Corn traders realize the fact we are entering a full-blown "weather market." June and July are notoriously the most susceptible to weather related noise and headlines. The trade had been focused on "planting" and the weather related risk associated with delays and re-plants. There was a bit of noise early on, but the crop has since gotten in the ground without many widespread problems or hiccups. In return the trade has given back some of the risk-premium it had built into the early-equation.

Many of the weather gurus are now saying the current forecast offers some heat and dryness during the next couple of weeks, but not really enough to cause major wide-spread concern. Meaning the current crop-condition ratings could remain strong into late-June. As we all know, weather forecasts can change quickly this time of year, so we need to keep paying close attention. A developing ridge or extended lack of moisture could easily trigger another rally.

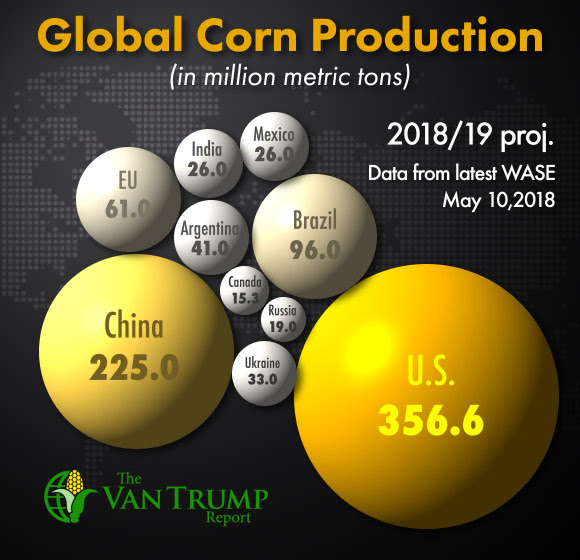

Another headwind we are battling right now is lack of progress on the trade front. Trade with China clearly remains uncertain, but we are now having to digest retaliation headlines from Mexico, Canada and the European Union. At the same time, if we look out a bit further on the horizon, Argentine corn is getting a bit cheaper than exports from here in the U.S.

Let's also keep in mind, there's still a lot of uncertainty brewing in the ethanol space surrounding RINs and exports. I don't know if the overall trade is that concerned as of yet, but we've been feeding the bulls with headlines that show record U.S. corn exports and record amounts of corn being used for ethanol. I suspect if that rhetoric was to fade or disappear into the sunset, the bulls might find the market starts to fire on a few less cylinders.

Obviously I'm keeping a close eye on U.S. weather, but I'm also paying attention to "demand." The demand part of the equation is the number one reason I've been bullish longer-term. From a technical perspective, the March low at $3.77^4 is being closely watched. I suspect if the JUL18 contract can bounce, the bulls will be talking about a double-bottom. If the market closes aggressively below this level the bears will be talking about a breakout to the downside.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like