Fears of trade wars and a strong dollar caused fund managers to sell some commodities favored by Wall Street types this week. But those big speculators bet more money on the nose in the grain market helping spur a rally until late in the week.

Here’s what funds were up to through Tuesday, May 1, when the CFTC collected data for its latest Commitment of Traders put out on Friday.

![]()

Back in

After trimming bullish bets in crops and livestock the two previous weeks, hedge funds bought agriculture week, boosting bullish bets by 108,928 contracts. But the interest wasn’t across the board. Big speculators sold some parts of the grain complex, including livestock. And investors looking to own commodities with funds following indexes were only light buyers.

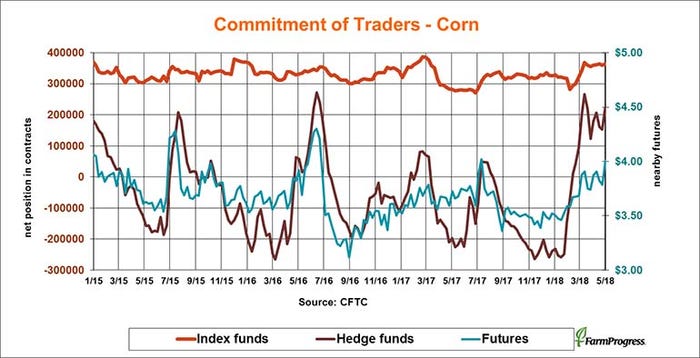

Seeds of doubt

Big speculators stopped selling in the corn market and started buying again as planting delays took center stage. Hedge funds added 68,647 contracts to their net long position, helping boost July futures back above $4.

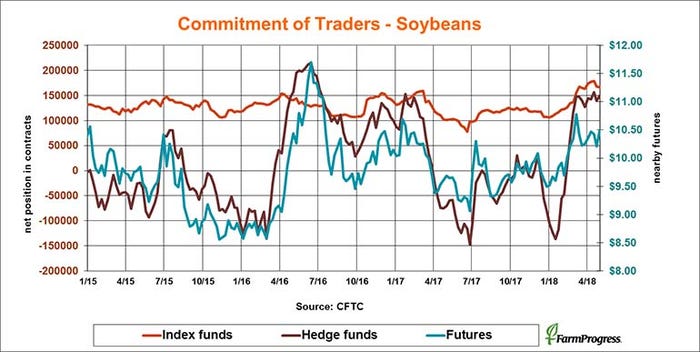

Hanging around

Big speculators haven’t been buying or selling a whole lot of soybeans over the past month, maintaining their bullish bets around the highest levels since January 2017. Hedge fund managers added 10,402 contracts to their net long position in the latest week, likely waiting for USDA’s May 10 report for guidance.

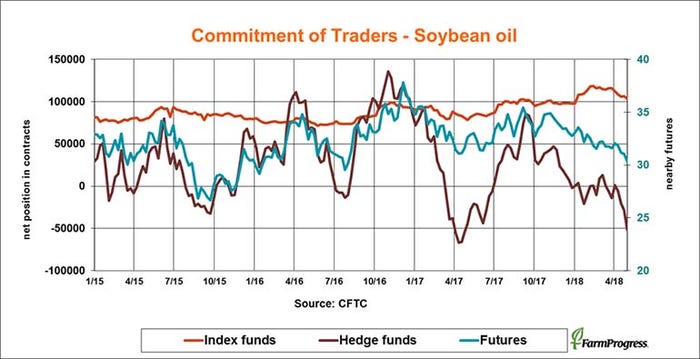

Short-sided

Soybean oil is still the short leg of soybean spreads as demand isn’t likely to keep up with rising crush. Big speculators sold another 22,744 net contracts, extended their bearish bet to its lowest level in more than a year.

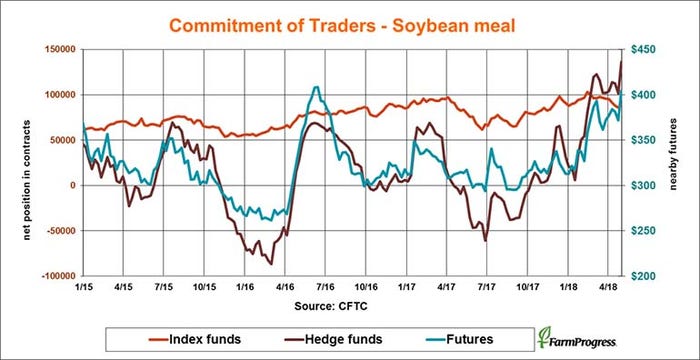

Record setter

Big speculators wound down some of their holdings in soybean meal over the past two months, but that profit taking ended in a hurry. Hedge funds added 34,381 contracts to their net long position, extending their bullish bet to an all-time high as meal prices surged past $400 a ton, at least briefly.

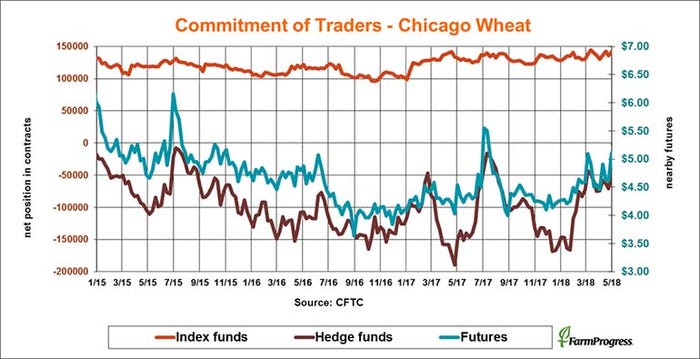

Is it time?

Big speculators have been bearish wheat for four years but that doesn’t mean they don’t do some buying. Lately they’ve been going back and forth, and this time they went forth. Hedge funds covered 23,833 contracts of their net short position, helping rally prices to nine-month highs.

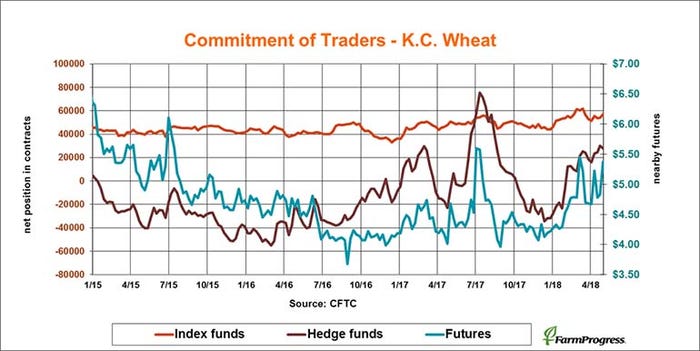

Treading wheat

Big speculators covered a little of their net long position in hard red winter wheat, but only a little, trimming bullish bets by 1,929 contracts. Prices surged nonetheless as yield estimates dropped.

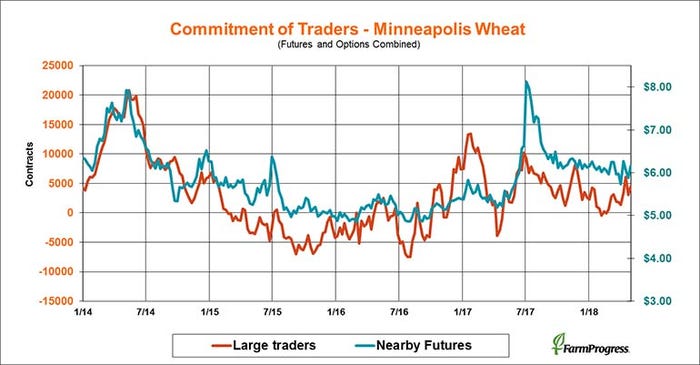

Rally 2.0?

Large traders have been net long spring wheat for a couple of months, hoping the market was ready for another rally like the surge seen last year. Weather over the next month or so should decide whether those bets pay off. They were modest buyers overall.

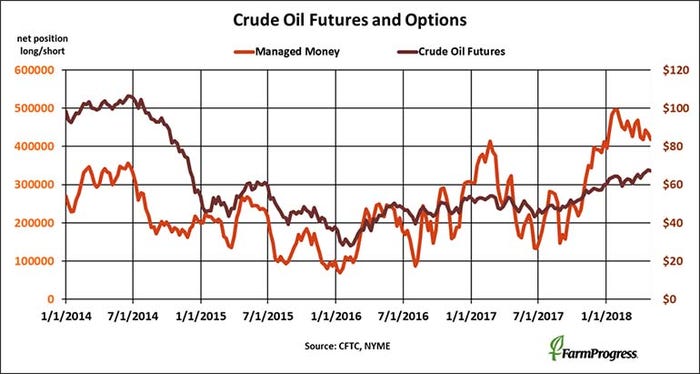

Too cautious

Crude oil futures took aim at $70 in the first week of May, but money managers went home from the party early. They sold more than $1 billion of their holdings as of Tuesday, the second straight week of profit taking.

About the Author(s)

You May Also Like