

6% of corn farms and 8% of soybean farms that used futures hedged all their production through the futures market.

Farmers who use marketing contracts are much more likely to use futures and options than farmers who do not use marketing contracts.

Agricultural futures and options are used most often by larger corn and soybean farms.

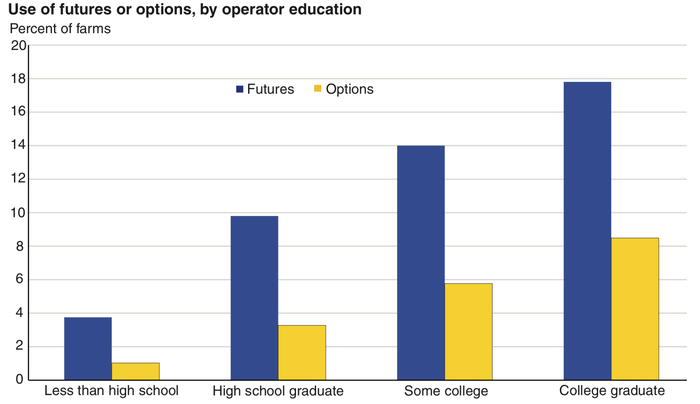

Nearly 18% of college-educated corn and soybean farmers used futures.

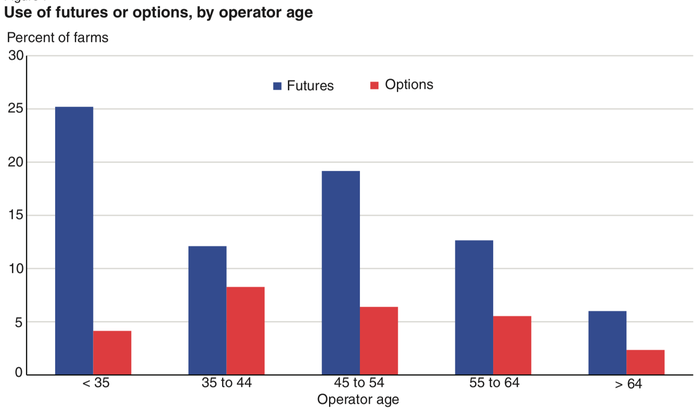

Nearly 25% of operators who were 35 or younger used futures.

Farms with debt are more likely to use derivatives than farms without debt: among all farms, only 10% used futures as compared with over 15% for those with debt.

How was the study conducted?

This study is based primarily on data from the 2016 Agricultural Resource Management Survey. The survey is representative of the 2 million farms in the 48 contiguous states.

Source: USDA ERS, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like